The Solar Energy Industries Association (SEIA) recently hosted its annual Finance, Tax, and Buyer’s Seminar in Times Square, New York City. This year’s seminar built on the main topic of 2023, the Inflation Reduction Act (IRA), and explored its various facets in greater depth.

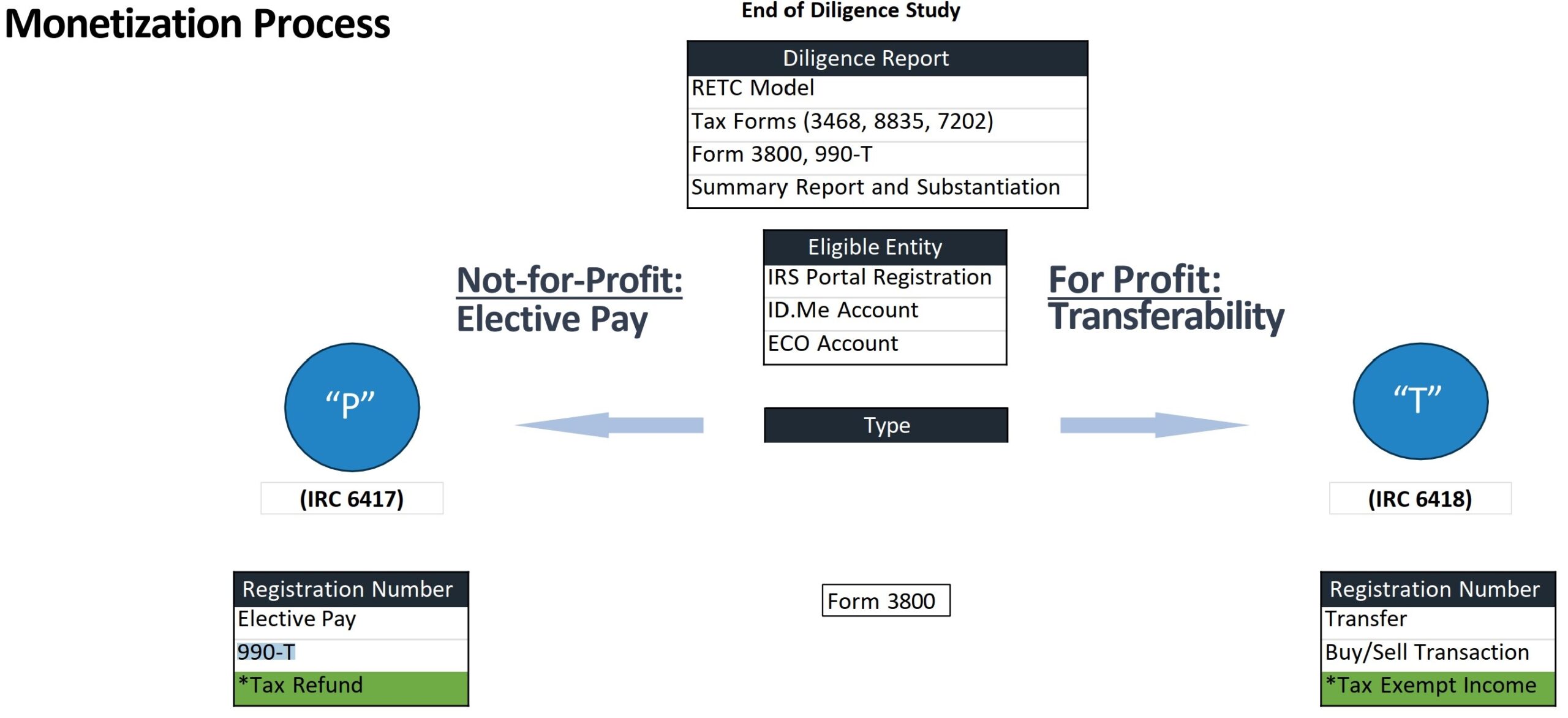

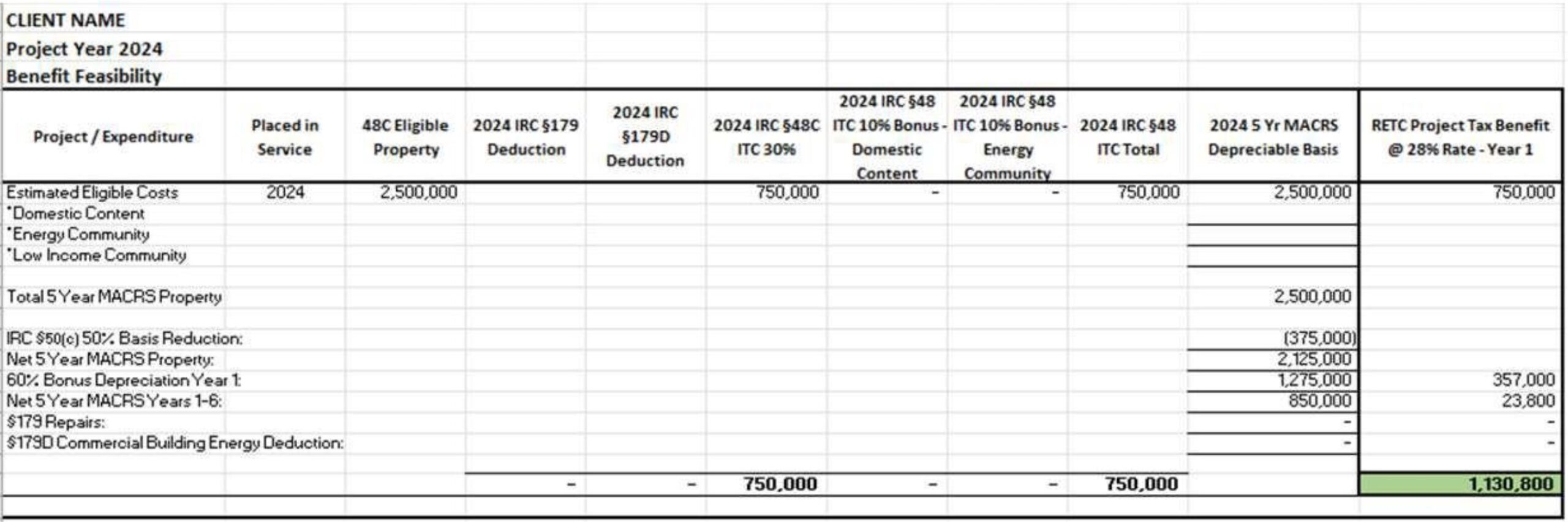

Key topics included the much-discussed tax credit transferability rules, the process of filing for and monetizing “elective pay” (also known as direct pay), domestic content and brownfield tax adders, capital structures, and the evolving finance structures as the Internal Revenue Service (IRS) and Treasury Department continue to release financial guidance.

Tri Merit, a specialist in renewable energy tax credit solutions, presented “The Process for Monetization of Renewable Energy Tax Credits.” The presentation highlighted a significant talking point for selling solar to non-profits: to convert the IRA tax credit into a direct payment, the non-profit must file the IRS 990-T form.

Their presentation outlined the steps for submitting various applications to the IRS, including parts of the process currently delayed due to the development of necessary online tools that will allow for the submission of the required documents.

pv magazine USA’s discussion with Tri Merit revealed their approach of early collaboration with project developers and CPAs to develop financial models. Represented by Barry Define and Randy Burge, Tri Merit provides a comprehensive document for developers to integrate into their financial models. As projects progress, Tri Merit assists with finalizing documentation for IRS submission, working with tax professionals to fine-tune values and navigate IRS website forms.

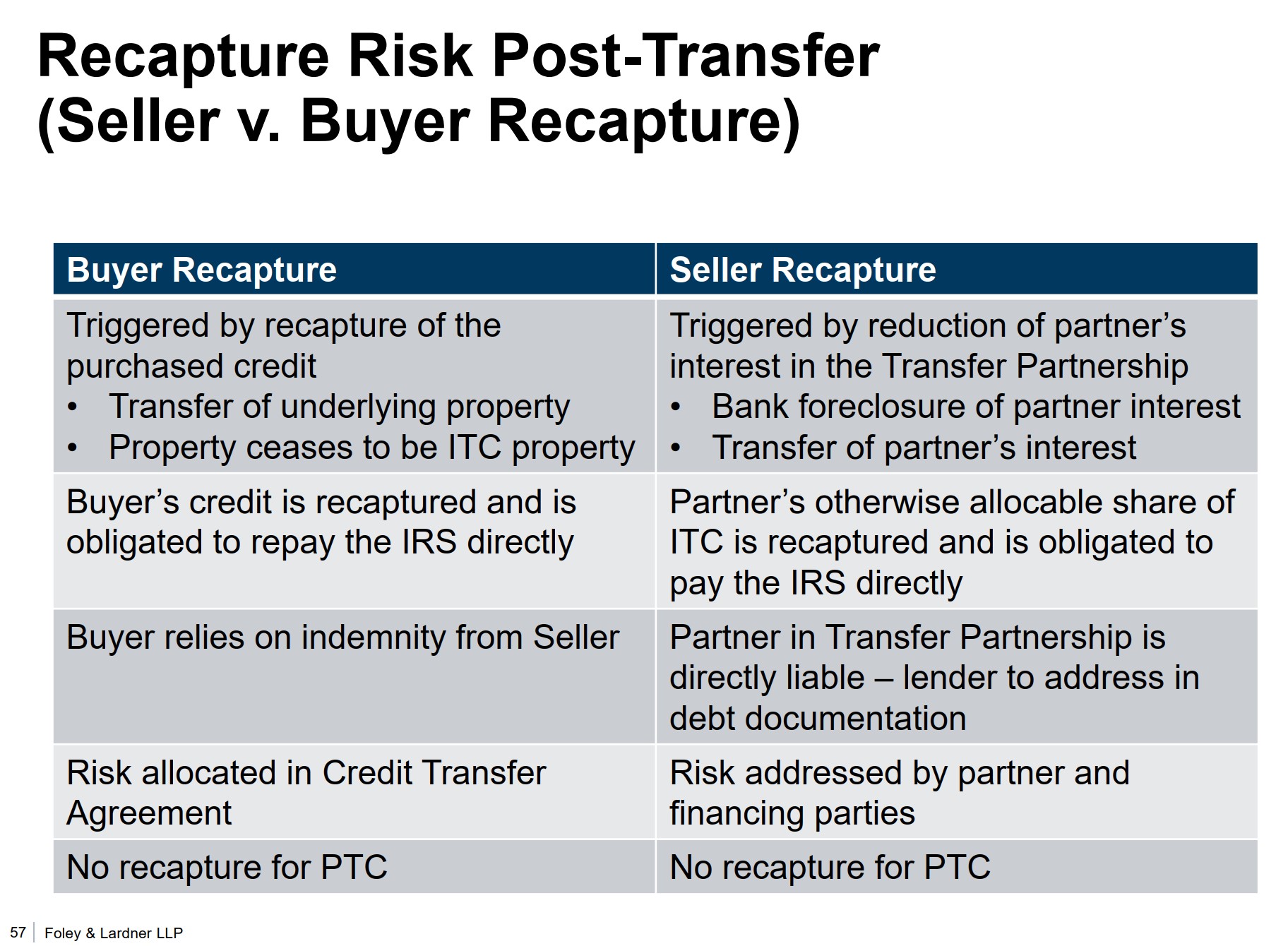

Despite the purported simplicity of the tax credit transfer process, multiple presentations highlighted the risks and challenges associated with monetizing the credits, especially among larger organizations dealing in projects priced above $10 million. Foley & Lardner LLP, a law firm with extensive experience in tax and energy law, presented “General Overview of Tax Credit Transferability,” which delivered a wealth of high-level information on the subject.

The Foley presentation covered the risks of tax credit recapture by the IRS, which can occur when solar projects fail to meet the technical requirements that initially qualified them for tax benefits. These recapture risks are a major factor driving the extensive documentation requirements, which continue to include significant fees and recapture insurance, necessary to complete tax credit transfers.

The presentation also detailed the processes of the newly developed finance structure that has emerged with the introduction of transferability. This structure begins with the traditional tax equity finance model that has been in use for years, but it now incorporates an additional tax credit transfer step at the end. A key aspect of this process, which is more complex and costly than a simple tax credit transfer, is that it enables solar developers to include a “step up” (or development fee) in the transaction at an amount approved by the IRS. It also has the potential to monetize the project’s depreciation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.