As part of the newly signed Inflation Reduction Act, the Investment Tax Credit (ITC) includes a nuanced change that allows for the tax credit to be sold for cash, to parties that are in no way associated with the solar project.

This is a significant departure from the former structure of the ITC, which originally required a complex, often expensive tax equity process in order to meet IRS standards. Those standards required parties buying into a project for a tax benefit to prove that they took on real risk and responsibility.

An article released by Segue Sustainable Infrastructure, a principal investment firm providing development capital to renewable energy projects, compares this new tool – transfer payments – to tax equity in a technical financial writing.

The author, who provides tax equity related services for solar projects, gives credit to US Bank as the American company that has “done the most to support clean energy” over the last 15 years via their tax equity work.

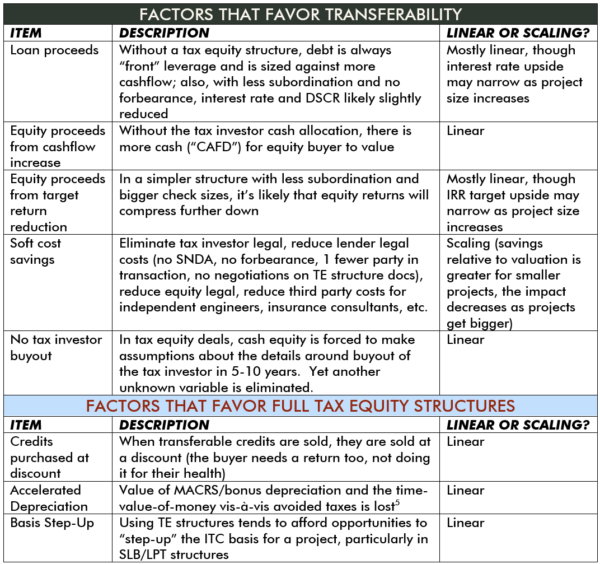

Segue describes the factors that favor each type of project finance when using a tax inefficient partner (one who cannot take advantage of depreciation) to buy transfer payment credits:

The author sees an opportunity for large scale solar power plants to take advantage of the less complex transfer payment structure, however, industry nuances still complicate this decision. Factors like depreciation, as well as the price paid for tax credits versus expected transfer payments, and basis step up opportunities, can get tax equity to within 40-60 basis points of the weighted average cost of cash for a transfer payment project.

The author believes this is a price gulf that a hungry tax equity professional can work through if they really want the deal.

One important question is – how much should our tax credit be sold for? What’s a fair market price?

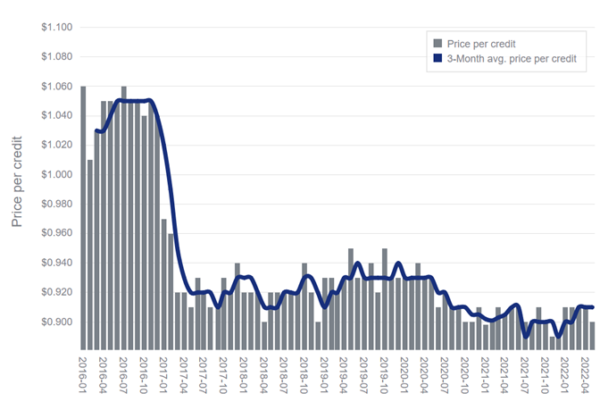

LIHTC pricing over time:

The author compares transfer payment to the Low-Income Housing Tax Credit (LIHT”) market, as it’s “the largest and longest-running transferable credit market”. Segue notes that none of the many professionals they spoke to on this topic would give an opinion on whether solar transfer credit would trade at a premium or discount to the LIHTC.

There are some upsides to the solar transfer payment. The payment is delivered all at once, whereas the LIHTC is distributed over ten years. Also, the LIHTC carries an occupancy risk – whereas solar does not. One drawback to the solar transfer payment is that it is still new. And of course, LIHTC investments are motivated by a number of factors other than tax credit revenue.

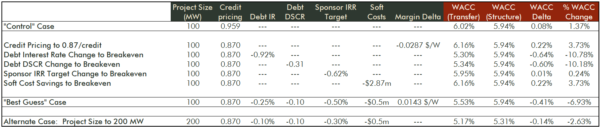

The author also put together a “control case” to look at differences between 100 MW projects, which changes certain variables so that a developer may ignore tax equity and transfer payments. One of these variables includes soft costs – specifically, lawyer and accountant fees. The estimated spread between the tax equity and transfer payments was $2.7 million – which speaks to how transfer payments should be easier, and cheaper (though not easy/cheap as the author notes).

The author also estimated how much more a developer might earn on this 100 MW “control case” project if they were to sell via transfer payments, and found a significant increase of $0.0143/W.

Among the closing thoughts is the question of whether a solar project can change hands within the first five years. The current assumption is that the transfer payment owner will likely be entirely disconnected from the solar facility, and would not be affected by a project transfer of ownership. In the tax equity world, the buyer of a tax credit is part of the project, so they would have to remain an owner for five or more years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

When the table says “step up” the ITC basis of a project does this mean adjusting the asset’s value to the fair market value? What is an average 100 MW project going for these days? 85 cent/Watt? What what would the FMV be set to?

Is the step up not possible with the transferable credit?

I am looking for a reliable and trustworthy overseas investment partner to manage my funds provided we can reach an agreement on percentage for Return On Investment or do you have any good business idea in mind that requires funding or do you need a personal loan to fund your business for as low as 3% interest per annum.

Kindly contact me, if interested, so that we can deliberate further.

Email: herbert.h@hiltonmachineries.com

Website: https://hiltonmachineries.com

Mr. Herbert Hilton