The tax transfer and equity market is on track to exceed $40 billion in 2024, with tax credit transfers specifically projected to account for $22-25 billion of that total. In the third quarter alone, Crux estimates that transfer deals closed between $7 and $7.5 billion.

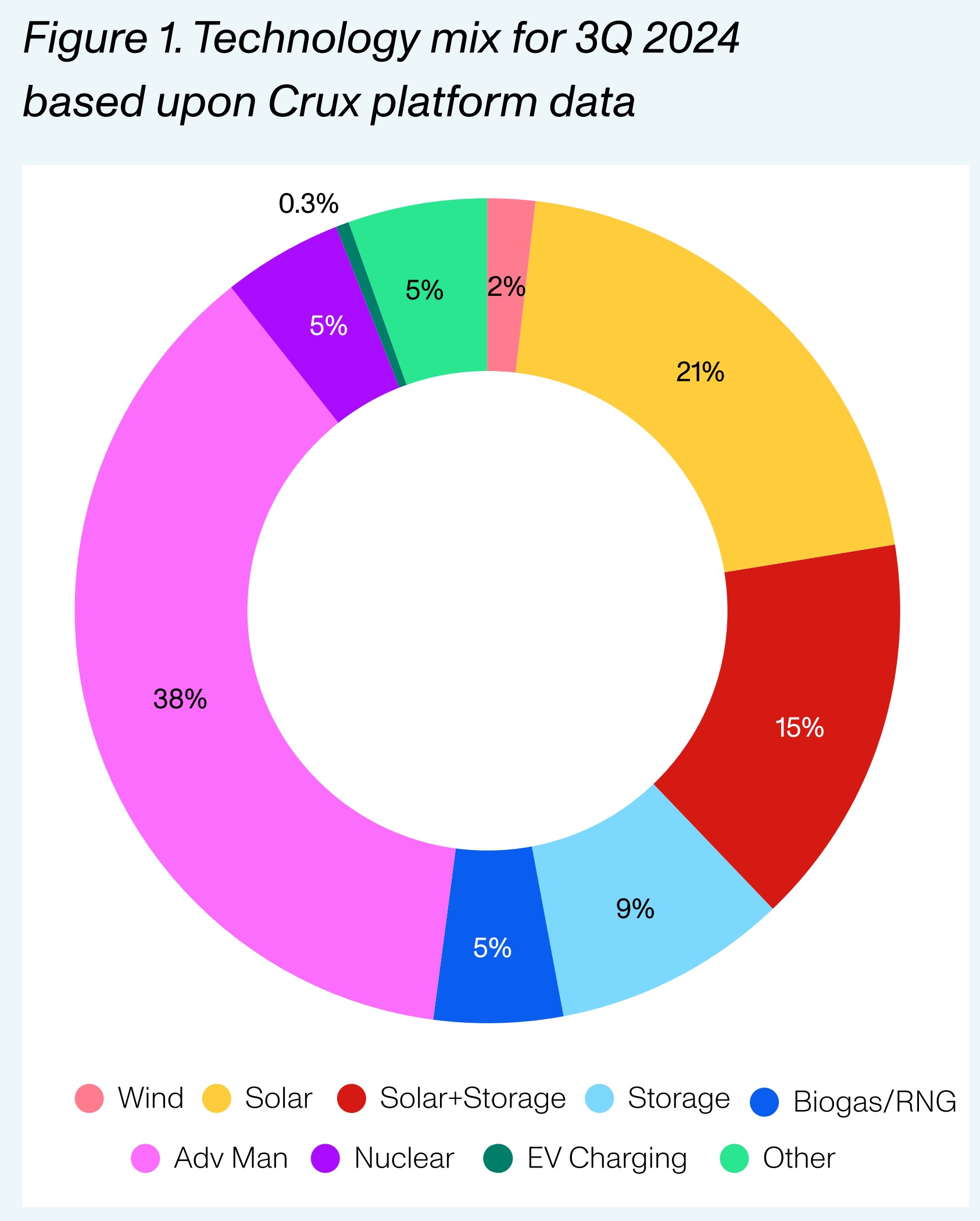

Within this volume, solar projects comprised 21% of the transactions, solar-plus-storage 15%, and standalone storage 9%, totaling 45% of all tax credit transactions in Q3.

According to Crux’s “3Q 2024 Market Update: The State of the Market for Transferable Tax Credits,” the majority of Inflation Reduction Act (IRA) tax credit transfers was directed towards advanced manufacturing. For example, solar module manufacturer Heliene closed on a $50 million manufacturing tax credit transfer deal.

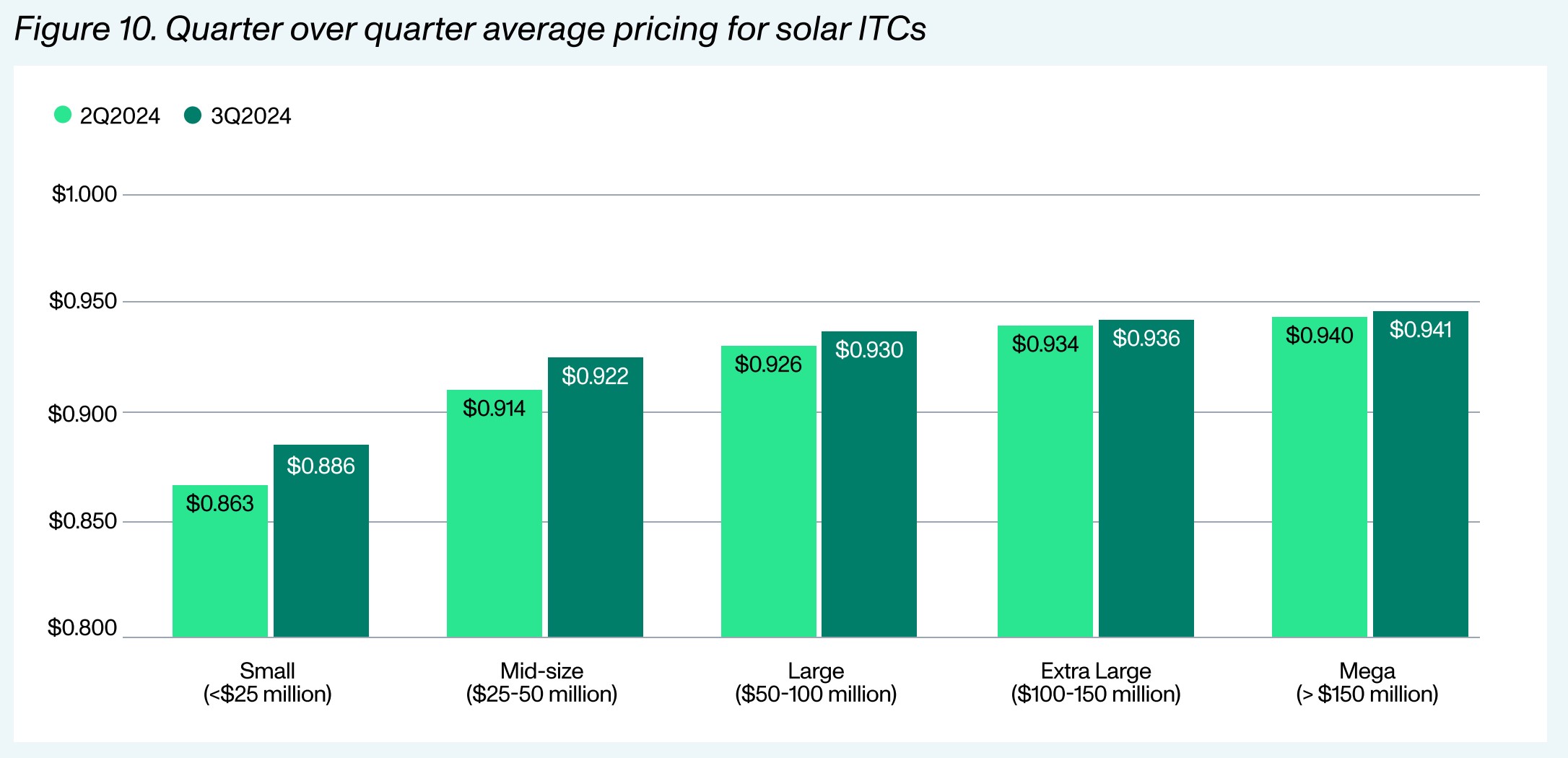

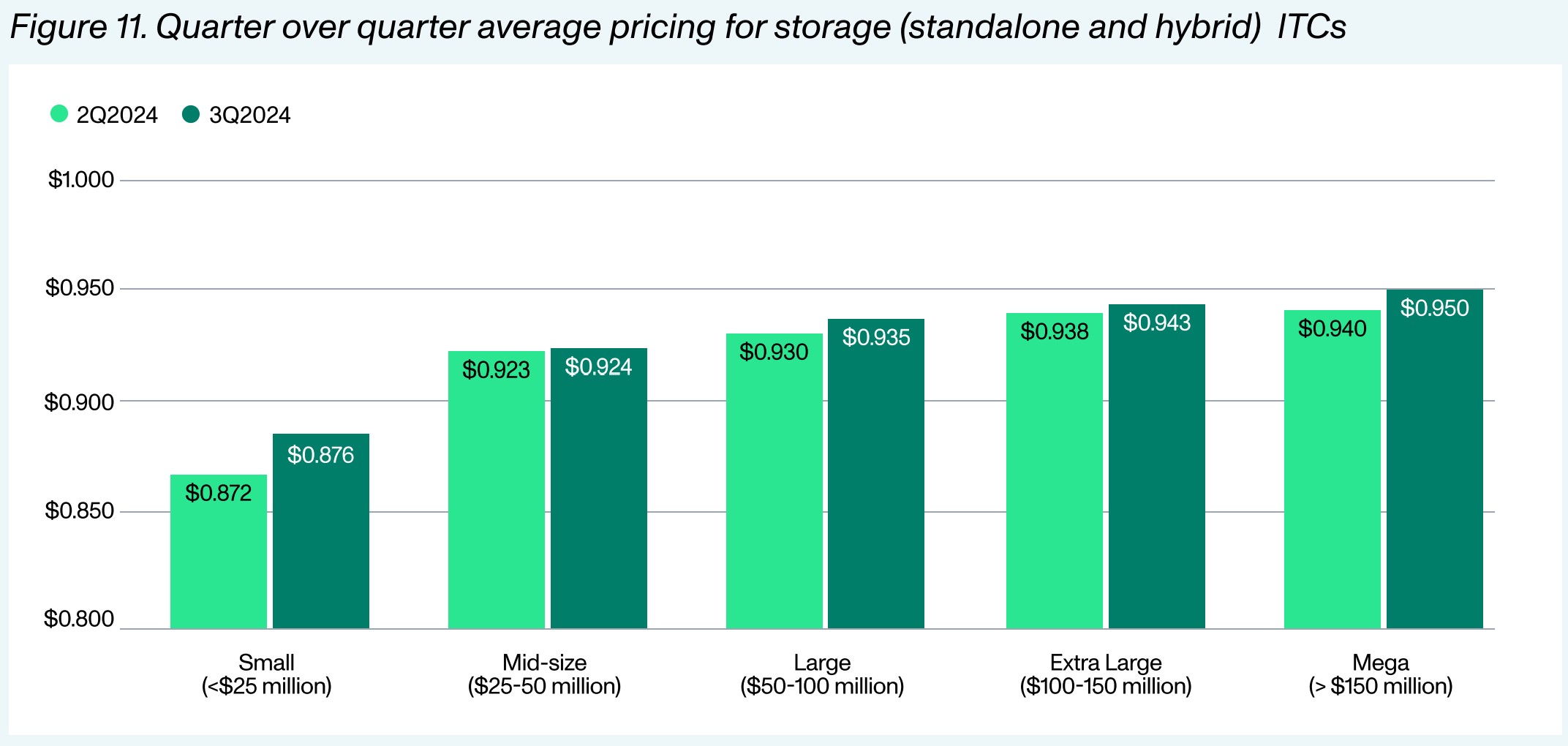

The pricing for tax credit transfers varied significantly, with rates on Crux’s platform ranging from $0.886 to $0.941 per dollar of tax credit transferred. This variance spanned from ‘small’ transactions of less than $25 million to ‘mega’ transactions exceeding $150 million. Similarly, smaller-scale solar tax credit transfers under $1 million on other platforms displayed comparable pricing trends.

The report also noted an increase in the value of these tax credits across all project sizes from the second quarter to the third quarter.

Smaller projects on Crux’s platform demonstrated higher pricing variance. Bids for these projects varied by plus or minus $0.02 around the average priced bid. Mid-size projects showed a variance range of $0.006, large projects had the smallest variance at $0.0025 up or down, and ‘mega’ projects displayed a variance of $0.008. This range of bids has tightened as Crux recorded an 1800% increase in the number of bids compared to the fourth quarter of 2023.

Crux indicated that pricing variability is influenced by the availability of insurance, the risk of ITC recapture, the financial stability of the party seeking the tax transfer, and project size, as smaller projects must absorb greater fixed costs. Almost 90% of deals on the platform have included some form of partial or comprehensive insurance coverage.

The report observes that a higher percentage of large-scale energy storage and hybrid solar-plus-storage projects, increasingly dominating the power generation construction market, are seeking tax transfers. In contrast, larger solar projects are more frequently staying within the tax equity market.

This preference for tax equity over direct tax transfer transactions, as detailed in an analysis by Segue Sustainable Infrastructure, is primarily due to the significant depreciation benefits that larger projects can capitalize on. These benefits are substantial enough to justify the additional legal and accounting due diligence costs associated with tax equity financing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.