Third-party solar had a pretty good run as the dominant business model for the U.S. residential market. Third-party pioneers SolarCity and Sunrun became the two largest providers in the residential market using this business model, with SolarCity reaching a share of roughly 1/3 of the entire market.

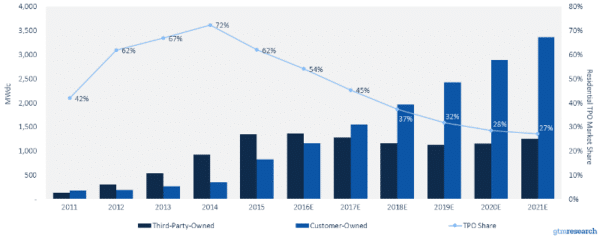

By 2014, 72% of the residential solar in the United States was sold under solar leases and power purchase agreements, which suggested that the business model would continue to dominate.

However, things began to change last year, as the share of third-party solar fell to 62%. There were many reasons for this, including the increasing availability of a wider range of loan options. Another factor may be the higher costs of third-party solar, which are bloated by higher sales and administrative costs.

Today GTM Research released a report which predicts that direct ownership will again overtake third-party solar as the dominant business model in the sector, beginning next year. U.S. Residential Solar Financing 2016-2021 reports that third-party solar fell to 62% of the overall market in 2015 and predicts that it will be only 54% of the market this year, and will fall further to 45% in 2017 and 28% in 2020.

In terms of raw numbers, GTM Research expects the volume of third-party solar to remain steady, while direct purchases take all of the growth in the market.

The company credits several factors for this, including the slowdown by large national installers including SolarCity and Vivint Solar, who still are primarily dependent on the third-party model. The company says that local installers, which tend to sell systems for cash, are growing more rapidly, and the report also notes that third-party solar arrangements are not allowed in some of the emerging state markets such as Utah and Florida.

Another factor may be the rise of online solar marketplaces. While GTM Research says that it does not have numbers on the degree to which online solar marketplaces are shifting sales to direct ownership, there is likely an influence.

“I would expect that an increasing amount of procurement through online marketplaces (like EnergySage, Pick My Solar) is contributing to the shift toward customer ownership, since those marketplaces tend to work with local installers who have a higher share of direct sales,” report author and GTM Research Senior Solar Analyst Nicole Litvak told pv magazine.

Litvak also notes that the shift to direct ownership will have ramifications for the degree of consolidation in the industry. “The solar loan market is much more fragmented than the leasing market ever was,” notes Litvak. “Installers and homeowners have access to more companies financing loans as well as multiple options for loan tenors, interest rates, and dealer fees.”

GTM Research also reports that Mosaic was the leading solar loan provider in the first half of 2016.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.