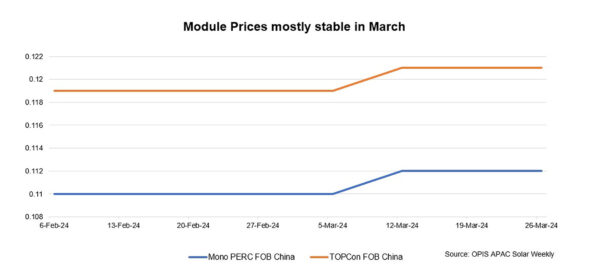

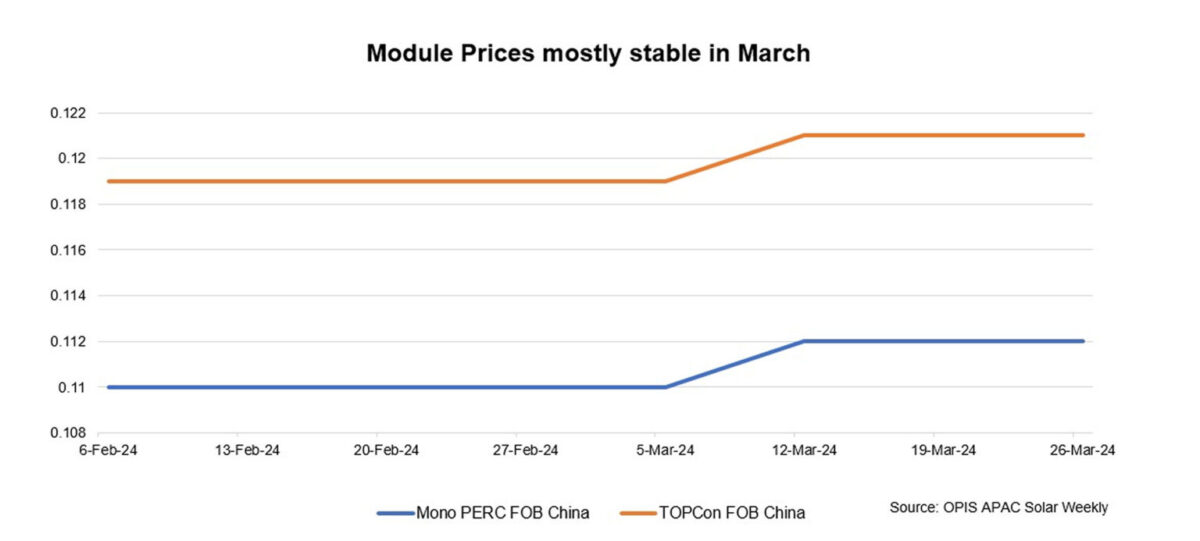

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules was assessed at $0.121 per W, unchanged week to week while mono PERC modules from China were assessed at $0.112/W, stable from the previous week amid unchanged market fundamentals.

The past few weeks of price hikes in the Chinese market saw a slight respite this week with many market participants pointing out that market activity had quietened down and prices were starting to stabilize in the domestic market.

Overseas demand continued to remain firm as March and April are the start of a strong quarter for solar deployments across Europe, with many companies installing the backlog of contracts they had accumulated over the winter, a market source said.

Turkey has implemented anti-dumping measures on solar panel imports from Vietnam, Malaysia, Thailand, Croatia, and Jordan where a guarantee fee of $25 per square meter will be levied on photovoltaic (PV) cells that are assembled in modules or arranged in panels originating from these countries.

According to OPIS sources, these measures would not have a big impact on Southeast Asia modules as the majority of Southeast Asia modules are destined for the U.S. market. The current U.S. Section 201 tariff exemption of bifacial modules from Southeast Asia that is set to expire in June was expected to have a greater impact.

Freight rates from Southeast Asia to the United States remained at $0.02-0.03 with some players locking in their freights at lower rates, a market participant said. About 30 GW of module inventory that was imported last year to the United States was distorting prices in the market as sellers dropped prices of these old stock in a bid to clear inventory, the market source added. According to the source, prices of mono PERC in the warehouses are sold at $0.17/W, down from $0.19/W previously in December.

New domestic U.S. module capacity is expected to come on stream in the fourth quarter of this year or the first quarter of 2025 and demand for US-made modules is expected to remain high which will support firmer prices of these products, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.