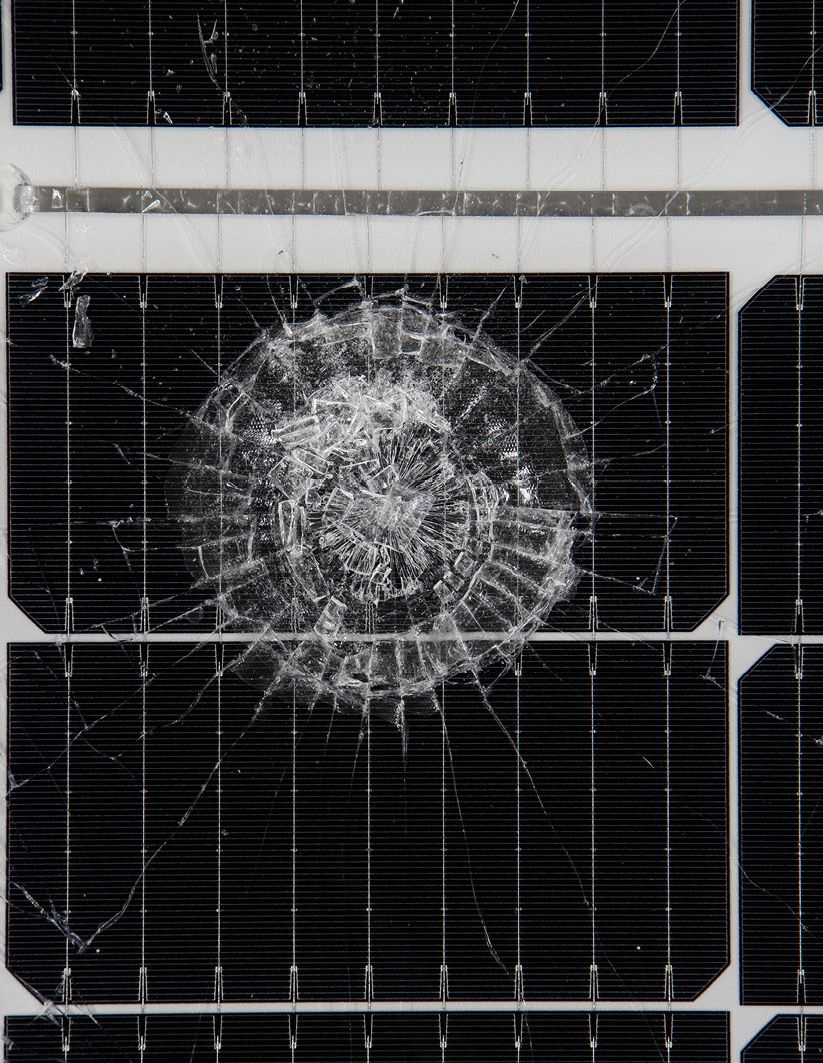

Modules are the main point of failure for solar projects during hailstorms. With wafers growing in size from M6 (166 x 166 mm) to M10 (182 x 182 mm) and G12 (210 x 210 mm), panel dimensions have grown from 1 meter by 2 meter to 1.3 meters by 2.3 meters, and larger. Thin frames and glass may have helped drive prices down, but they also mean less resilient products.

Recent Australian solar projects have featured bifacial panels with 2 mm-thick front and rear glass. Typically certified to minimum International Electrotechnical Commission (IEC) test standards, for 25 mm ice ball resistance, they can usually pass 35 mm hail impact tests. Severe Australian hailstorms have always had 35 mm-plus hailstones and climate change means such events are more frequent and more damaging.

Some laboratories have introduced more stringent, bespoke tests beyond minimum IEC requirements. As a result, some manufacturers are offering customized bill of materials featuring 2.5 mm glass front and rear. This increased glass thickness comes with a weight penalty, but in many cases, the modules can pass a 45 mm hail impact test.

Manufacturers have also released “hail- resistant” modules with 3.2 mm front glass and either 2 mm or 1.6 mm rear glass that can pass 50 mm, and in some cases 55 mm hail impact tests. Those modules are heavier and in a market like Australia, where occupational health and safety manual handling limits make it prohibitive to use panels weighing more than 40 kg, the size (and power class) of such panels that can be used will be limited.

Racking selection

In areas that experience severe hailstorms, for projects that use trackers, having a hail stow mechanism can significantly reduce the number of panels damaged during such weather. By tilting the panels away from the incoming hail direction, the angle of impact can be increased and the impact energy decreased. Most major tracker manufacturers now offer a hail stow feature in their products and this feature should be included in an Employer’s Requirements for new projects.

Fixed-tilt projects cannot count on a smart stowing strategy. No matter what racking system is used, the additional weight of the modules also needs to be considered during structural design to ensure adequate strength and stiffness.

A 2023 study by the University of Queensland and the Australian Bureau of Meteorology identified the southeastern corner of Queensland and the northern coast of New South Wales as the most hail-prone parts of Australia. Those areas include the Central West Orana and New England renewable energy zones (REZs) under development in New South Wales as well as the Southern Downs, Western Downs, and Darling Downs REZs, in Queensland. The draft integrated system plan by the Australian Energy Market Operator for 2024 envisages those areas hosting up to 14 GW of new solar by 2040.

Similar studies in other regions illustrate the importance of considering hail and, more generally, environmental risk at an early stage of project development. Knowing the expected climate risks will let developers pick the best equipment for a location, reducing risk and securing the long term bankability of portfolios.

At the procurement stage, it is important that hail impact tests are undertaken by reputable independent testing and certification authorities, and that this is included in the employer’s requirements for new projects. Generally speaking, proper sourcing should include a factory audit and a series of tests that go beyond IEC standards, both prior to shipment and at reception on-site.

Insurance issues

For a developer, there is efficiency in having as much generation capacity as possible in the same geographical area. Everyone loves to have a “stage-two” or even “stage-three” extension for a project, but for an insurer, such geographical concentration raises the risk of a large loss event.

Other than the technical mitigations discussed above, developers may look to procure insurance at a portfolio rather than project level, to leverage the scale of portfolios and geographic diversity. This may be a way of increasing the coverage available for projects in hail prone regions at a manageable cost. Developers that spread their projects across multiple locations will be able to avoid concentration risk and perhaps be able to pursue a portfolio-level insurance strategy.

Future planning

Anticipating the impact of a hailstorm is not a simple task. Developers should carefully consider the location of projects within a wider portfolio context and should ensure that design and procurement decisions are taken with adequate consideration of hail risk and the mitigation strategies discussed above. Ensuring the durability of PV developments requires a range of skills including planning and defining an insurance strategy as well as proper design, engineering, and procurement. With the aid of a thoroughly conducted climate risk assessment that evaluates and mitigates commercial and financial impact on operating expenditure, revenue, or project life from the early phases of development, this should ultimately help to keep future lenders’ requirements manageable.

About the author: Simon Mason is a partner at Everoze, a technical and commercial energy consultancy specializing in renewables, energy storage, and flexibility. He is one of the founding partners of Everoze’s Australian operation and has been working on utility-scale solar, battery energy storage, and wind projects in Australia and Southeast Asia since 2008.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.