LevelTen Energy released its quarterly power purchase agreement (PPA) pricing index for North America, releasing data for the full year ending in 2023. The company operates a PPA marketplace with over 900 project developers, energy advisors and resellers, and some of the world’s largest clean energy buyers.

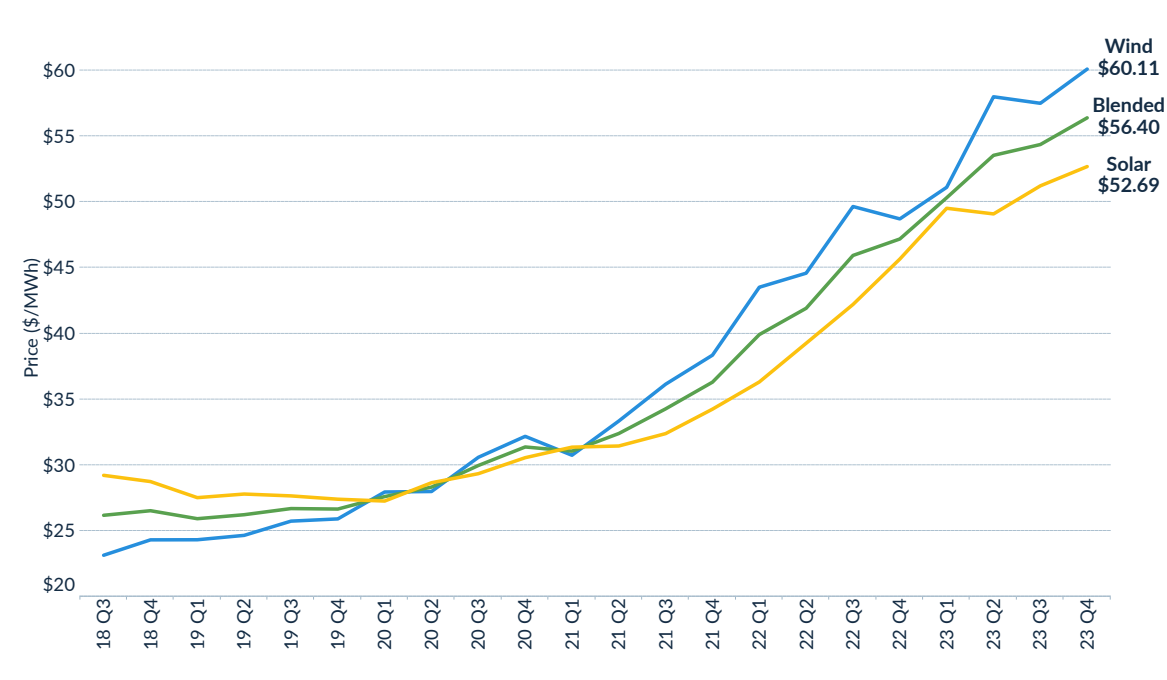

The report noted that P25 prices for PPAs rose 3% in Q4 and 15% for the full year 2023. P25 pricing represents the 25th percentile of prices developers are offering in contracts, not the final transacted PPA prices.

LevelTen reported a mixed picture for the solar market regionally. P25 prices rose 15% in CAISO, California’s regional grid operator, while lowering in other markets.

“The increases were likely driven by regulatory adjustments, prevailing market conditions and increasing buyer demand,” said Sam Mumford, analyst, energy modeling at LevelTen Energy. “The CAISO increase in particular was likely caused by select developers pricing projects much higher than the previous quarter’s P25 price, potentially to account for expectations around cost of capital or future REC value.”

Meanwhile ERCOT (Texas) prices declined 3%, and Southwest Power Pool (SPP) declined 2%.

“The downward pressure on PPA prices during Q4 can be attributed to factors such as a moderation in panel prices, alleviation of supply chain constraints, and expectations of future interest rate changes,” said Mumford.

The report said that lower PPA prices in ERCOT can largely be attributed to lower interconnection costs and faster timelines.

(Read: “Bringing ERCOT’s speedy interconnection process to the rest of the U.S.”)

Mumford said that push-pull dynamics persist in solar PPA pricing. He said the market is seeing improvement in challenges related to the solar supply chain and module prices, but now the impact of high interest rates is impacting project returns and making it difficult for developers to reduce PPA prices.

LevelTen said its developers in its PPA marketplace have shown preference for contracting with a single credit-worthy large offtaker rather than managing multiple PPA contracts, even if that means contracting less of a project’s production volume. This can make it more difficult for new, smaller buyers to enter the competitive PPA landscape, but despite these barriers, LevelTen helped facilitate 19 first-time buyers in 2023.

The report said corporate demand for PPAs has remained strong, driven by changes like the electrification of transportation and buildings to rapidly increasing power requirements from datacenters supporting functions like AI and cryptocurrency. Corporate buyers and PPA sellers will have to adapt to the higher interest rate environment over the coming years, which leads to stricter financing requirements from banks.

“Increased competition and growing demand have resulted in challenges, many of which stem from a shift in negotiation power toward sellers,” said Guidehouse Insights in an interview section in the report. “Heightened demand/competition has led to more assertive requests from developers, who aim to transfer market risks and cost/price uncertainty to buyers. As such, buyers now face heightened exposure to outcome volatility and higher standards from developers on issues like minimum volumetric commitments and credit capacity.”

“Buyers and sellers will need to continue embracing a partnership approach to continue getting deals done,” said Mumford.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.