Wood Mackenzie released a report updating the current market size of community solar in the United States. The firm forecasts that community solar installed capacity will essentially double in five years.

Community solar typically involves a customer subscribing to a portion of an off-site solar facility’s generating capacity, receiving credits on their utility bills for the electricity produced by the facility.

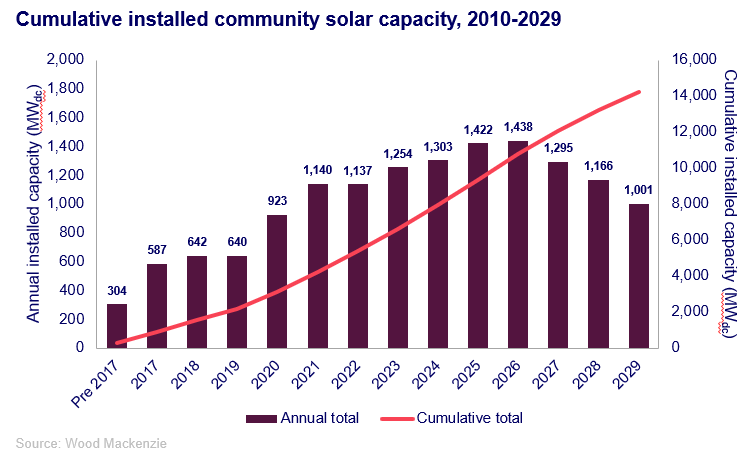

Wood Mackenzie forecasts that 7.3 GW of community solar will be installed through 2029, bringing the cumulative total to over 14 GW that year. The firm forecasts a national growth rate of 5% through 2026 and an 11% contraction through 2029.

The U.S. community solar market has tripled in size since 2020, but growth is beginning to slow in existing state markets, said Wood Mackenzie.

“Additionally, the May 2024 decision on California community solar resulted in a significant 14% reduction to Wood Mackenzie’s five-year national outlook. Without a major market entrant like California, long-term community solar growth will largely depend on the enactment of legislation to enable new state markets,” said Caitlin Connolly, senior research analyst at Wood Mackenzie, and lead author of the report.

Under a bull case forecast, the firm’s expectation increases by 21% in existing markets, while the bear case projects a potential 20% decrease. These alternative scenarios do not account for the establishment of new state markets, such as Ohio, Pennsylvania, Michigan, and Wisconsin – all of which have significant interest and pre-development project pipelines. These markets would result in at least a 17% increase from the base forecast, reaching 17.1 GW installed in 2029, said Wood Mackenzie.

Community solar developers are continuing to navigate federal incentives.

“The fruits of the Inflation Reduction Act are numerous but difficult to count on,” said Connolly. “Community solar stakeholders are navigating a steep learning curve while trying to secure tax credit adders. In addition, awards from the $7 billion ‘Solar for All’ fund were announced in April 2024. Final implementation plans are not confirmed but developers hope to utilize federal funds to expand into new state markets even in the absence of official state programs.”

Wood Mackenzie expects 3.6 GW of community solar will serve low- to moderate-income households by 2029. Currently, about 829 MW of community solar serves LMI customers.

“The share of community solar capacity serving LMI subscribers grew from 2% in H2 2022 to 12% in H1 2024,” said the report. “Given the availability of the LMI tax credit adder, Solar for All funding, and evolution of state-level LMI requirements, the share of community solar dedicated to LMI subscribers will grow to nearly 25% by 2025.”

The top three community solar subscription managers cover 56% of subscribers an 71% of LMI subscribers. LMI subscribers remain the most costly to acquire with costs averaging $113 per kilowatt, 27% higher than the average cost to require non-LMI residential subscribers, said Wood Mackenzie.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.