Capacity auctions held by grid operators are not known for being terribly exciting events. But the results of the capacity auction yesterday in the PJM Interconnection were a shock to the energy sector for a number of reasons.

Much ink has been spilled on the relative increase in coal-fired capacity that cleared and the sharp decline in the fortunes of the nuclear industry, but what has been less mentioned is the greater volume solar that participated this year.

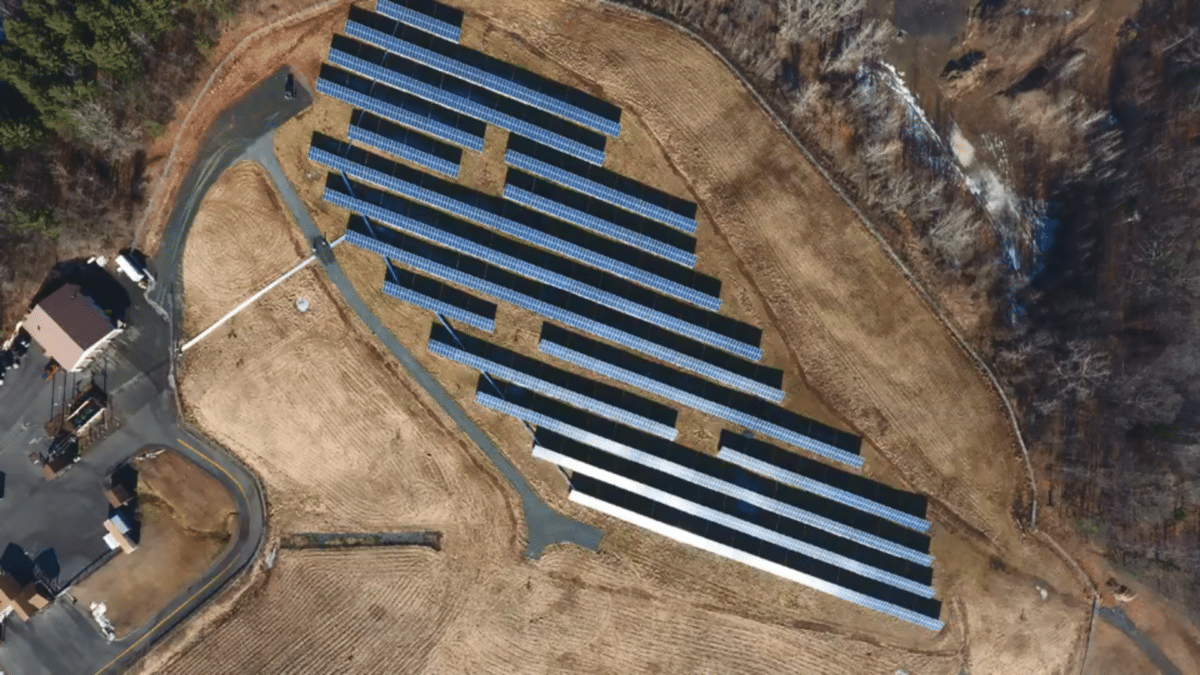

PJM reports that 1.64 GW of solar projects cleared the 2021/2022 Base Residual Auction, which after downrating represented 570 MW of capacity. This is 964 MW more than the nameplate capacity that participated in the 2020/2021 auction, which suggests a large volume of new projects in the region.

Solar projects at least 100 kW in capacity can bid into the auction.

PJM Interconnection covers part or all of 13 states and the District of Columbia, stretching from the Chicago metro area to the Jersey Shore. The grid covers a slice of coastal North Carolina, which has been the nation’s second-largest solar market, as well as all of New Jersey, where most of the solar in the PJM Interconnection has traditionally been located.

The capacity of wind plants clearing in the auction also increased 21% to 8.13 GW. Bloomberg New Energy Finance has told pv magazine that as the capacity of wind increases it is putting downward pressure on prices at times of strong wind, and corporations that are looking for projects to meet renewable energy mandates have turned more to solar in the PJM Interconnection.

The total contributions of solar and wind are still a drop in the bucket for the region. PJM reports that 164 GW of capacity cleared the auction, and the 2 GW of solar and wind in that total (downrated for capacity contribution) is only 1.2%.

However, in addition to solar and wind 14.0 GW of demand response and energy efficiency also cleared, which represents another 8.6% of total capacity. In contrast to this, while 500 MW of additional coal and 1 GW of new gas capacity cleared, nuclear capacity fell 7.4 GW – meaning a significant net decrease in conventional generation.

The combination of the increase in capacity being met with renewable energy, demand response and energy efficiency, when coupled with the fall in thermal generation that cleared, is showing the beginnings of what may be a much larger transition in PJM.

“Even with nuclear clearing at a much lower value than last year’s auction, the market still cleared a healthy reserve margin of 21.5% – spurred by demand response and energy efficiency increasing significantly over last year’s auction – even more evidence that Trump Administration claims that losing generation will cause a grid disaster are complete nonsense,” states Robbie Orvis, the director of energy policy design at Energy Innovation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.