VDE Americas releases “Physical Work Test” playbook to clear OBBBA regulatory hurdles

With the July 4 “start of construction” deadline looming, a new technical memorandum provides a roadmap for developers to navigate the end of the 5% safe harbor and secure tax credit eligibility.

Tax credit investment market up 60% over 2024

Corporations of all sizes participate in the transferable tax credit market, with financial and energy sectors showing the most activity, according to a recent Crux report.

Watch: Solar industry leaders discuss unlocking capital and navigating post-tax credit market

Day 1 of pv magazine USA Week 2025 focused on “Unlocking Capital,” addressing the urgent financial and regulatory challenges facing U.S. solar and energy storage. Industry leaders discussed strategies to accelerate solar growth despite tightened tax credit deadlines, increased import restrictions, and reduced federal funding.

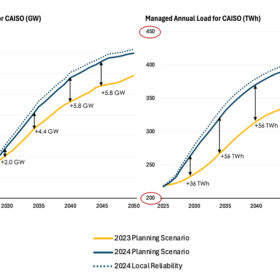

California proposes order of 6 GW by 2032 to get ahead of expiring tax credits

A California Public Utilities Commission Judge called for a “premature” order of additional electric capacity in the state to take advantage of lucrative renewable energy federal tax credits while they still exist.

Solar and battery developer Soltage closes $525 million investment

The independent power producer specializing in development, financing and operation of distributed utility-scale solar and energy storage assets closed a tax credit investment agreement.

Solar and storage rising as wind fades in $20 billion clean energy tax credit market

Crux’s 2025 Mid-Year State of Clean Energy Finance report finds transferable tax credits nearly doubled year-over-year, with the total tax credit market reaching toward $60 billion for the full year. Solar and storage dominate activity, while manufacturers are beginning to spread their wings.

One big bad bill for solar projects

The One Big Beautiful Bill Act (OBBBA) is loaded with negative measures for the U.S. solar industry. What does the bill mean for solar project development over the coming years?

Solar tax credit cliff tightens project deadlines

U.S. project developers face a shrinking timeline as federal investment and production tax credits are set to end early, and new import restrictions target Chinese components.

Treasury issues guidance for solar, wind ‘start of construction’ tax credit rules

The rules for safe harboring clean energy tax credits are “not as bad as rumored” but uncertainty remains on qualification requirements.

Solar installers must educate homeowners on impact of OBBB, survey finds

In addition to educating potential customers on going solar, Aurora Solar’s CEO advises that installers must cut soft costs, adjust sales strategies and prioritize transparency.