The soothsayers of the solar power industry, those giving us advice to drive the industry forward, have often suggested that the industry needs to mature to the point where the largest of the global pools of capital – the institutional investors and their more than $100 trillion – are ready to start buying. pv magazine has some evidence for you to consider – Sunrun batting .984, solar power assets in AAA bonds, Dividend gets industry’s first AA, CCA gets first investment grade rating – in the argument that it’s time to put this challenge behind us and build, build, build.

sPower has closed a $499 million, investment grade, private placement financing representing approximately 650 MW of utility-scale wind and solar power projects.

The proceeds from this issuance are refinancing approximately $425 million of medium-term bank loans, lengthening tenor to a fully-amortizing 23.5-year facility and eliminating the refinancing risk associated with previous bank loans. Incremental proceeds net of the bank loan refinancing will be used to fund sPower’s continued development of additional renewable energy projects.

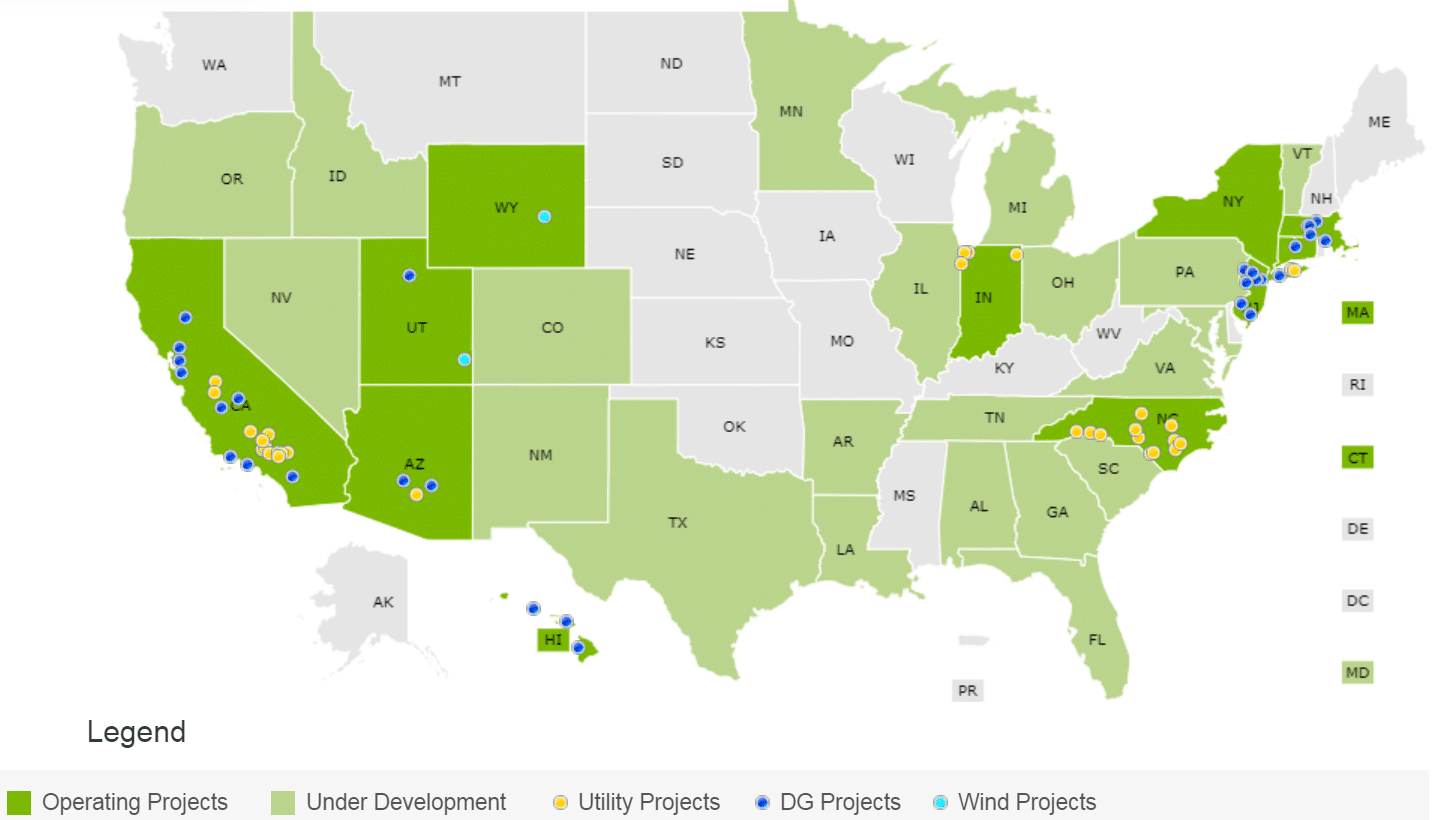

No specific details on individual projects contained in the portfolio were available, though it was noted that the group being refinanced contained both wind and solar assets and that it represented roughly half of sPower’s 1.3 GW portfolio. The above map, composed of sites on the company’s U.S. project list, lays out 66 projects – 1,092 MW in total. Two of the projects are wind – an 80 and 60 MW, the rest solar power – ranging from 106 MW down to 700 kW.

The company has a great video gallery, however their photo gallery – while showing many great images – could use an upgrade on the image sizes/resolutions.

The company noted that the portfolio was heavily oversubscribed, meaning more people wanted in than the portfolio had assets. A common industry refrain is that there is more money looking to buy projects than there are projects available to be bought. And with over $160 billion spent on solar last year, the big finance groups around the world are building teams to acquire and manage these long-term, low-risk cash producing projects.

And just in case you happened to need support in building out a team to finance your $500 million worth of power plants, here’s some perspective on the number of people that participate in deals like this:

- Citigroup Global Markets Inc. served as Ratings Advisor, Structuring Agent, and Lead Placement Agent

- CIBC World Markets Corp, Credit Agricole Securities, KeyBanc Capital Markets Inc., Rabo Securities USA Inc., Societe Generale Americas Securities, LLC, and Wells Fargo Securities, LLC served as Co-Placement Agents

- CohnReznick Capital served as an advisor

- Stoel Rives LLP served as sPower’s counsel in the deal

- Skadden served as Note Purchasers’ counsel

The solar power industry no longer has to prove itself to institutional investors, it now needs to deliver them portfolios.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.