California, once known as a clean energy leader, has fallen off track to meet its clean energy goals. This is the view that was shared last week by the California Solar and Storage Association (CALSSA) on a panel discussion at the Intersolar North America conference in San Diego, California.

The state passed a bill in 2018 targeting 100% carbon-free electricity by 2045. Governor Gavin Newsom recently set an interim target of 90% carbon-free electricity by 2035, accelerating the clock for deployment.

When considering the state’s ambitious goals for whole home electrification and the halt of new gas-powered car sales by 2035, electricity demand is only expected to rise sharply, making these goals even more ambitious.

The California Energy Commission (CEC) projects that the state will need to build 6 GW of solar-plus-storage every year for the next 26 years straight to meet the 2045 target. Over the past five years, California has only averaged about half of the 6 GW deployment figure.

“We started to get on pace in the past two years, but it is driven at least 50% by the distributed [rooftop solar] market,” said CALSSA executive director Bernadette del Chiaro.

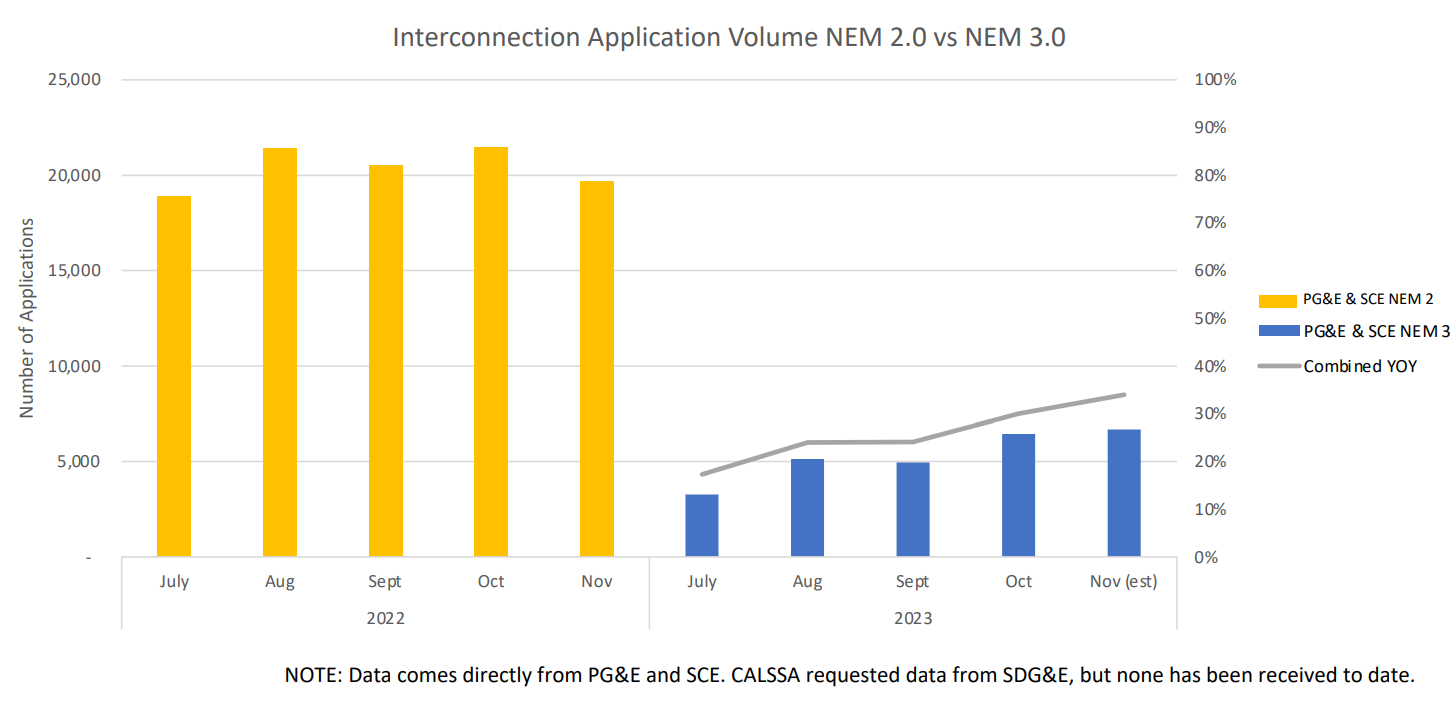

On this march toward 100% carbon-free power, California shot itself in the foot, passing Net Energy Metering (NEM) 3.0, a policy that cut customer compensation for exporting power to the grid. Combined with a high interest rate environment, project economics for rooftop solar in California have eroded, and demand has imploded.

CALSSA reports that roughly 17,000 rooftop solar jobs have been lost, demand for rooftop solar has fallen about 80%, and solar business insurer Solar Insure told pv magazine usa that 75% of its covered companies are considered a “high risk” for bankruptcy. Major publicly traded global equipment providers like Enphase and SolarEdge have made significant cuts to their workforce.

California has averaged about 2.3 GW of utility-scale solar-plus-storage installations over the past few years, far behind the pace to reach that near mid-century goal of 100% carbon free power. Del Chiaro said she believes the goal is impossible to reach with a utility-scale only model, which the state seems to be hurdling itself toward.

Just add storage?

NEM 3.0 was supported by CPUC to push the state forward from a standalone solar-only market to one defined by combined solar and energy storage. While the new rate environment does support the economics of a solar-plus-storage project over a standalone one, it no longer represents a cash-flow positive benefit to the homeowner, making it a very difficult sale.

Ross Williams, chief executive officer of HES Solar, a regional installer operating in California, shared this grim reality in the Intersolar panel discussion. What was once a $20,000 to $25,000 standalone solar system with a five-to-seven-year payback turned into a solar-plus-storage system that costs $40,000 to $45,000 that has a nine-to-ten-year return.

“You weigh that against all the other options in the investing world, and that is not a good option,” said Williams. “Simply adding storage increased the cost by almost double.”

At the same time, high interest rates have further squeezed the industry, making it more expensive borrow money to pay for systems. Williams said a $25,000 standalone system used to be a cash flow-positive investment under, meaning on an annualized basis, paying for the loan would cost less than simply remaining with the traditional utility company. Now, with a $40,000 project and higher financing costs, customers would expect to pay more for power with a solar-plus-storage.

“It’s not as simple as ‘just add storage,’” said Williams.

Part of what made the NEM 3.0 decision such a disaster for rooftop solar companies were the wild oscillations of business it caused. For HES Solar, a rush of consumers trying to secure NEM 2.0 rates led to its first quarter booking 20% more sales than the entirety of 2022. Once NEM 3.0 went into effect in April 2023, sales went to zero for HES Solar.

“We had one sale in May. In the first quarter we sold 600 systems. I’m telling you it went to zero,” said Williams.

When July and August came around for HES Solar and sales were still 50% of what they needed to be to retain staff, Williams had to begin to lay off staff. A similar story has plagued most of the rooftop solar installers in the state, leading to the some 17,000 jobs lost.

CALSSA warned that the next couple of months could be even worse, as this is typically a slow season for rooftop solar. Cash flow issues and going concerns are likely to be raised in the first quarter of 2024, said Del Chiaro.

Changes

The Intersolar panelists warned that California may be only the beginning for the fall of rooftop solar. Del Chiaro said 15 to 20 states are already mulling cuts to net metering, including Minnesota, Oregon, Washington, and others. She said utilities have the wind at their backs now, citing California’s decision to cut net metering as justification for their own cuts.

CALSSA said it is currently focused on supporting changes that can get the industry through the next six months, suggesting changes to keep businesses alive. Brad Heavner, director of policy for CALSSA shared steps for stopping the bleeding. Short of reversing NEM 3.0, CALSSA’s specific recommendations include:

- Do no more harm – reject the $30 income-graduated fixed charge. Simplify AB 2143 to protect small businesses installing solar and storage, and do not limit licensed solar contractors from installing solar plus batteries.

- Launch a Million Solar Batteries Initiative – create investments in energy storage for all consumers across income brackets.

- Restore multi-meter properties right to self-consume power.

- Dramatically expand virtual power plant programs.

- Cut red tape – assess penalties for utility non-compliance in interconnection timelines and simplify permitting at city and county level by fully implementing Senate Bill 379.

- Reform the utility profit model – utility financial returns should be based on positive outcomes, not just capital expenditure.

As currently structured, utilities in California and much of the nation have a perverse incentive to inefficiently spend money on transmission projects. The more capital utilities spend on infrastructure, the more they can get rate increases approved.

Customer-sited solar is preferable to centralized utility-scale solar when it comes to reducing transmission needs, systemwide costs and efficiency and transmission line losses. It also cuts down on the development of otherwise usable land. California’s largest solar-plus-storage facility just went online, and to power over 200,000 homes, over 4,600 acres of previously undisturbed land was developed into a sheet of nearly two million solar panels.

Customer-sited solar represents competition to utility sales and directly cuts its potential earnings base. In return, it offers customers local-clean energy that is more efficient in its operations, more environmentally friendly, and more predictable in cost.

“Getting the utility to stop fighting customer solar is ultimately the thing that is needed in California and around the world,” said Heavner. “We’ve had it in our head for years, how do we change this perverse incentive. It’s a hard thing to undertake, but I’m hearing more talk about it.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Wow, a nine-year payback would be great. Here in Texas, getting an eleven year payback is almost unheard of. Yet rooftop is still coming online here. The 5-year payback is justified given the crisis we face, but nowhere else is the country is it possible to get that kind of return on rooftop installs.

The biggest aggregate benefits will come from solar parking lot canopies +on-site stationary storage batteries +Vehicle-2-Grid chargers installed right where most energy is being consumed, by large apartments & condos, neighborhood shopping centers, business parks & various public facilities.

We have vast acres of valuable, ridiculously under-utilized (sub)urban land locked up in widely distributed hot asphalt parking lot heat islands that can easily be shaded with solar canopies without any new utility transmission, site acquisition, or other site improvement spending. In many cases, it’s easier to install much larger solar parking lot canopies than it is to retrofit much smaller rooftop systems. And modular canopy structures will lasts for 75+years with minimal maintenance. That’s 3 generations of improving solar panels.

This is the most rapidly exploitable strategy to accelerate widely distributed electric vehicle charging infrastructure & NetZero commercial properties, while constructing a matrix of reliable neighborhood micro grids. And it can be accomplished by typical leased commercial property investors using IRA investment incentives, with just ordinary local building permits & no NIMBY opposition.

Jerry, your comments are spot on, especially great for developers of affordable multi-family housing where the federal government’s IRA will pay for as much as 70% of the cost of both the solar panels and the parking canopy or “solar support structure.” Battery storage would be covered as well, as long as it is 100% solar charged, dramatically cutting investment pay-back time and still providing clean power to occupants during the evening and nighttime .

A modest (and likely, ignorant) proposal in answer to the ‘unfair competition’ of rooftop solar to electric utilities: the ‘natural’ monopoly is gone. So, remove their monopoly status. Let electricity prices go as high as they want…. but everyone will have the right to get solar. And, let’s add a new product for solar installers: zero export systems. This looks like energy efficiency to the utility. This could eliminate the need for a connection permit.