Everyone in the solar industry by now has heard the dire predictions made by both Solar Energy Industries Association (SEIA) and GTM Research, which include the loss of 88,000 solar industry jobs and a market decline of up to 66% over a four-year period.

However, such warnings are based upon a scenario where President Trump adopts the trade remedies recommended by Suniva to imports from all foreign nations. And while this is still a possibility, there is a significant possibility that not all imports will be banned.

Specifically, in its September 22 ruling the International Trade Commission (ITC) found no significant injury from imports from nearly a dozen nations. And while most of these nations such as Peru, Colombia and Central American nations host no cell or module manufacturing, the commission also found no injury from two nations that do: Singapore and Canada.

If Trump adopts the recommendations of the ITC and does not impose trade remedies on these nations, this could be a lifeline for a U.S. industry in need of affordable modules. With that in mind, pv magazine took a look at the capacity which may be available.

Singapore

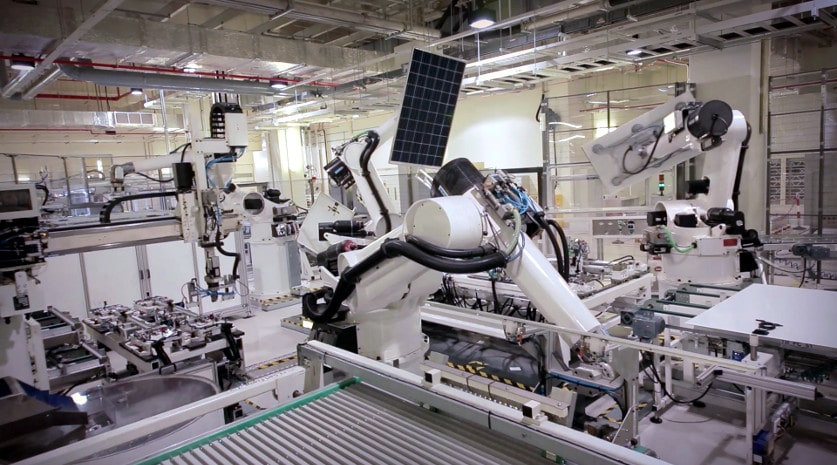

Despite being one of the world’s smallest nations in terms of land area, Singapore is home to a major solar cell and module manufacturer – REC Solar ASA. REC boasts enough integrated cell and module capacity to produce 1.4 GW of modules annually, and its products are already widely used into the U.S. market.

REC did not comment on whether it had plans to expand this capacity by press time, but if the tariffs and/or minimum price requested by Suniva become a reality, you can bet that it will.

Canada

Canada also possesses significant solar manufacturing capacity, with Silfab and Canadian Solar serving as two of the larger manufacturers. And while Silfab alone has 300 MW of capacity to draw on, both Silfab and Canadian Solar both make modules, not cells, in Canada.

The Section 201 relief is directed at cells, meaning that in order to supply products that are tariff-free to the U.S. market, both Silfab and Canadian Solar will need to source cells from the United States, Canada or another trade action-free location.

Domestic production

Once imports from Canada and Singapore are exhausted, the next source of tariff-free supply will be modules produced from U.S.-made cells.

The largest crystalline silicon factory currently online is SolarWorld’s facility in Hillsboro, Oregon, which produces both cells and modules. As of last summer the factory had 550 MW of module capacity; however given layoffs it is likely that much of this has been idled.

Unlike SolarWorld, which has seen massive layoffs but which is still running a factory, Suniva would have to both emerge from bankruptcy and restart its factories to meet U.S. demand.

Mission Solar Energy is another potential source of modules, but like Canadian Solar and Silfab the company is currently engaged in making modules, not cells, in North America – meaning that it will likely face the same pressures in terms of finding affordable tariff-free supply of cells.

In terms of smaller producers, Itek Solar is also undergoing an expansion in Washington State, after which it expects to have an annual production capacity of 210 MW, including 72-cell modules.

There is also Tesla’s Gigafactory in Buffalo. And while this promises 1 GW of supply to the U.S. market, there are several uncertainties. The first is how much of the supply will be Tesla’s Solar Roof product, and how much will be modules. The second is how much of this, if any, will be available to third-party suppliers. And finally, even though the first cells have been produced, timelines as to when the facility will ramp to full production are not clear.

Finally, there are a number of small PV makers in the United States, and a number of larger companies that have token U.S. production.

Thin film

In the event of trade action, by far the largest source of tariff-free products to serve the U.S. market in the near term will be thin film solar, which will not within the scope of the Section 201 process and thus will not be subject to any trade action. However, in what is truly unfortunate timing, the world’s largest thin film PV maker currently has part of its capacity shut down, as First Solar switches over to its large-format Series 6.

Significant tariffs or a minimum price could give First Solar an even larger presence in the U.S. utility-scale market, but this again will be limited to the availability of modules from the lines that it has not yet idled, and it will be 2019 until First Solar is expecting to be back to 3.5 GW of annual production capacity.

First Solar is doing everything it can to meet demand in the interim, including re-starting its idled factory in Vietnam.

Additionally, Japan’s Solar Frontier could see a revival of activity in the U.S. market, where it has had limited presence. However Solar Frontier’s 1 GW of global production capacity will be stretched between the Japanese market, which it has long prioritized, and the United States.

In the event of significant trade action there will be no easy solutions for cell and module supply. However, if the Trump Administration follows the ITC’s lead and declines to impose trade action on Singapore and Canada, there will at least be a lifeline of tariff-free products until U.S. manufacturing catches up.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It appears that any sanctions that will raise the cost of panels in the US market will slow the efforts for the US to even try to keep up any semblance of leadership in the world of renewables. Are we ready (and willing) to stay in 2nd or 3rd place in the developed world in this ever growing market, just when our economy is getting on track again?