Crux, a marketplace for buying and selling transferable tax credits, released a survey detailing the 2023 and 2024 transferable tax credit market.

The Inflation Reduction Act (IRA) introduced the ability to transfer solar project tax credits from the project owner to other commercial entities with tax liabilities. Previously, tax equity models required the future owner of the tax credits to share in the project’s risk. The new transferability option simplifies the process significantly, eliminating the need for the tax credit’s new owner to be a partner in the solar project; they only need to be able to utilize the tax credit.

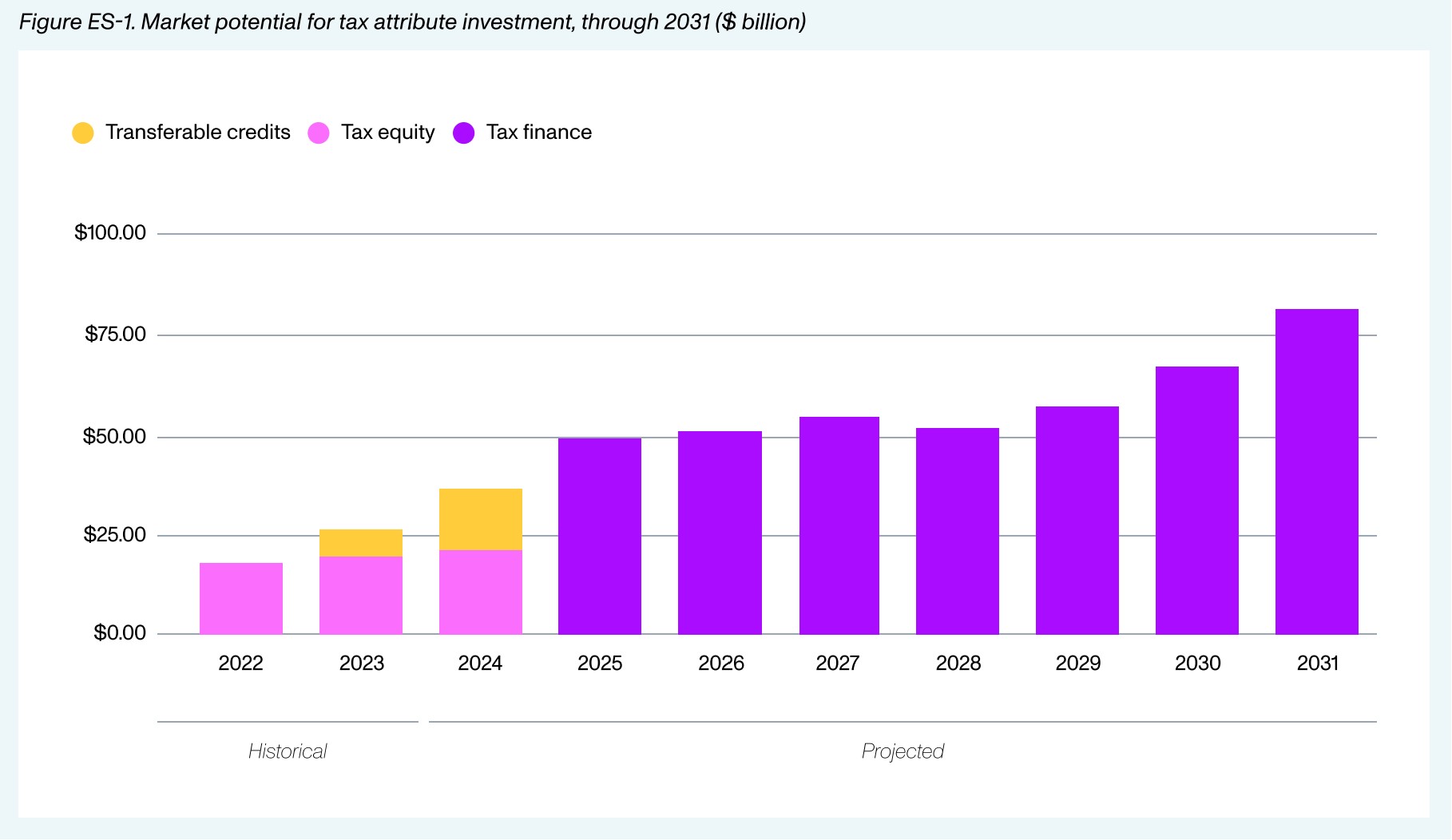

Crux estimates that, propelled by the IRA, roughly $7 billion to $9 billion in transferable clean energy tax credit transactions occurred in 2023. The report indicates a particularly strong growth in the transferable sector specifically, which already accounts for one-third of the entire tax finance market, estimated at $23 billion in 2023. Looking ahead, Crux anticipates the potential for over $80 billion in solar tax finance by 2031, with a significant portion of this growth expected to stem specifically from transferable tax credits.

Crux estimated that solar and solar-plus-storage capacity contributed to approximately one-third of the entire 2023 transferable credits.

The “Transferable Tax Credit Market Intelligence Report,” is based on responses from 150 out of the 2,000 organizations contacted by Crux, and indicates that the marketplace is in its early growth stages, with many respondents still getting familiar with the sector.

The report highlights several significant transfers, notably First Solar’s monetization of about $729 million in manufacturing tax credits, resulting in approximately $700 million from sales of just over 4 GW of solar modules. Crux believes that recent guidance from the U.S. Department of Treasury, coupled with market participants’ efforts to navigate legal complexities, will lead to the announcement of many more significant transfers once the legal details are ironed out.

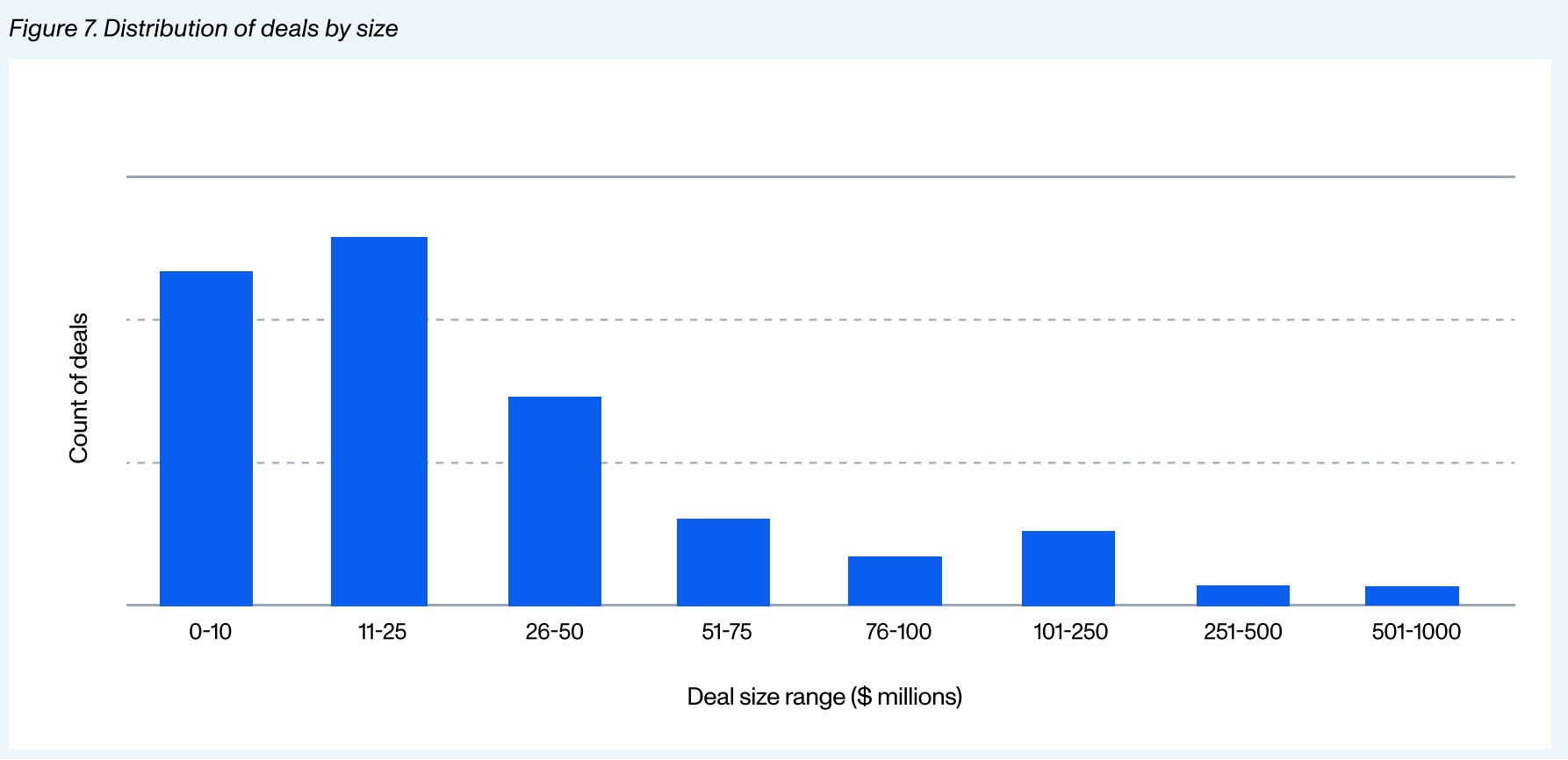

In 2023, transactions within the $11 to $25 million bracket were most prevalent, followed by a substantial number of deals under $10 million. Both of these categories surpassed the combined total of all transactions ranging from $51 million to $1 billion. The $25 to $50 million range also saw a significant volume of transactions.

Crux points out that the high volume of deals below $50 million showcases the advantage of the new transferability options, which previously made it challenging for smaller deals to gain market attention. The market’s diversity in project types, including manufacturing, energy storage, biofuels, and electric vehicle infrastructure alongside wind and solar projects, hints at a potential large expansion in transferable transactions. Wind and solar growth in this report is expected to be undercounted, as many large projects likely had pre-committed funding from tax equity partners, leaving no credits available for the transferable market.

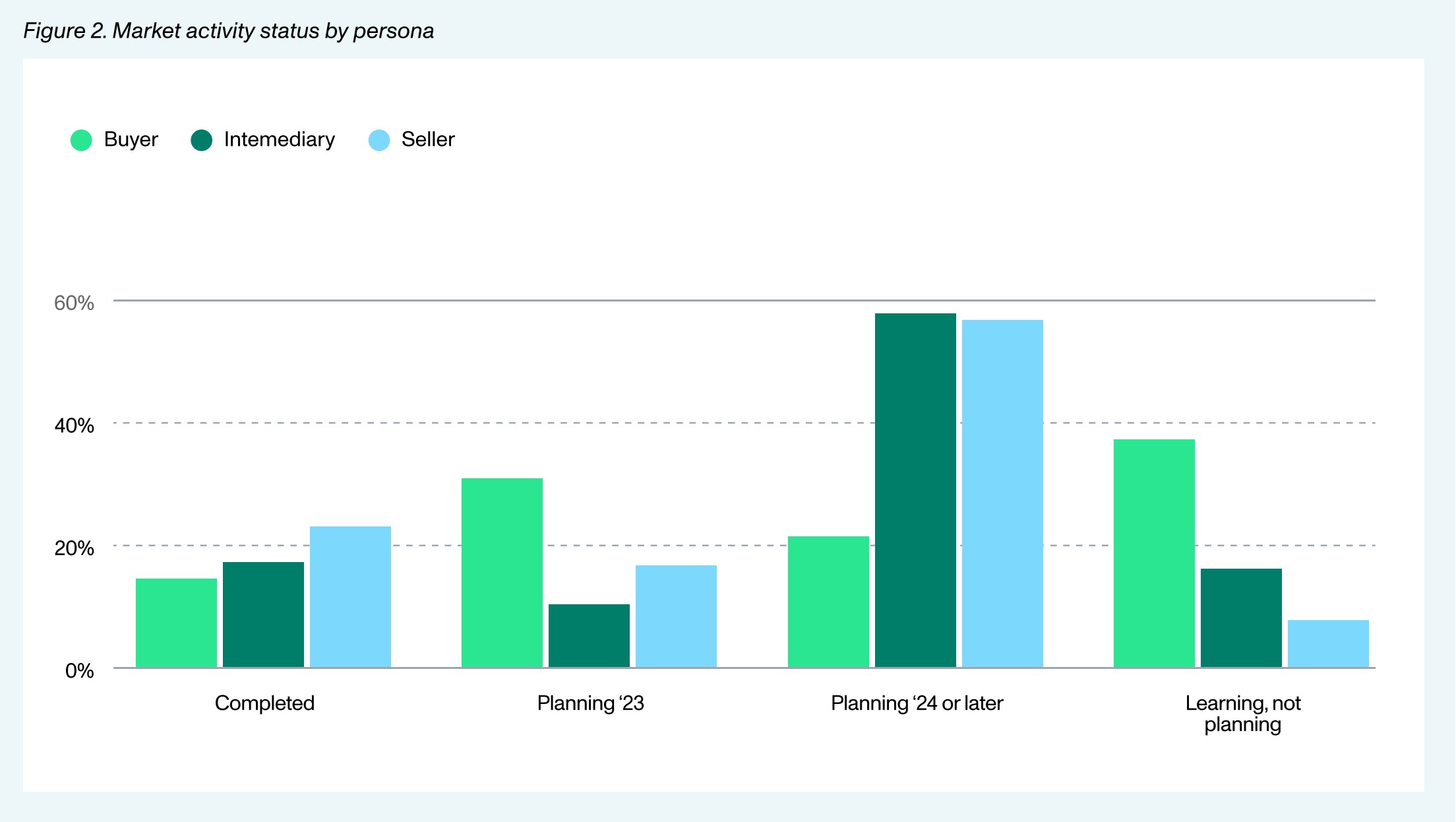

The market, still in its infancy, shows varied intentions among participants. According to Crux’s data, “The majority of sellers (55%) indicated that they are planning to begin monetizing transferable tax credits in 2024; 36% of them were expecting to transact in 2023 or had already done so.”

A smaller segment (9%) is not yet ready to enter the market, opting to first deepen their understanding. On the buyers’ side, 43% either completed transactions or expected to do so in 2023, with an additional 21% targeting 2024 to commence trading. The remaining 36% are still contemplating their entry into the market.

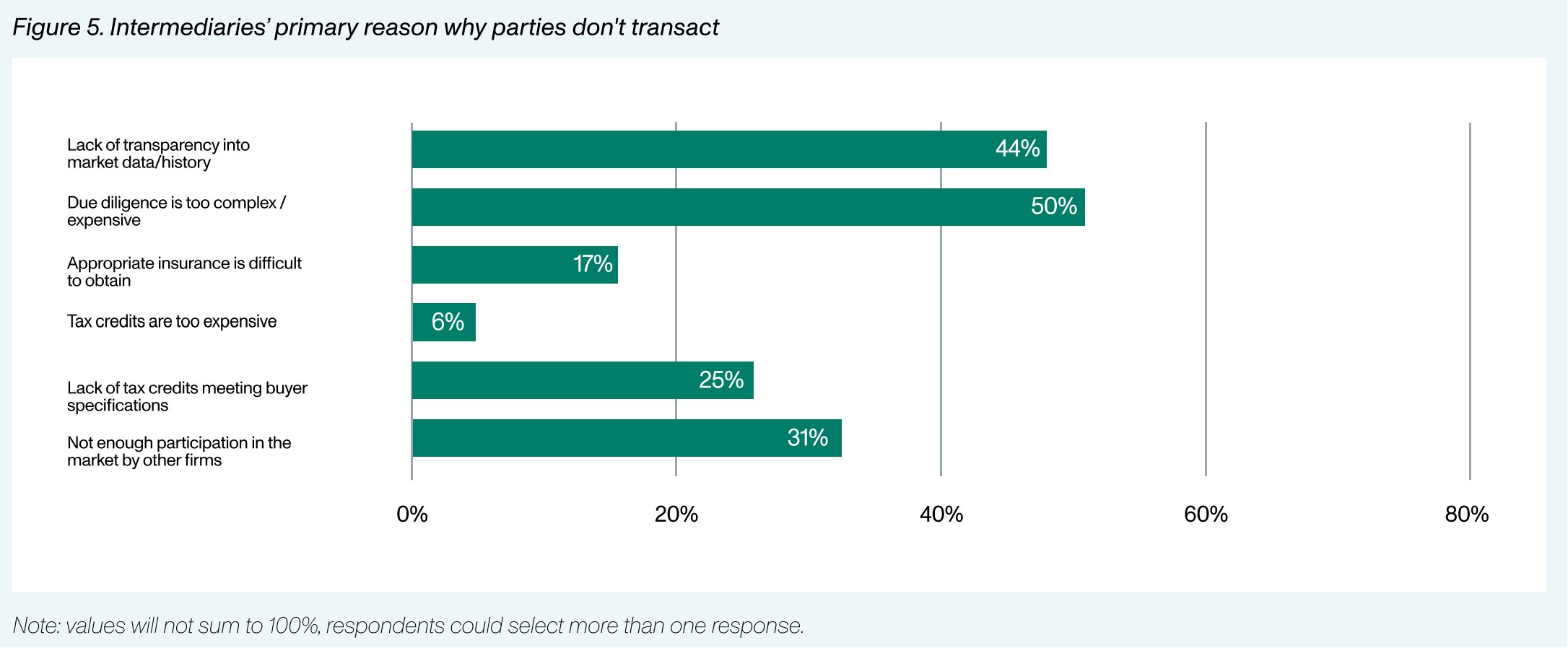

Buyers and sellers face distinct challenges in navigating the fledgling transferable tax credit market. Buyers contend with the complexities of pricing and the rigorous nature of due diligence, while sellers point to market transparency as a key challenge. Interestingly, a third of sellers perceive buyers as having unrealistic expectations, a sentiment that Crux notes is mirrored by the buyers’ views on robust pricing.

Intermediaries, such as banks and brokers, cite market transparency and the complexity of due diligence as significant obstacles. However, they expect that market expansion could naturally follow an increase in transaction volume and positive industry feedback. Moreover, they suggest that additional regulatory guidance and enhanced transparency could further catalyze market growth.

To safeguard transactions, buyers are adopting insurance policies and sponsor guarantees as mitigation measures against a range of risks, including recapture, qualification issues and various potential errors and omissions. These strategies also address financial liabilities like penalties and interest, and ensure the accuracy of representations and warranties, aiming to maintain compliance and protect the financial interests involved in the deal.

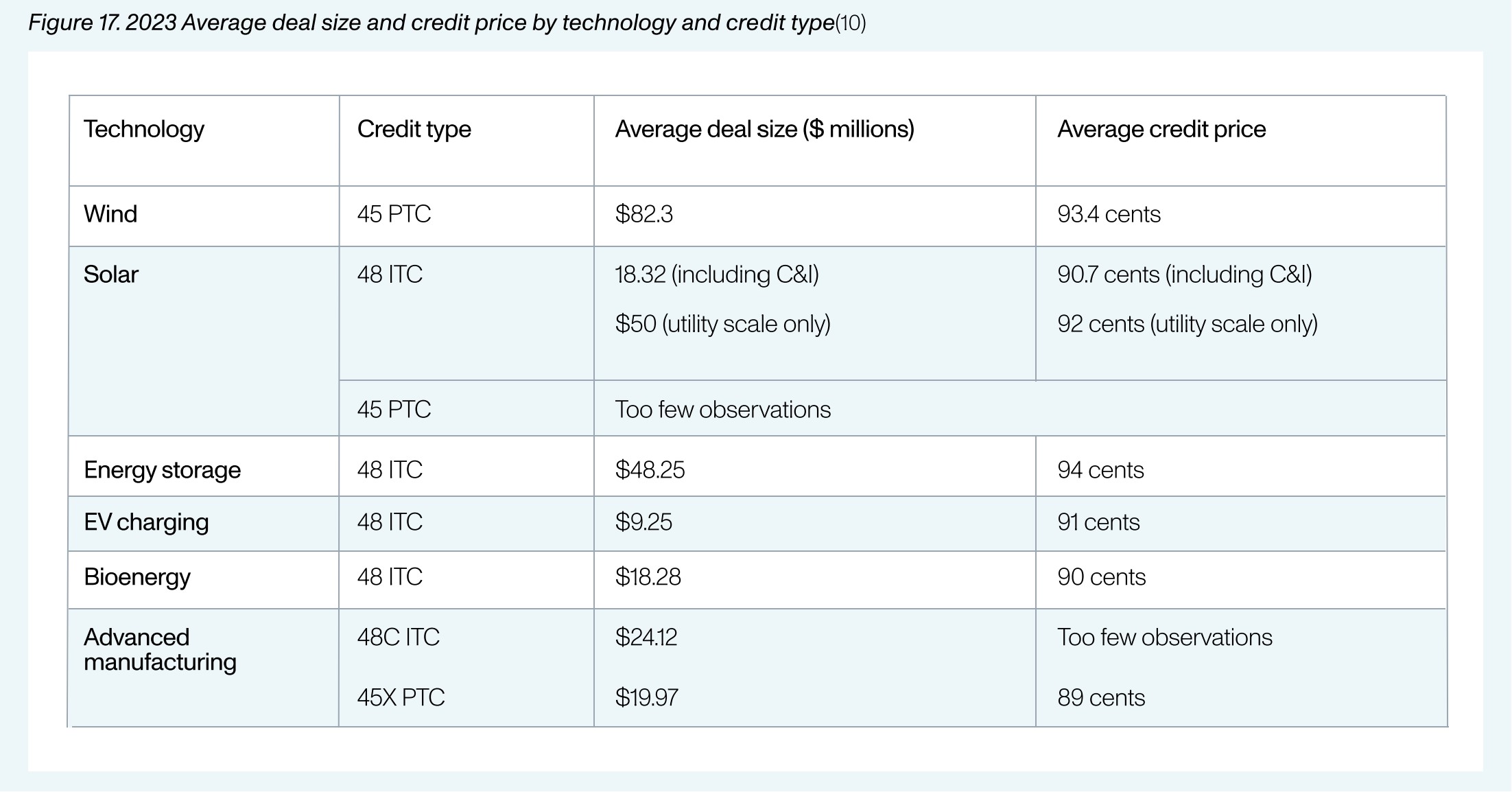

The settled prices for tax credits have generally ranged between 92 and 94 cents per dollar, although Crux acknowledges that factors such as the size of the deal, the type of credit and technology, the project’s location, the timing of service delivery, and prevailing market demand can influence the closing price. Notably, First Solar clinched 96 cents on the dollar in its major $729 million deal. On average, commercial and industrial solar projects closed at 90.7 cents on the dollar, utility-scale solar transactions settled around 92 cents, and energy storage projects achieved closing prices at 94 cents on the dollar.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.