U.S. utilities increased their battery energy capacity 68 percent to 1.3 gigawatt-hours (GWh) by year-end 2017, according to a utility survey conducted by the Smart Electric Power Alliance (SEPA). While the increase in battery power capacity, measured in watts, was just 31 percent, the installation of longer-duration batteries last year helped produce the bigger jump in battery energy capacity, measured in watt-hours.

The use of longer-duration batteries, able to discharge for several hours, has enabled balancing of solar with widespread storage, as in California and Hawaii, and with co-located solar + storage installations, as in Hawaii and Florida.

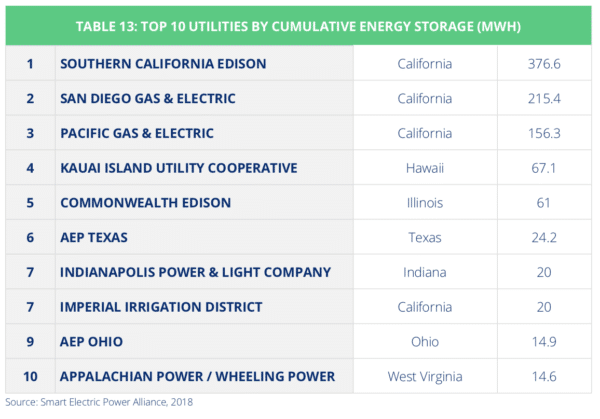

California utilities remained far in the lead in storage energy capacity, in response to state storage policies that support renewable goals. California added 75 percent of the nation’s incremental battery energy capacity in 2017, and was home to nearly 60 percent of the cumulative energy capacity.

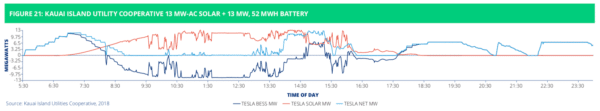

Illustrating the concept of “dispatchable” solar + storage, where storage adapts to micro-variations in solar generation in order to firm solar output, the SEPA report shows a sample daily profile for the first solar + storage installation by the Kauai Island Utility Cooperative (KIUC) in Hawaii (Figure 21). This system, “with 13 MW of solar and 13 MW/52 MWh of storage, stores power during the day, and sends power to the grid in the morning, evening, and during cloudy periods throughout the day” (Figure 21).

SEPA calculates that KIUC had 2,036 watt-hours of storage per customer at year-end, compared to 151 for San Diego Gas and Electric, the top utility in California on this measure. KIUC continues to add solar + storage, helping the utility forge ahead on its high-renewables path.

The report noted four other utilities with planned or operating solar + storage installations (here linking the pv magazine story on each): Florida Power & Light, Arizona Public Service, the Salt River Project serving the Phoenix area, and Vistra Energy in Texas (adding storage to an existing solar power plant).

FERC Order 841 will unleash extensive cost-effective storage

The SEPA report flags FERC Order 841 as a primary driver of near-term growth in storage. FERC Order 841 directs RTOs/ISOs (regional transmission organizations and independent system operators) to allow a storage resource to sell into the wholesale market all capacity, energy, and ancillary services that the resource is technically capable of providing.

The Brattle Group, which co-produced with SEPA the report’s discussion of FERC Order 841, has projected that FERC Order 841 could spark profitable storage investments ranging from 7 GW/ 20+ GWh, with storage “participating in grid-level energy, ancillary service, and capacity markets,” to 50 GW of storage “if all benefits can be captured, but [that would] require states to unlock T&D [transmission and distribution] and customer benefits.”

Either way, such tremendous growth would give utilities more experience with storage, helping pave the way for wider use of storage to balance solar and wind generation.

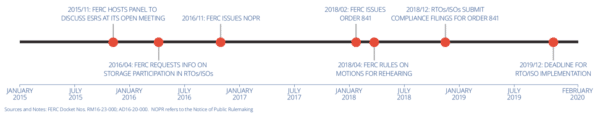

FERC Order 841 was issued as a final rule in February, and RTOs/ISOs must submit compliance filings by December, as shown by a timeline in the report:

Asked about the motions for rehearing shown on the timeline for April 2018, Energy Storage Association Vice President for External Relations Marissa Gillett explained that “The FERC has not yet issued a decision on the rehearing requests, and a timeline for doing so is not known. Regardless, the requests for rehearing are limited in scope with respect to Order 841 and do not seek to revisit most of the major directives of the decision, with which the RTOs and ISOs are still planning to comply.” She added that “RTOs and ISOs … continue to work diligently on compliance filings that are due by December 3, 2018.”

Many utilities have begun installing storage

A list of the top ten utilities by cumulative energy storage capacity, shown in Table 13, includes several of the many utilities that have begun installing storage, to attain a wide range of storage benefits.

SEPA’s 2018 Utility Energy Storage Market Snapshot reflects survey responses from 137 electric utilities, which serve 58 percent of customer accounts nationwide. While focused on battery storage, the survey included flywheel storage (discussed in one case study) as well as supercapacitors and compressed air energy storage (not discussed). In addition to solar-related storage markets and FERC Order 841, the report covers the use of storage to defer transmission and distribution investments, and other topics. The report was written by SEPA staff members Nick Esch and Maclean Keller, with The Brattle Group partnering on the discussion of FERC Order 841.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.