At the Solar Energy Industries Association (SEIA) Finance, Tax, & Buyers Seminar, Deloitte Tax discussed five potential pitfalls when interpreting and applying the Inflation Reduction Act in the early days of implementation.

A team from Deloitte discussed five tax-related ‘traps’ for solar professionals to consider during the IRA transition.

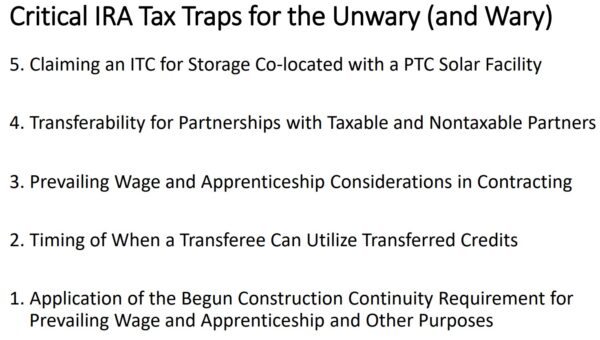

The group first discussed the IRA’s reversal of rules regarding the application of a 30% tax credit to standalone energy storage projects. Under the prior solar Investment Tax Credit (ITC), batteries received a 30% tax credit because they were charged by solar power and integrated into the solar power project. However, under the IRA, energy storage gets its own 30% ITC, so the advice was to physically separate the two facilities, especially when exploring new finance techniques.

The second pitfall concerned business partnerships owning solar power projects with both taxable and non-taxable partners. Direct pay and transferability options provide greater flexibility to partnership structures, but guidance from the U.S. Department of Treasury is still needed.

The third pitfall focused on prevailing wages and apprenticeships in contracting. It was noted that projects smaller than 1 MWac and projects that began construction before Jan. 29, 2023 do not have wage and apprenticeship requirements. For projects seeking the full 30% tax credit and are 1 MWac and larger, the question arises regarding how projects will be required to verify that installation crews are paid the legally obligated rates. The Department of Labor Form WH-347 might be the right tool for this purpose, since it has been utilized previously in similar situations.

The Deloitte team also highlighted a nuance of the apprenticeship requirement. While the obligation to pay prevailing wages falls on the specific sub-contractor writing checks to workers, the apprenticeship requirement applies to all companies involved in the project construction, including sub-contractors and the general contractor.

The tax advisory firm mentioned that the rules for when a purchaser of transferable tax credits can use those credits were not yet clear. As corporations have specific rules for when they can take tax credits, and are allowed to adjust their estimated tax payments if they complete a solar power project early in the year, it would be prudent to assume that a purchaser of transferable credit could do the same. However, further guidance is needed.

The final pitfall involved proving project site work continuity, which applies to projects aiming to demonstrate that construction began before the prevailing wage and apprenticeship requirements came into effect on January 29, 2023. Deloitte emphasized the importance ‘two prongs:’ 1. Initiating significant physical work, and 2. satisfying the 5% safe harbor rules, both of which are closely considered by banks and tax lawyers when documenting projects.

Deloitte’s experts cautioned that it is very important for all projects that began construction prior to the IRA to meticulously track their work efforts through images, logs and receipts, dating back to 2019, in order to avoid potential pitfalls related to prevailing wage requirements.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.