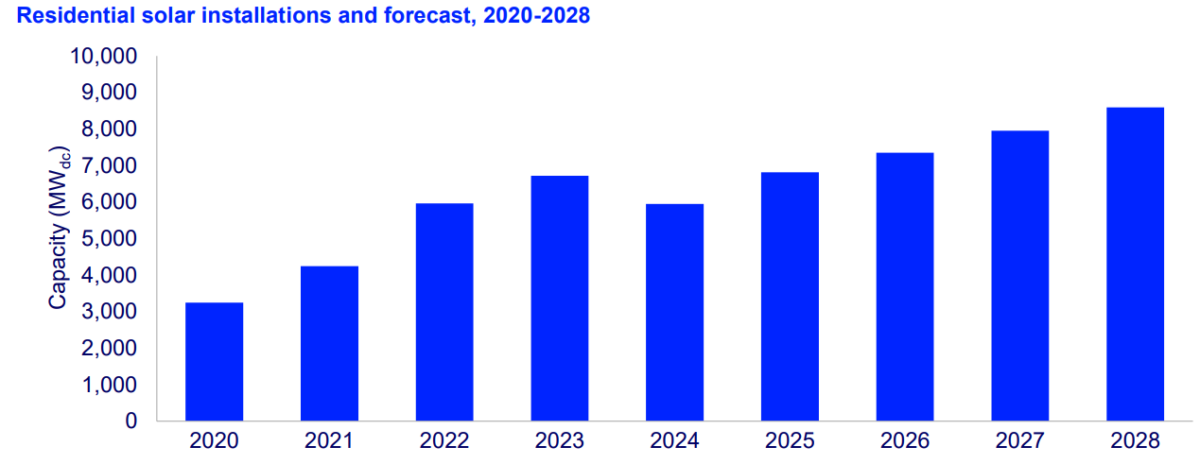

Residential solar posted modest growth in installations in the United States through three quarters of 2023, growing 24% year-over-year, according to Wood Mackenzie’s latest market insight report.

As supply chain constraints of 2022 improved through the year and Californians rushed to secure solar under a more lucrative rate structure before it transitioned to NEM 3.0 in April, residential solar posted growth.

Wood Mackenzie warns the market to temper its expectations for 2024, though, as high interest rates persist, lowering residential solar demand. The firm expects the California NEM 2.0 backlog of orders to continue into early 2024, temporarily buoying installations figures before they take a dive. California represents roughly 40% of the U.S. residential solar market and has noted a sharp 80% drop off in installation orders following the transition to NEM 3.0.

In Q3 2023, the residential solar segment installed 1.8 GW, growing 12% year-over-year and setting a new quarterly record for the nation. However, Arizona, Florida, and Texas, all major residential solar markets, experienced quarterly and annual declines in installed capacity in the third quarter. Installers are meeting these challenges by focusing on operational efficiencies or experimenting with pricing and product offering tweaks to survive the slowdown.

While high interest rates and policy changes like those seen in California are pushing down the 2024 outlook for residential solar, Wood Mackenzie noted there are some tailwinds at play.

“While high interest rates persist, the segment has some tailwinds, such as module oversupply resulting in lower pricing,” said Wood Mackenzie. “Coupled with increasing retail rates, installers can still provide customers with a compelling value proposition in some states. With third-party ownership (TPO) products less sensitive to interest rate increases than loans, installers also continue to report an increase in TPO installations.”

Wood Mackenzie forecasts 13% growth in the residential solar market in 2023. However, looking ahead to 2024, the firm expects a 12% national contraction.

“The residential solar market will recover in 2025 and grow at an average annual rate of 10% between 2025-2028 as growth picks up in emerging markets,” said Wood Mackenzie.

Battery competition

As the residential solar-plus-storage market grows, competition is increasing among battery vendors. Wood Mackenzie said that in Q3 2023, 11% of residential solar and 5% of non-residential solar systems were paired with storage.

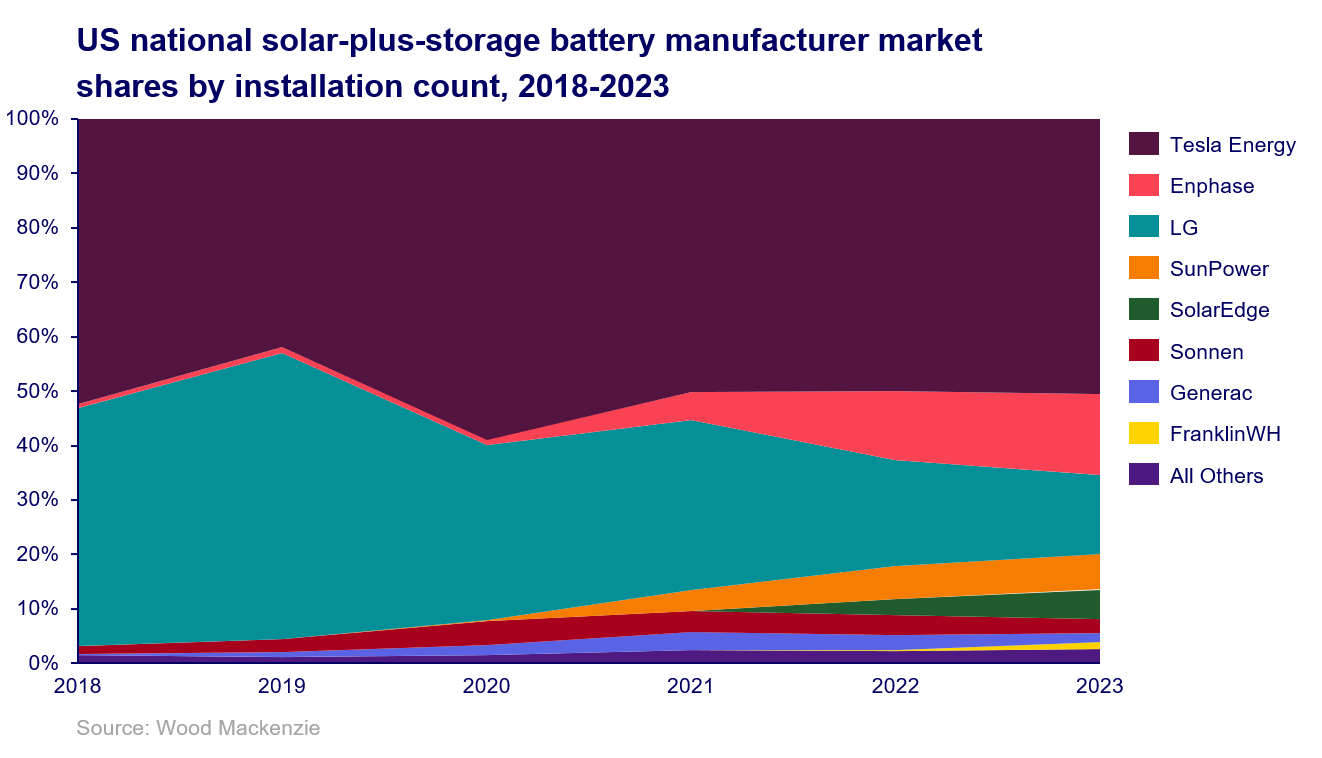

According to Wood Mackenzie, Tesla, LG and Enphase remain the big three battery vendors, holding 80% of the cumulative market from 2018 through Q3 2023. However, new entrants are beginning to leave their mark on market share. In 2018, the big three providers were installed on 96% of solar-plus-storage systems, but in 2023 they represented 65%.

Energy equipment companies like SunPower, Generac, and SolarEdge have carved out spots among the top seven providers. FranklinWH ranks eighth in storage only two years after launching its first product for the sector.

“The top five players in the residential solar-plus-storage ranking hold 59% of the market, while the top five players in the residential solar market hold just 24%,” said Max Issokson, research analyst, Wood Mackenzie.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.