It is almost certain that as soon as the numbers from the latest National Solar Jobs Census come out, certain writers, pundits and organizations will be penning articles casting doubt on the future of solar.

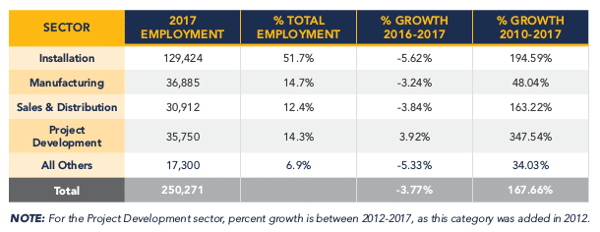

To reach that conclusion it would be necessary to not understand the context, and in the case of advocates for competing power sources such misunderstanding appears to often be intentional. It is true that Solar Foundation’s 2017 census, which is widely regarded as the definitive report on U.S. solar jobs, shows a 3.8% decline in solar jobs from November 2016 to November 2017 to just over 250,000 U.S. workers employed at least half-time in solar.

This is the first year that Solar Foundation has found a year-over-year decline in solar jobs in the seven years that it has been publishing the Census, and context is vital here. The fall in job numbers is much lower than the decline in the volume of solar installations, with GTM Research showing a 22% market decline year-over-year from 2016 to 2017.

This is due partially due to trouble in some sectors, but has much more to do with the scheduled drop-down of the U.S. Investment Tax Credit (ITC) at the end of 2016, which drove roughly 15 GW of installations in 2016. The irony here is that even though the ITC was in fact extended at the end of 2015, developers, utilities and other actors had already put so many plans in place to beat this deadline that 2016 installations came out at double 2015 levels.

“It’s the biggest of three factors,” notes Ed Gilliland, senior director at Solar Foundation and the report’s principal author. His assessment is additionally supported by the sectors that were most affected. Installation jobs fell 5.6% to 129,000, with project development taking the second-largest hit with a 3.9% decline.

Residential market woes

However, it is also clear that jobs were lost in the residential solar sector due to the combination of troubles that we have documented extensively at pv magazine: pull-back from national installers, policy changes and uncertainty, exhaustion of first-adopter demographics in key markets and, in the case of California, heavy rains in the first few months of 2017.

Supporting this conclusion is the correlation between job losses and declines in the labor-intensive residential market at the state level. The Solar Foundation reports California’s solar workforce contracted 14% year-over-year to 86,000, while Massachusetts employment fell 21% to 15,000, the largest raw losses of any states.

GTM Research has reported large declines in the residential solar markets in both states, with Massachusetts’ market falling a stunning 49%. Meanwhile Nevada showed a 22% decline in employment, which is hardly surprising given that the state’s residential solar industry was devastated by the unexpected and swift dismantling of net metering.

Net metering was eventually re-instated in Nevada, however employment clearly has not caught back up yet. “Policy uncertainty that hurt those markets, or policy change and not enough time for people to adjust to the new policy and figure out how to navigate around those policies,” Gilliland told pv magazine.

Section 201 impacts

A third factor cited by Solar Foundation in the relative job decline is the impact of the uncertainty caused by the Section 201 trade case. This is an inherently political subject, as the opponents of the trade case, led by Solar Energy Industries Association (SEIA), repeatedly warned of widespread job losses due to potential trade action.

Solar Foundation says that a relative decline in jobs is already a reality, not due to the tariffs but due to the uncertainty created by the Section 201 process. 71% of survey respondents stated that the Section 201 case had already affected hiring.

It is unclear if the worst is yet to come. While 86% of survey respondents indicated that they expected Section 201 trade action to negatively affect their business, the timing of the Census meant that such responses had to be given before President Trump imposed milder tariffs than many expected, and a large exemption for imported cells.

Manufacturing

In the larger picture, manufacturing must also be given its due. However, the vast majority of U.S. solar jobs are in deploying solar, not making it. The Census found only 15% of jobs in manufacturing, and 2/3 of these are not in solar cell and module production, but in making other components that go into PV plants such as mounting structures, racking and tracking.

Whether or not the 201 tariffs will increase manufacturing employment, even in the limited area of cells and modules, is a hotly debated subject. While opponents of the 201 case repeatedly warned that tariffs would not result in substantial new cell and module production, in the past three months pv magazine has reported on three U.S. module manufacturers that are planning to expand their facilities, as well as plans by two Asian companies for new U.S. solar manufacturing.

While today’s highly automated solar factories require limited manpower on the factory floor, manufacturing not only drives demand for the supply chains that feed production, but also has a general “knock-on” effect in the larger economy; increases in manufacturing create everything from construction jobs to more demand at local restaurants. As such, the full job impacts of manufacturing are inherently difficult to assess and were beyond the scope of Solar Foundation’s study.

5% growth expected this year

But even given the negative expectations of many businesses around the impact of solar tariffs, the collective result from survey respondents indicated that solar employment is expected to grow 5% by November 2018.

Another encouraging factor is that while employment slumped in the largest state markets, 29 states reported increased solar employment. This means that like solar markets, solar jobs are becoming more evenly spread throughout the United States.

And the longer-term trend is clear. Over the course of the past seven years solar jobs have grown 168% from around 93,000 jobs in 2010 to over 250,000. Solar now employs twice as many workers as the coal industry, almost five times as many as nuclear power, and nearly as many as the natural gas industry.

Despite a rocky year, this is just the beginning.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.