Renewable portfolio standard (RPS) policies have been the bedrock of utility-scale solar and wind development in the United States. Starting mostly in the late 1990s states began requiring that electricity providers procure an increasing amount of their electricity from renewable energy sources (typically excluding large hydroelectric dams), with mandates usually set as a percentage by a certain year.

These policies often reward deployment through a system of tradable renewable energy credits (RECs) that pay for each megawatt-hour of electricity generated and whose value is set against payments that utilities had to make for non-compliance.

The result has been a stable and predictable policy that was particularly important in the early years of mass wind and solar deployment, and from 2000 through 2007 nearly all utility-scale non-hydro renewable energy was driven by RPS requirements.

RPS to non-RPS

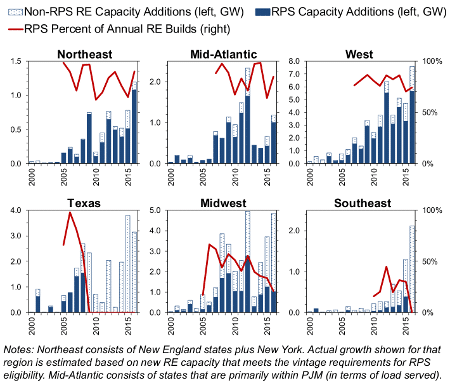

However, this is changing – and fast. The latest report by Lawrence Berkeley National Lab (LBNL) on the state of RPS policies finds that such mandates were responsible for only 44% of U.S. non-hydro renewable energy deployment in 2016, and even less in regions such as the Midwest, Texas, the Plains States and the Southeast.

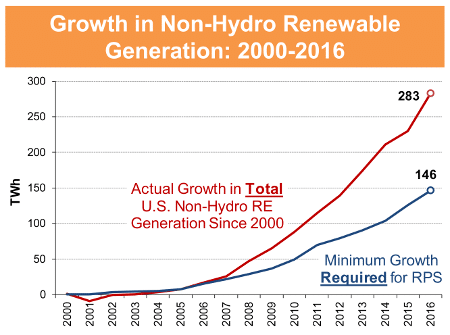

In fact, LBNL found that compared to the 283 terawatt-hours (TWh) of annual non-hydro renewable energy generation added since 2000, RPS policies required only 146 TWh.

In fact, LBNL found that compared to the 283 terawatt-hours (TWh) of annual non-hydro renewable energy generation added since 2000, RPS policies required only 146 TWh.

The report does not go into great detail as to the other policies that have driven such deployment outside of state mandates. And while for both wind and solar federal tax credits have been important, there are a variety of other drivers, depending on scale, for solar.

In particular, this year GTM Research expects more than half of the utility-scale solar that comes online to be procured under the Public Utilities Regulatory Policy Act of 1978 (PURPA), while state net metering policies have been the foundation for the deployment of behind-the-meter solar.

Shifting geographies

As renewable energy deployment moves from being RPS-driven to non-RPS driven, the geography of deployment is also changing. With costs for wind falling, the Plains States and Texas have seen impressive deployment, despite having weak or no state mandates.

For solar, the geography is different, but significant amounts of solar are being added in Southeastern states such as Georgia and North Carolina that have weak or no RPS policies. The same is true for Texas and Utah, and in both Utah and North Carolina, PURPA has been the driver for the vast majority of the solar market.

For solar, the geography is different, but significant amounts of solar are being added in Southeastern states such as Georgia and North Carolina that have weak or no RPS policies. The same is true for Texas and Utah, and in both Utah and North Carolina, PURPA has been the driver for the vast majority of the solar market.

This does not mean that RPS policies are not important. Such policies continue to drive the large majority of renewable energy adoption in the Northeast, Mid-Atlantic and Western states. However, in Texas, the Midwest and the Southeast, LBNL found that such policies are responsible for a very small portion of the renewable energy being put online.

Solar outpacing wind

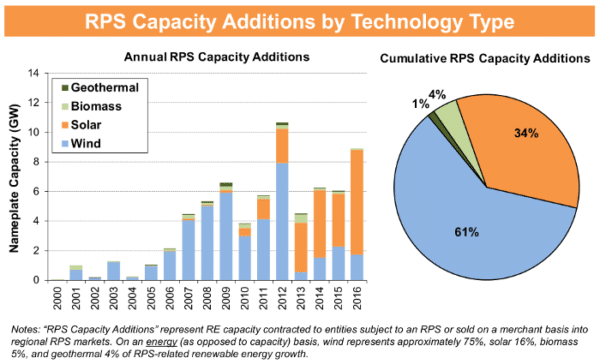

Another significant trend documented in the LBNL report is that as time goes on, solar is making up a larger percentage of RPS deployments. While wind dominated RPS deployments through 2012, starting in 2013 solar has made up the large majority of RPS deployment and made up 79% of RPS build-outs by capacity in 2016.

This may be in part due to falling costs for utility-scale solar or fpr the reasons of geography described above – that the wind market has shifted to non-RPS states with cheap land and strong wind resources. And it may be in part the influence of California, which offers excellent solar potential and whose 50% by 2030 RPS (in a state of 39 million residents) is driving large volumes of deployment.

The laggards

LBNL also notes that while most states are meeting RPS requirements, there are two that stand out for not doing so, and unfortunately they are two of the larger states by population and electricity demand in the nation.

Both New York and Illinois are well behind in meeting their targets, with Illinois only reaching 60% of its 2016 target under the state’s 25% by 2025 mandate, while New York is only a third of the way to where it should be under a more aggressive 50% by 2030.

There is hope for Illinois, as late last year the state passed legislation to fix its broken RPS, and protected the funds for programs from being raided in the last budget. But the situation is less clear for New York. Despite having the nation’s most ambitious plan to reconfigure its distribution grid, New York still has a long way to go in terms of deployment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.