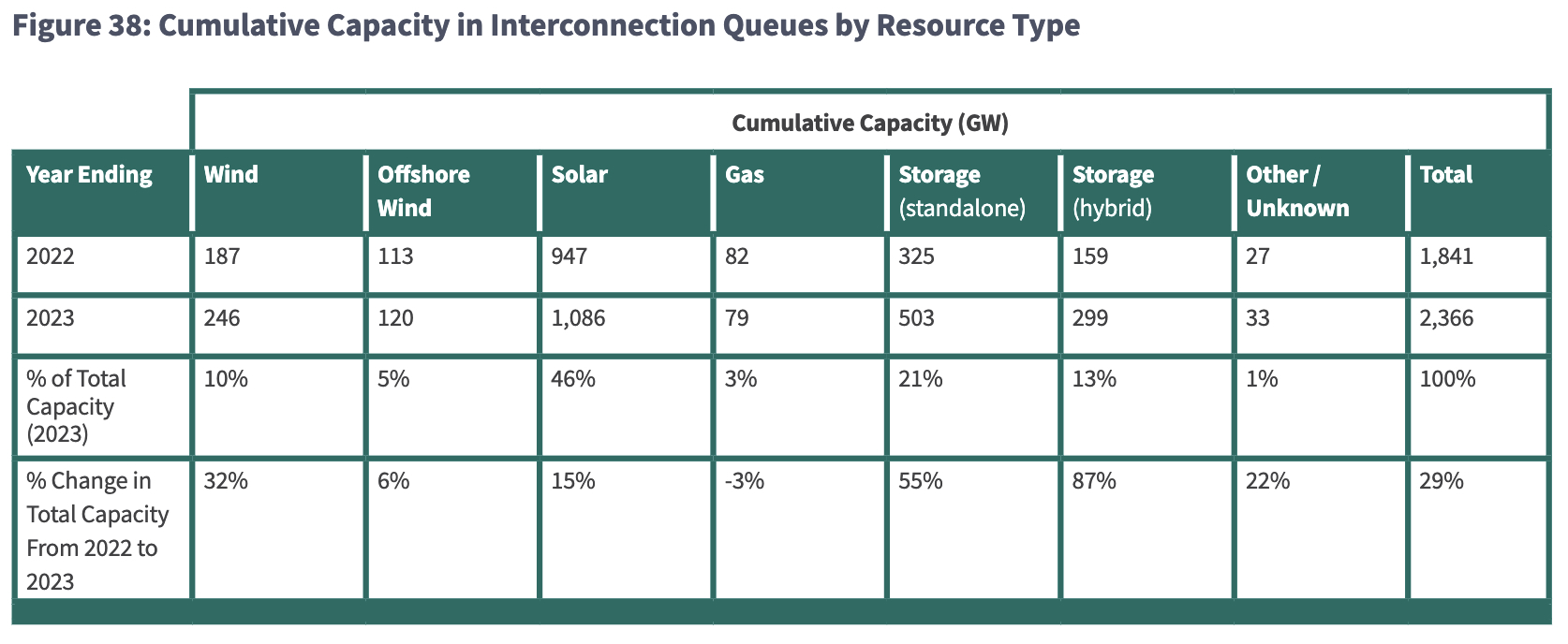

By year-end 2023, 1086 GW of solar projects awaited transmission interconnection, along with 503 GW of standalone storage, according to preliminary data from Lawrence Berkeley National Laboratory (LBNL). The amount of storage in hybrid projects, such as solar-plus-storage projects, awaiting interconnection at year-end was estimated at 525 GW by LBNL, based on imputed values for missing data when storage capacity for hybrid projects was not reported.

The data were reported in a staff report from the Federal Energy Regulatory Commission (FERC).

LBNL’s preliminary values for all but one of the resource types awaiting interconnection are presented in the table below from the FERC staff report. The exception is hybrid storage, which FERC staff shows as 299 GW in the table, not LBNL’s preliminary 525 GW, because FERC staff excluded hybrid storage projects for which capacity was not reported.

Solar, wind, and battery storage represented nearly 95% of the total capacity in interconnection queues as of year-end 2023, the staff report said.

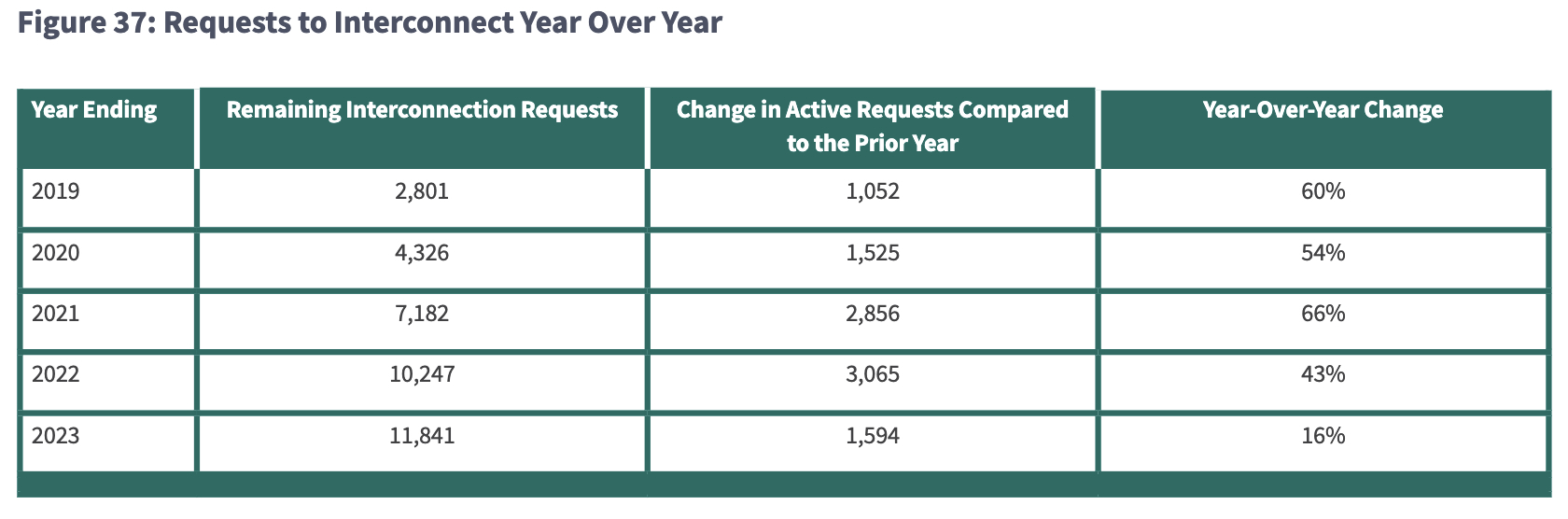

Pending transmission interconnection requests at year-end 2023 rose to 11,841, according to LBNL’s preliminary data, representing a 16% increase since year-end 2022 and more than a four-fold increase since year-end 2019, as shown in the table below.

The FERC staff report includes summaries of transmission plans submitted by grid operators to FERC last year, including plans for transmission that could help bring solar and storage projects online.

The transmission plan from California grid operator CAISO included 21 transmission projects at a cost of $5.5 billion to help meet the renewable generation requirements set by state regulators. Some of those projects would enable importing wind power from outside CAISO.

Mid-continent grid operator MISO planned 142 transmission projects to interconnect new generators.

The PJM grid operator stretching from Chicago to New Jersey “identified” 93 transmission projects at a cost of $180 million to support generation seeking interconnection, and “evaluated 227 supplemental projects put forward by transmission owners,” the report said, that would cost $2.4 billion.

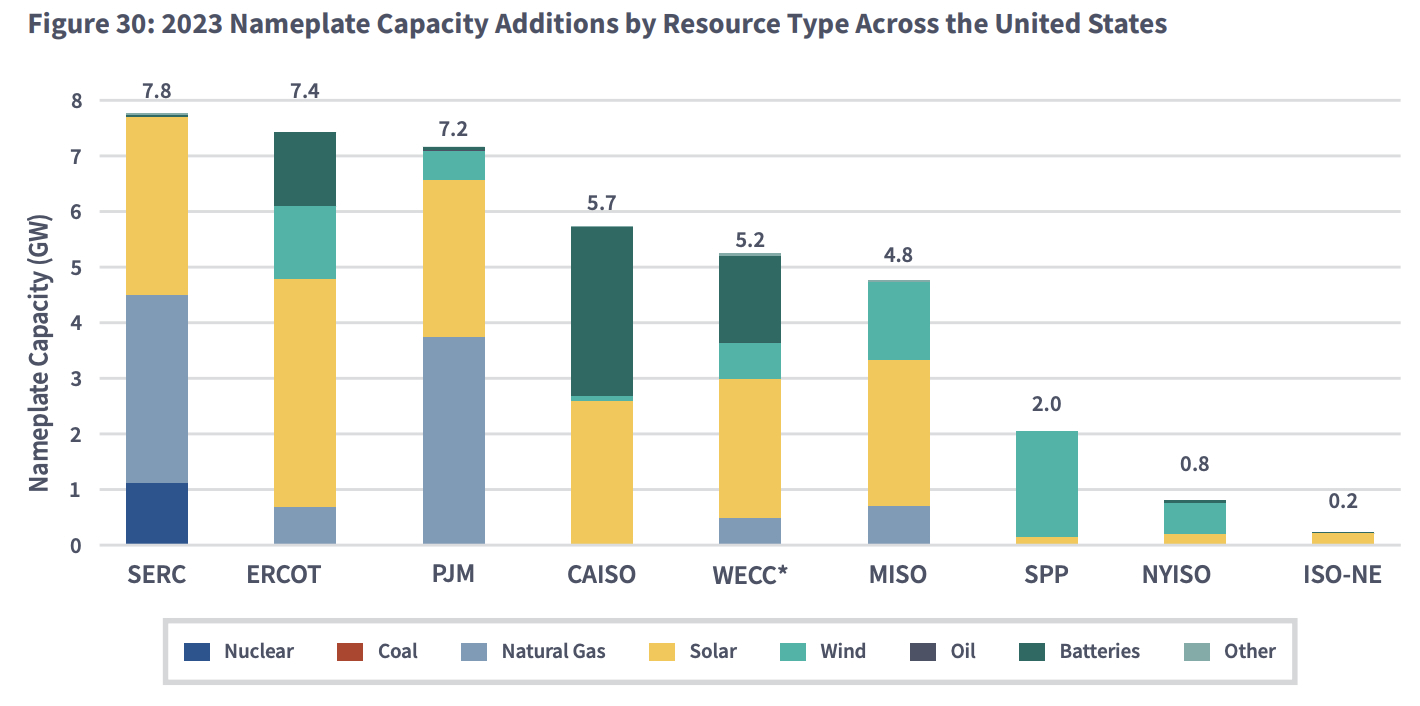

The ERCOT grid region in Texas added the most solar of any region last year, as shown in the following chart from the report, showing capacity additions by grid region.

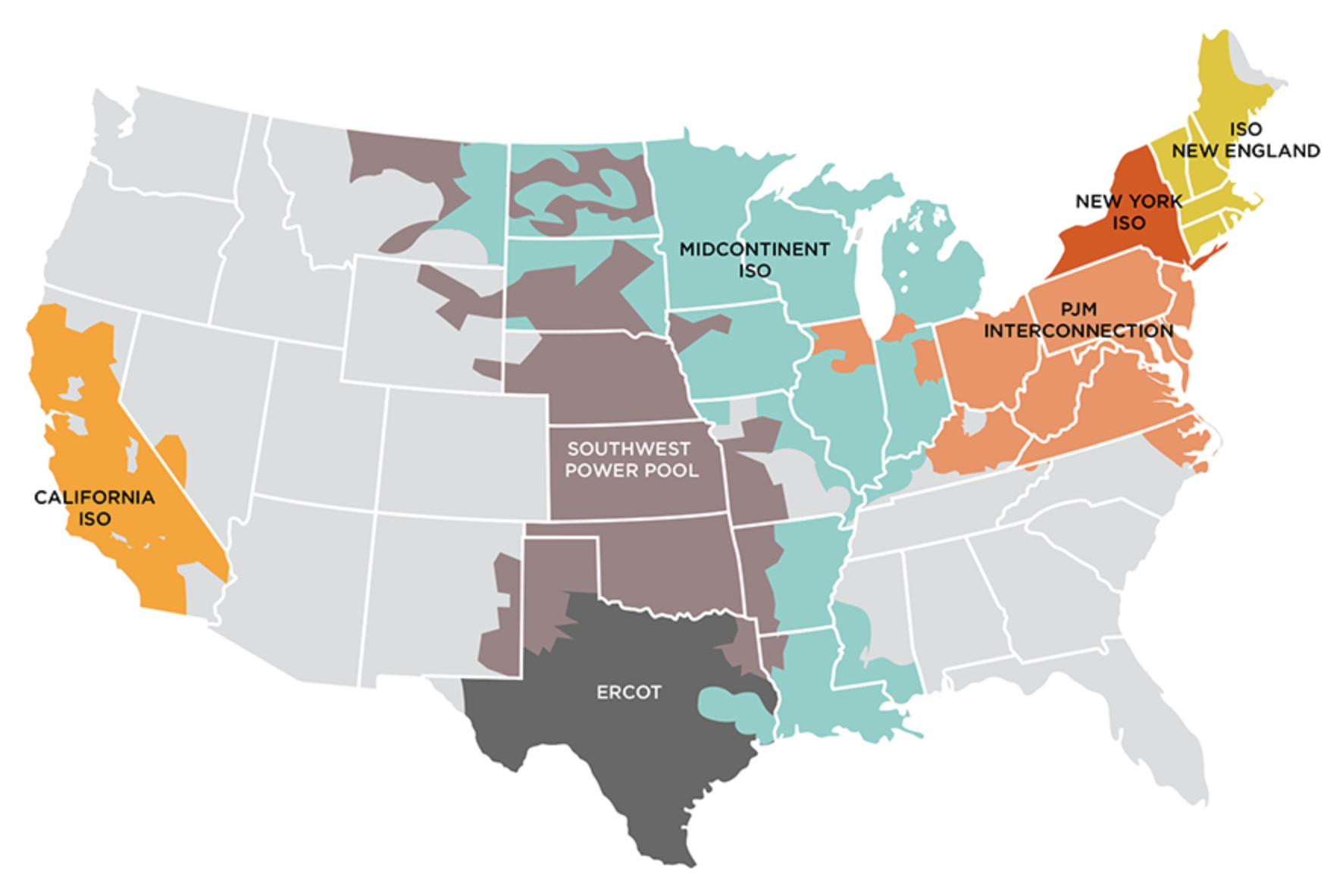

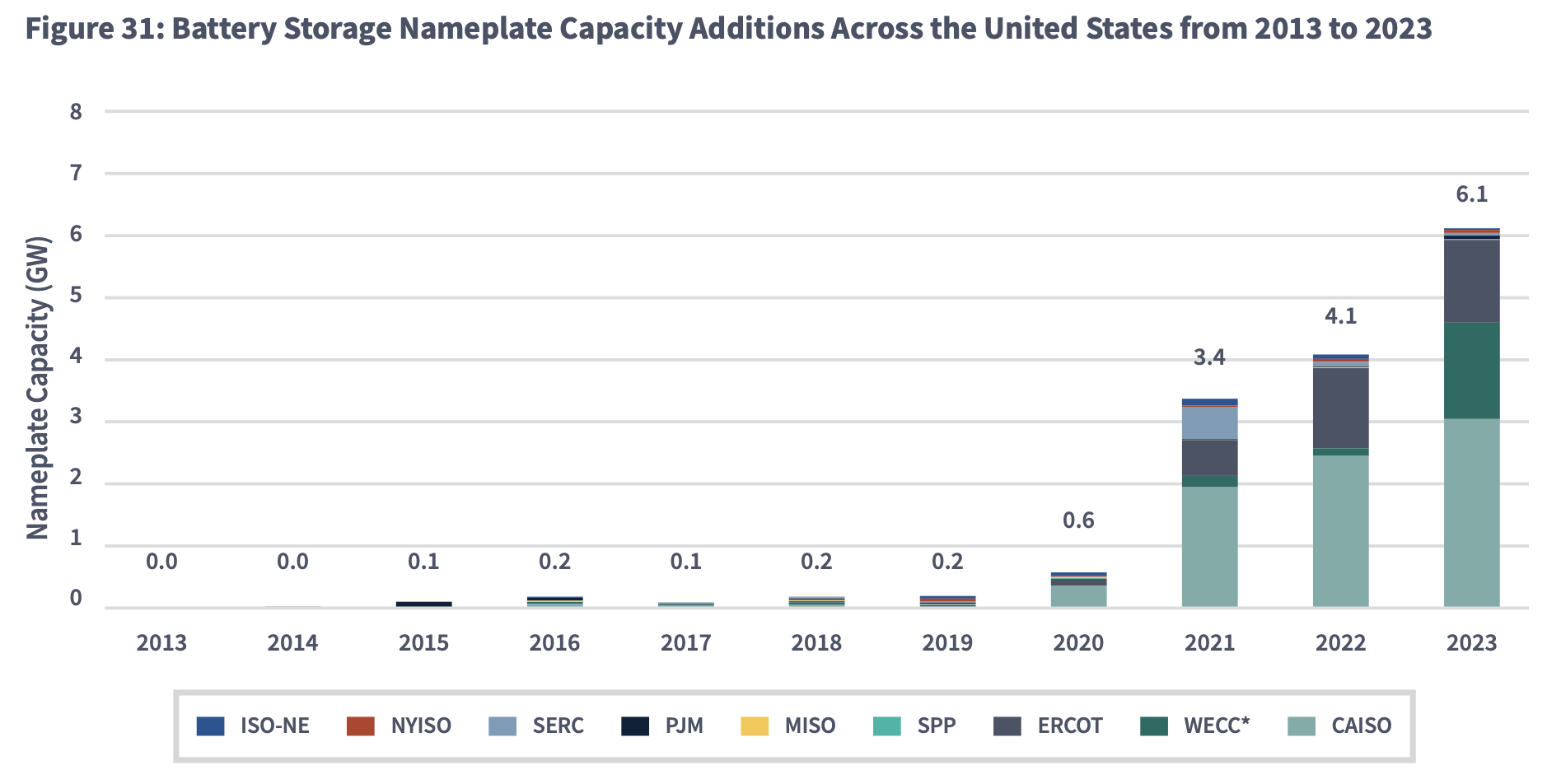

The geographic areas of seven of the nine grid regions referenced in the chart are shown in the map below. The other two regions are the “SERC region,” which is the SERC Reliability Corporation (SERC) area in the Southeast, and the “WECC* region,” which is the Western Electricity Coordinating Council area in the Western states without California’s CAISO region.

The CAISO and ERCOT grid regions account for most of the growth in transmission-connected batteries in the past three years, as shown in the following chart from the report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.