U.S. thin-film solar module manufacturer First Solar announced it closed two separate tax credit transfer agreements to sell $500 million and $200 million of Inflation Reduction Act advanced manufacturing tax credits.

Under the tax credit transfer, Fiserv agreed to pay $0.96 per $1 of tax credits to First Solar during the first half of 2024, inclusive of fees and commissions paid by First Solar to the placement agent. Fiserv is a global provider of payments and financial services technology solutions. Citigroup Global Markets acted as placement agent for the transfer of Section 45X tax credits.

The tax credits were generated as a result of the sale of solar modules produced in 2023 by First Solar in the United States, including at its new factory in Ohio.

“This is the IRA delivering on its intent, which is to incentivize high value domestic manufacturing by providing manufacturers with the liquidity they need to reinvest in growth and innovation,” said Mark Widmar, chief executive officer, First Solar. “This agreement establishes an important precedent for the solar industry, confirming the marketability and value of Advanced Manufacturing Production tax credits.”

The deal from First Solar marks one of the first major sales of 45x tax credits. The deal was inked on December 22, 2023, less than two weeks after guidelines for accessing the credit were released.

“As it relates to the 2023 financial year, we expect a pre- and post-tax impact of up to $28 million, resulting in a reduction of our diluted earnings of up to $0.26 per share for the year,” said Alex Bradley, chief financial officer, First Solar.

First Solar has the option of receiving these funds either as a tax benefit or a direct cash payment from the U.S. Department of Treasury. The company opted for the Tax Credit Transfer over the Direct Payment option, citing the ability to monetize it 12 to 18 months sooner through a third party. This third party can immediately apply the credit to their own tax liability and provide an instant cash payment to First Solar. In contrast, the Direct Payment would only be processed after First Solar files its tax returns, potentially delaying funds until the second or third quarter of 2024, pending the Internal Revenue Service’s processing and refund issuance.

First Solar’s vertically integrated solar manufacturing facilities are unique in their production of the entire supply chain. This was highlighted in an industry note released by Roth MKM on December 14, 2023, suggesting that First Solar may qualify for the full $0.175/W wafer, cell, and module credit.

Calculations based on the $700 million credit, valued at $0.96 on the dollar, indicate a total manufacturing credit of approximately $729 million. This implies that First Solar manufactured around 4.16 GW of solar panels eligible for the credit in 2023, at a rate of $0.175/W.

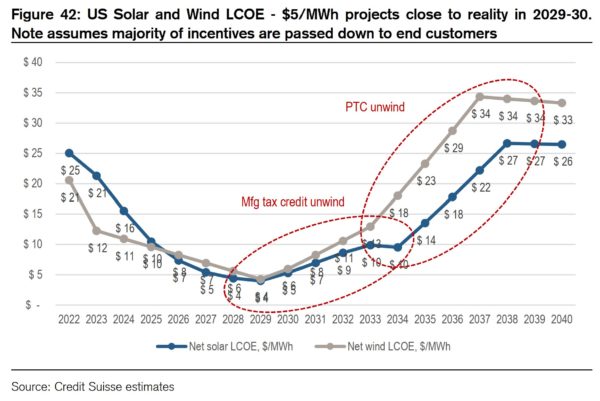

With First Solar’s average sales price at $0.32/W, the tax credit amounts to roughly 55% of the cost of their solar panels. This, combined with the potentially higher value of the IRA’s Production Tax Credit compared to some power purchase agreement costs, and the downward trend in solar module pricing due to massive capacity expansions, leads to an intriguing possibility. It’s conceivable that power purchase agreements could be signed at $0.00/kWh before the 45X manufacturer’s credit expires in 2029.

Currently, no other U.S. manufacturers are eligible for the comprehensive suite of solar module manufacturing tax credits. While a number of manufacturers are eligible for the solar module assembly tax credit, eligibility for the cell credit is notably scarce, and this rarity extends to credits for wafers and solar glass as well. Q Cell might benefit from the polysilicon tax credit due to the partial operation of the Moses Lake facility by the end of 2023. However, this polysilicon must be exported and processed into wafers and cells prior to being installed in Q Cell modules, as their facilities are not fully operational yet.

In addition to boosting U.S. manufacturing, transferability of Inflation Reduction Act tax credits are also gaining momentum in the developer space. Read more about strategies to utilize credits in solar project development here.

“Over the past year, nearly $100 billion in clean energy manufacturing investments have been announced, with plans for close to 100 new facilities across the U.S.,” said José Zayas, executive vice president of policy and programs for the American Council on Renewable Energy (ACORE).

First Solar expects to invest over $2 billion in new manufacturing facilities in Alabama and Louisiana and expansions in its Ohio plants. The company expects to have 14 GW of vertically integrated U.S. solar manufacturing capacity by 2026. It is also investing up to $370 million in a research and development center in Perrysburg, Ohio, expected to be complete by 2024.

“This remarkable progress is only just beginning. Projections show the Section 45X manufacturing tax credit will help spur billions of dollars in new economic activity over its life,” said Zayas.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.