A variety of factors including declining component costs, increased competition, lower overheads and better system configurations is driving solar PV systems costs ever lower, particularly for utility-scale projects, according to the U.S. Department of Energy’s National Renewable Energy Laboratories (NREL).

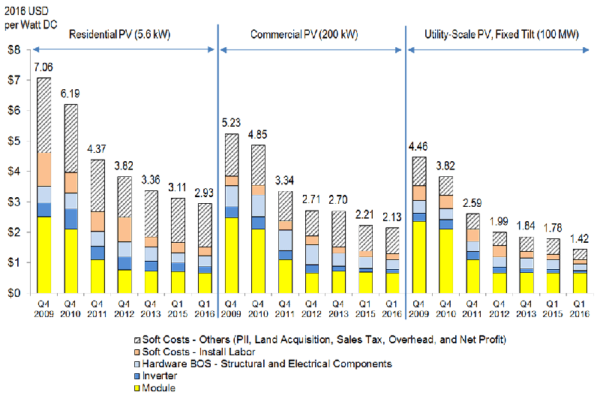

NREL’s U.S. Solar Photovoltaic System Cost Benchmark Q1 2016 shows costs for a typical 5.6 kW-DC residential PV system at $2.93 per watt, and $2.13 per watt for a 200 kW commercial system. For utility-scale PV, the authors gave a figure of $1.42 per watt for a 100 MW fixed-tilt system, and $1.49 per watt for a 100 MW system with single-axis tracking.

This represents 6% and 4% annual cost reductions for residential and C&I PV systems, but a stunning 20% reduction in costs for fixed-tilt utility-scale systems. NREL notes that while falling component costs are a factor, “increased competition, lower installer and developer overheads, improved labor productivity, and optimized system configurations also contributed, particularly for EPC firms building commercial and utility-scale projects”.

NREL also found that while cost are slightly higher for PV systems with single-axis tracking, that levelized cost of electricity is lower for such systems across a range of states, due to higher output. This appears to be the conclusion of developers and construction contractors as well, as trackers are increasingly dominating the U.S. utility-scale market.

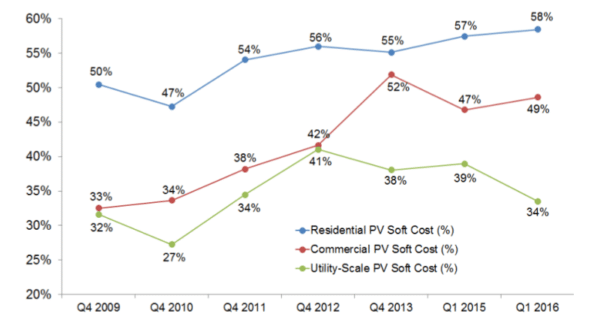

But while costs are falling fast for utility-scale solar, residential and commercial solar remain hamstrung by high non-hardware or “soft” costs. The report found that soft costs have grown to 58% of the cost of installation of residential PV systems under its model, and 49% of commercial systems.

For residential solar, the largest single category of soft costs is sales and marketing, particularly for third-party solar companies such as SolarCity, Sunrun and Vivint. These costs totaled $0.31 per watt for installers, but $0.43 per watt for third-part solar companies, giving these companies a $0.23 per watt premium over the typical installer.

Overhead, general and administrative costs were also high, and again higher for third-party solar companies. When $0.35 per watt of profit is factored in, these three categories represented more than a third of total system costs.

These three categories, particularly profit, were all smaller on a per-watt basis for commercial and utility-scale PV, meaning that even with similar module costs – modeled at $0.64 per watt by NREL – commercial and particularly utility-scale systems have had greater success at bringing down costs.

One final detail revealed by the report is fierce competition for the residential inverter space between SolarEdge and Enphase. NREL found that Enphase’s microinverters were used in only 24% of installed residential capacity in 2015, versus a nearly 1/3 share in the previous two years, while SolarEdge rose from a 15% to a 22% market share in 2015.

One factor may be price. Enphase’s microinverters are more expensive than SolarEdge’s inverter solutions with module-level power electronics. In a bid to regain market share Enphase has aggressively cut prices in recent quarters, which has wiped out its profit.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.