CohnReznick Capital Markets shared that the 2023 U.S. renewable energy market is expected to be defined by the the juxtaposition of tremendous momentum from recent changes in U.S. policy and uncertainty stemming from upheavals in global markets.

As the International Energy Agency expects 2,400 GW of renewables to come online through 2027, the world will add as much renewable energy capacity in the next five years as it did over the last two decades. With this market evolution comes the opportunity for significant merger and acquisition (M&A) activity, and the profile of this activity is expected to shift.

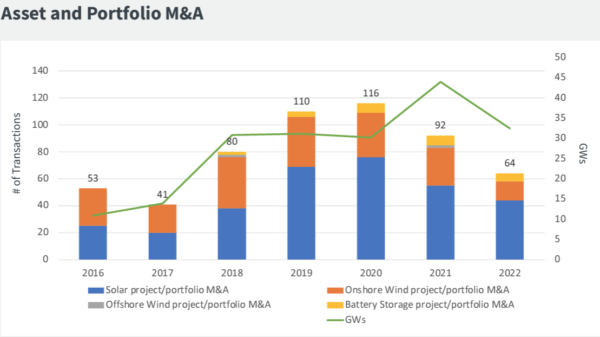

Throughout 2020 and 2021, M&A activity for renewables surged as valuations for platforms, which included project portfolios and corporate development teams that manage them, reached all-time highs. Now with increasing capital deployment rates, there is a shift from majority platform M&A activity to transactions in which investors could take a minority stake.

“Investors are providing growth capital in the form of a minority stake, often receiving preferred equity in a company that has the potential to grow and expand in the post-IRA world, in which company value could increase substantially over the next few years,” said CohnReznick in a whitepaper.

There is a growing trend of international players acquiring experienced U.S. developers with strong project portfolios, and CohnReznick said it expects this trend to continue in 2023. International independent power producers and infrastructure funds see acquisition as an efficient tool to enter or expand their presence in the growing North American market. Corporate M&A activity that includes developer experience and a portfolio of projects offers scale and transaction efficiency that the acquisition of individual projects aren’t able to match.

Now that the Investment Tax Credit (ITC) and Production Tax Credit have been extended for projects that begin construction before 2034, independent power producers and infrastructure funds are looking to access a much larger project pipeline through acquisition, according to CohnReznick.

As the ITC now includes energy storage, this category is expected to drive more M&A activity as well. Mercom Capital reported there were 23 energy storage M&A transactions through the first three quarters of 2022 compared to 15 in 2021, a trend that is expected to continue as the energy storage market matures.

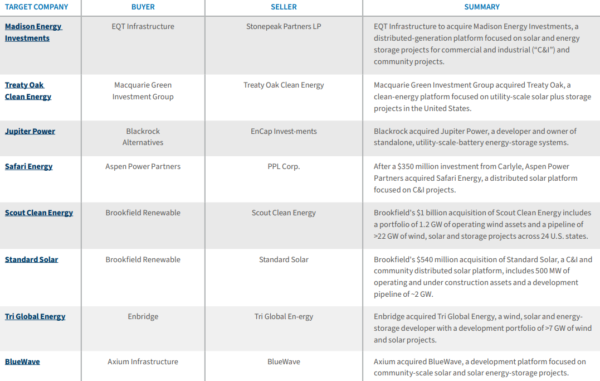

FTI Consulting said in a whitepaper that notable 2022 M&A transactions included Brookfield Renewable’s pair of acquisitions of Scout Clean Energy ($1 billion) and Standard Solar ($540 million), Enbridge’s acquisition of Texas wind developer Tri Global Energy for $270 million, and German energy producer RWE AG’s acquisition of Con Edison’s Clean Energy Businesses for $6.8 billion.

Image: FTC Consulting

FTI Consulting said renewable investors not only continued to move up the value chain in search of financial returns but also diversified into emerging subsectors, such as renewable natural gas (RNG), alternative fuels and standalone storage. Notably, RNG transaction volume more than doubled in 2022, spearheaded by transactions like BP acquiring Archaea Energy for $4.1 billion.

FTI Consulting said that 2023 deal flow is expected to remain strong, but creative solutions and investor flexibility will be needed as the market navigates persistent supply chain challenges, long interconnection queues, and high inflation rates, all of which will apply downward pressure on asset sales.

To meet these challenges, investors are expected to seek right-priced deals and move towards emerging technologies and subsectors to receive a digestible risk-adjusted rate of return. FTI Consulting said corporates may look towards divestiture of non-core assets as a means to free up cash flow for more strategic investments or other operational drivers.

The report said it may take four to six months for guidance to be issued on specific aspects of the Inflation Reduction Act, and developers and asset owners will require time to assess the relative value of their investments and to implement financing plants to make the most of the IRA’s incentives.

“With patience, we anticipate strong M&A activity in traditional renewable assets, platforms and emerging technologies trending toward the second half of 2023 and into 2024 as greater clarity and increased value creation are established,” said the whitepaper.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.