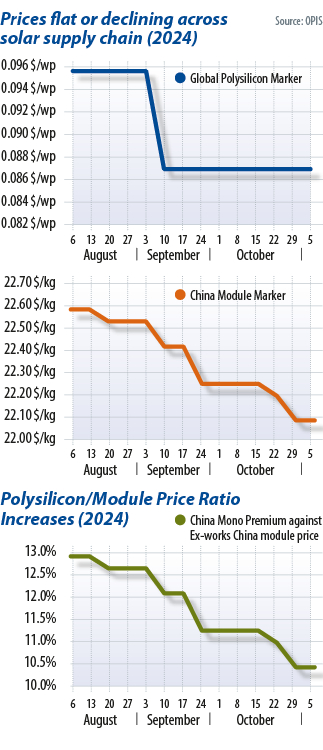

The Global Polysilicon Marker (GPM), the OPIS price benchmark for polysilicon produced outside of China, fell from $22.567 ($0.051)/kg on Sept. 3, 2024, to $22.068/kg on Nov. 5, 2024.

The Chinese Module Marker (CMM), the OPIS benchmark for Chinese modules that are FOB (free onboard, or excluding shipment costs), fell from $0.095/W to $0.087/W over the same period. Price declines were likewise recorded for modules delivered to Europe and the United States (see charts). The U.S. Department of Commerce’s (DOC) Oct. 1 announcement of its preliminary decision on countervailing duties for Southeast Asian solar imports was undoubtedly the most talked-about development in the past few weeks. The department said specific manufacturers in Thailand, Vietnam, Cambodia, and Malaysia have benefited from subsidy rates ranging from 0.14% to 292.61%.

For unspecified companies, the DOC established the following subsidy rates by country: 8.25% for Cambodia, 9.13% for Malaysia, 23.06% for Thailand, and 2.85% for Vietnam.

All of those rates were largely within market expectations. Some industry players found the preliminary rates to be slightly lower than they had predicted, but cautioned it would be premature to see this as a sudden boost for price and trading activity. Another preliminary antidumping ruling is due at the start of December 2024, which would provide a more definitive signal for buyers mulling over their purchase volumes.

All of those rates were largely within market expectations. Some industry players found the preliminary rates to be slightly lower than they had predicted, but cautioned it would be premature to see this as a sudden boost for price and trading activity. Another preliminary antidumping ruling is due at the start of December 2024, which would provide a more definitive signal for buyers mulling over their purchase volumes.

U.S. manufacturing

Policies for domestic solar manufacturing in the United States continued to appear favorable in the meantime. During October and November 2024, the Department of Treasury clarified that solar ingots and wafers qualify as semiconductor manufacturing, making them eligible for the 25% Advanced Manufacturing Investment Credit. The department also released regulations enabling tax deduction claims covered by the 45X Advanced Manufacturing Production Tax Credit, which insiders see as a boon to support new solar manufacturing projects in the country.

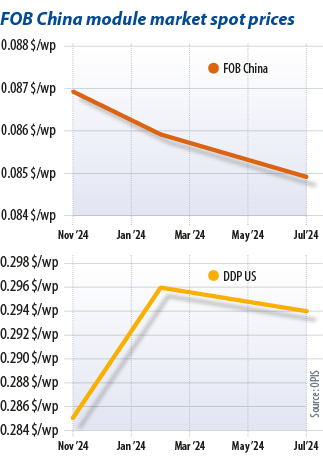

Those positive developments, coupled with the specter of additional import tariffs, were enough to keep the forward market for modules in a slight contango (meaning future prices are expected to be higher than current spot prices) up until June 2025. The spot price of delivered, duty paid (DPP) tunnel oxide passivated contact (TOPCon) modules on the US market was at $0.285/W as of Nov. 5, 2024. For June 2025, the price stands at $0.297/Wp, according to the OPIS Forward Curve, implying expectations of improving market conditions in the United States moving forward.

The FOB China TOPCon forward market remained in slight reverse, however, implying expectations that export market conditions are unlikely to improve in the near term. The spot price of FOB China TOPCon modules was at $0.087/W, as of Nov. 5, 2024, with the June 2025 forward price at $0.086/W, according to the OPIS Forward Curve.

The Chinese solar industry has been grappling with a hostile trading environment abroad and cutthroat price competition at home. In October 2024, the China Photovoltaic Industry Association (CPIA) responded by announcing it would release a production cost estimate for photovoltaic modules to urge producers to avoid below-cost offers in large-scale procurement tenders in the domestic market.

The association calculated the production cost for n-type M10 (182 mm x 182 mm) bifacial modules, excluding depreciation and taxes on key upstream materials such as polysilicon, wafers, and cells, at CNY 0.68 ($0.09)/W as of October 2024.

A state-owned tender the same month had attracted lowest offers for both positively doped, p-type and n-type modules at CNY 0.66/W.

A state-owned tender the same month had attracted lowest offers for both positively doped, p-type and n-type modules at CNY 0.66/W.

Manufacturers in China said the CPIA’s guidelines help provide an implicit price floor for tender offers, even though they are not legally binding. They also noted, however, that these guidelines only pertain to state-owned tenders and not export orders.

With Chinese polysilicon prices stabilizing since early October 2024, and module prices on a relentless downward slide, the cost of Chinese Mono Premium (CMP) polysilicon has risen. CMP is the OPIS assessment for the unblended polysilicon used for n-type ingot pulling measured against ex-warehouse Chinese domestic module prices. It stood at 11% of ex-warehouse Chinese domestic module prices in August 2024, rising to 13% on a per-watt basis in November 2024.

More regulatory and trade headwinds lie ahead for the global solar industry. Fresh subsidy allegations from petitioners has prompted the DOC to investigate the “cross-border” provision of silver paste and solar glass in Southeast Asia. The return of Donald Trump as US president, who made raising import tariffs a cornerstone of his re-election campaign, also looks set to keep the solar industry on tenterhooks regarding the chain reaction of intensifying protectionism.

About the author: Hanwei Wu, the editorial director of OPIS, leads the Asia-Pacific team in producing price assessments, proprietary data, and news analysis for the solar, carbon, oil, and petrochemical markets. His responsibilities include developing pricing methodologies for energy markets, identifying the latest industry trends and developments, and producing market-driven news and analysis. In recent years, he has launched data products for the oil and renewables markets, including solar.

About the author: Hanwei Wu, the editorial director of OPIS, leads the Asia-Pacific team in producing price assessments, proprietary data, and news analysis for the solar, carbon, oil, and petrochemical markets. His responsibilities include developing pricing methodologies for energy markets, identifying the latest industry trends and developments, and producing market-driven news and analysis. In recent years, he has launched data products for the oil and renewables markets, including solar.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.