In highly competitive situations, collaboration is often the way to go. Late yesterday, two solar companies that have been struggling financially while leading their respective fields in terms of technology announced an agreement that could give each something they need.

SunPower has agreed to sell its microinverter business to Enphase in exchange for $25 million and 7.5 million shares of Enphase stock, which represented a value of around $34 million yesterday before the announcement. The company also gets to put one of its people on the Enphase board.

But that is only the beginning. Enphase also gets the exclusive right to supply SunPower’s residential business for the next five years.

The benefits of this deal for both parties are easy to see. SunPower has been making its own microinverters for years; however given everything else SunPower had going on – high-efficiency back-contact cells and modules, its new shingled P-series, distinct modular solutions for the utility-scale, commercial and industrial and residential segments, and even project development – this clearly was not a big priority. You have to dig to even find any mention of SunPower microinverters on the company’s site.

But what SunPower does need is cash. This is obvious given its ongoing, heavy losses and the struggles that the company faces not only because of the Section 201 process, but in the face of a pending global oversupply of modules and crushed prices.

Through this arrangement SunPower gets $15 million when the deal closes, which is expected in the third quarter of this year. The company will receive another $10 million four months down the line, assuming all goes as planned.

Residential market positioning

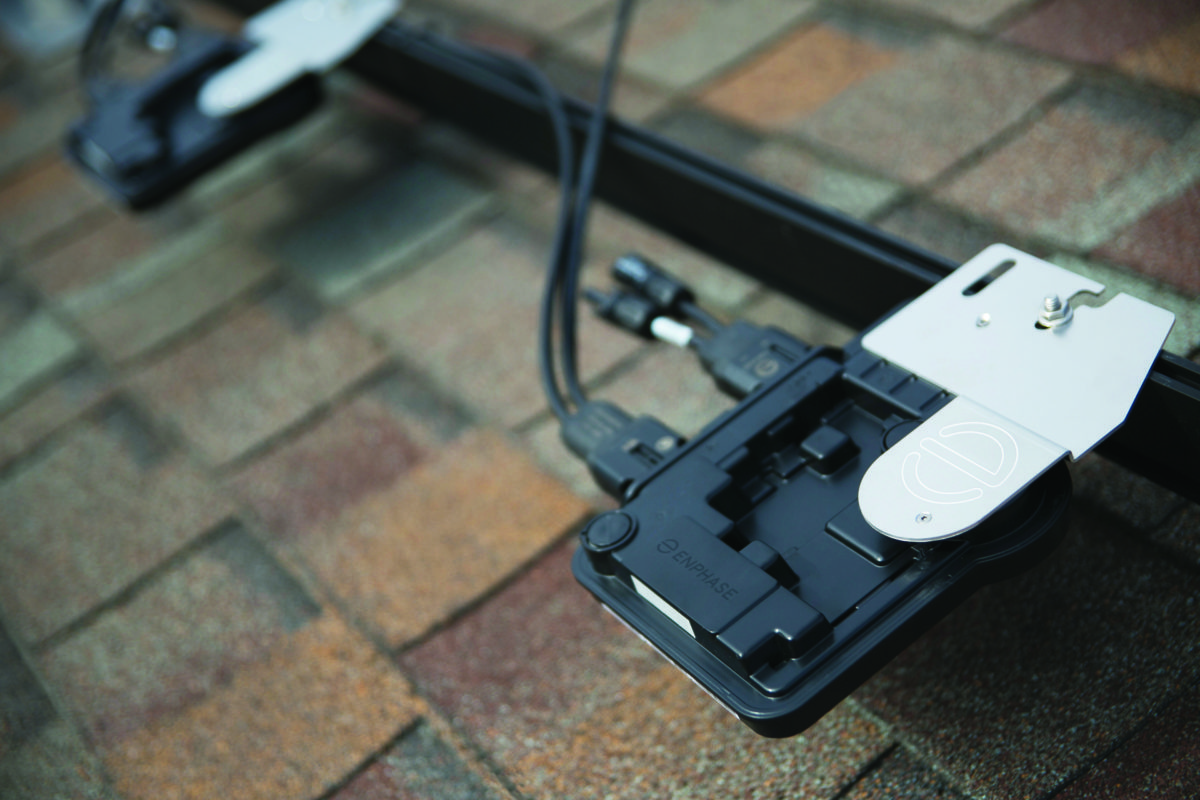

And while it is possible that Enphase could get some complementary intellectual property out of the deal, what may be far more valuable is the supply arrangement. As revealed in SunPower’s SEC filing, the master supply agreement means that “SunPower will exclusively procure module level power electronics and related equipment for use in the U.S. residential market from Enphase for a period of five years”.

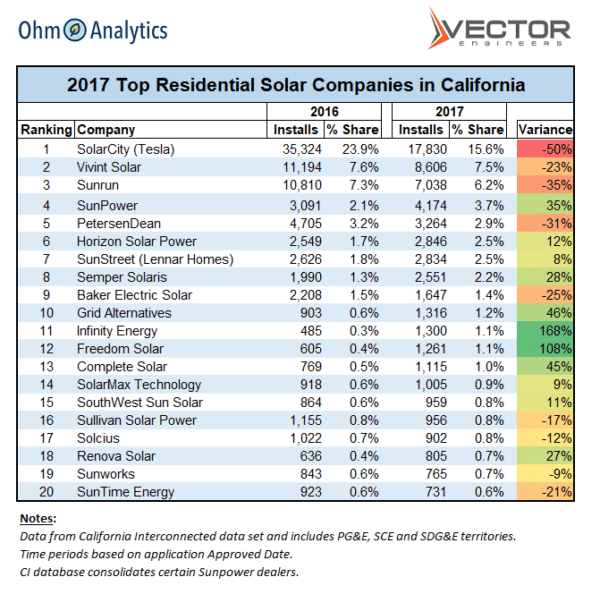

This is no small prize, given that SunPower and its dealer network took the fourth-largest position in California’s residential market last year. It is hard to over-state the strategic advantage for Enphase, which has has been struggling for years in the U.S. residential market against SolarEdge, whose power electronics offer some of the same features as Enphase’s microinverter products.

By dominating the supply of inverters to a major residential solar company, Enphase has practically guaranteed itself a set portion of this market, and one that comes with no additional sales effort.

A SunPower press release notes that Enphase’s microinverters will be deployed as part of SunPower’s AC modules. This is a further competitive move against SolarEdge, which largely supplies string inverters, by helping to advance AC modules as a product, and follows on Enphase’s February deal to collaborate with Panasonic on AC modules.

And by teaming up with SunPower, Enphase may be catching a rising tide. SunPower recently decided to shelve its utility-scale solar development business, and is increasingly focusing on the residential and C&I markets where its high-efficiency products have more of an advantage.

The results of this are showing in market data. Despite overall contraction in California’s residential solar market last year, the number of permits pulled by SunPower and its dealer network increased 35% – as the only one among the top five residential companies to show a gain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Interesting graph. Weren’t Baker and SemperSolaris installing SunPower in 2016-17?

I like Sunpower but they’re so overpriced vs going a DIY route in my opinion. Let alone Solarcity..