Legislation in both chambers in Georgia has been introduced to establish a community solar market in the state. The law would allow ratepayers, including individuals, nonprofits, businesses, and governments to subscribe to a portion of a solar facility’s generating capacity in return for credits on their utility bills.

The “Homegrown Solar Act” would cap eligible project sizes at 6 MW. Utility Georgia Power would credit a customer’s bill based on the utility’s total aggregate retail rate on a per-customer-class basis, less the commission-approved distribution cost components. It places protections on discriminatory fees for participating community solar customers.

Community solar extends local, distributed solar access to a set of customers that may otherwise not be a good fit for rooftop solar. The Department of Energy said community solar customers can expect to see about 10% to 20% savings on utility bills.

Georgia Power said in a hearing that it is “adamantly opposed” to the bill, calling it “a solution in search of a problem.”

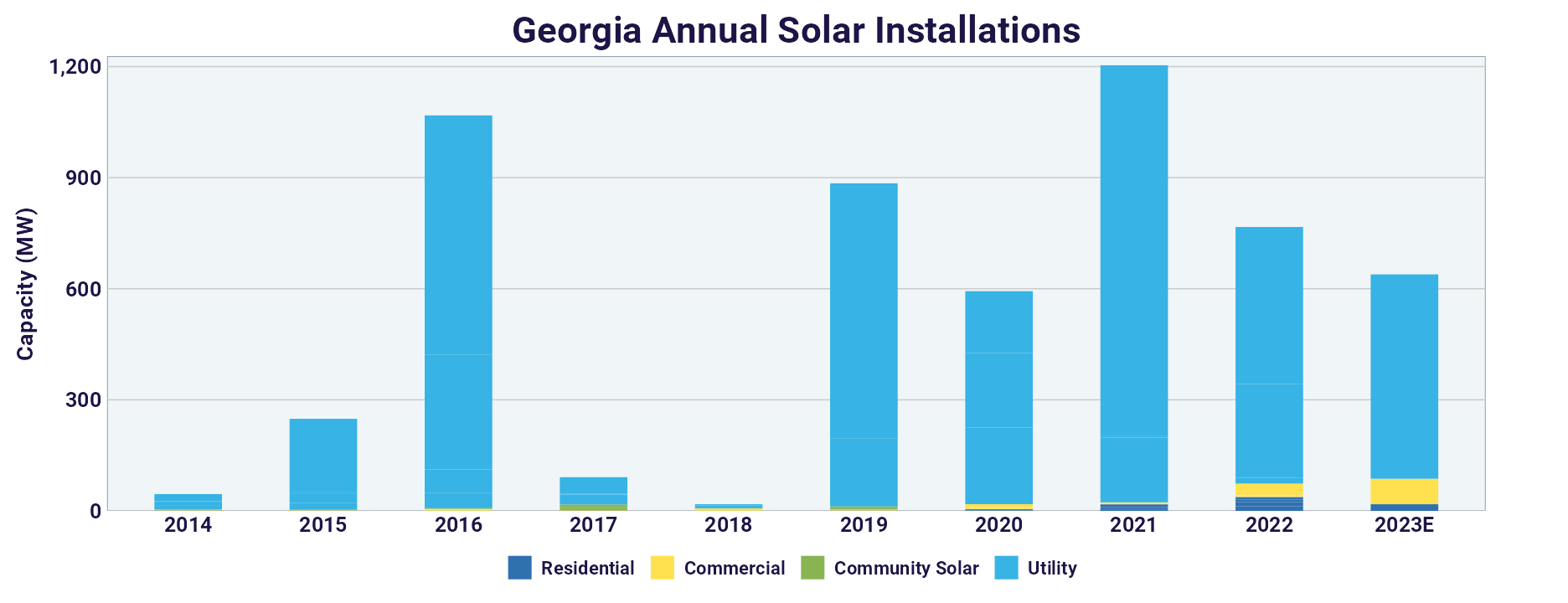

The utility cited the fact that Georgia is a top ten state in terms of solar installation capacity. However, Georgia ranks in the bottom ten for distributed solar like rooftop residential, commercial and industrial, and community solar.

Image: SEIA

These distributed forms of solar have been found to have benefits in reducing transmission needs, limiting land use, and increasing resilience to extreme weather events. They also provide customers with an alternative to purchasing power from an otherwise monopolized market.

Georgia Power cited its opposition due to a “cost shift,” arguing that community solar customers would unjustly cause rates to rise for non-solar customers. However, national studies have shown that this “cost shift” is negligible at current levels of distributed solar deployment, and that there may even be system cost benefits to non-solar customers.

Plus, if Georgia Power can prove there is a cost shift created by the program, there is language in the bill that allows the utility to assess a fee.

Georgia Power issued warnings in January that it may reach an electricity capacity shortfall as soon as Winter 2025. Its response was a request for the operation of three new oil and gas projects totaling 1.4 GW, and to extend the life of operational coal plants in Mississippi. Instead, Georgia could follow a state like New York, which has quickly added 2 GW of community solar, with the market first ramping up in 2019.

However, it stands to reason that Georgia Power could more cost-effectively prevent a shortage by lifting its opposition to the community solar bill. Solar is also now the most cost-effective new generation source in most markets and most conditions in the United States. On average, new-build solar costs 29% less than the next-cheapest fossil fuel alternative.

“We’re trying to help with the energy crisis, candidly,” said Steve Butler, Georgia Solar Energy Industries Association. “This is something our state could use right now and as quick as possible.”

Bills are introduced in both the state Senate and House. The bills must clear one chamber by February 29 to have a clear path to the Governor’s desk for approval.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.