FTI Consulting released a report reviewing renewable energy merger and acquisition (M&A) activity in 2023 and provided an outlook for 2024.

Entering 2023, M&A transactions faced headwinds including sustained high interest rates, inflationary pressures, supply chain constraints, government support uncertainties, and grid reliability issues. As a result, renewable energy deal volume dropped from 2022 levels. Interest rates are driving a wedge between potential buyers and sellers on valuation, said the report from FTI.

Established renewable technologies like solar and wind comprised about 60% of deal volume, said FTI. Meanwhile, traditional nuclear energy M&A and “renewable” natural gas and biogas transactions increased, suggesting mainstream adoption for a once-niche market.

Looking into 2024, FTI anticipates various factors will drive an increase in M&A activity in the renewable energy sector. As high costs of capital put pressure on project viability, smaller developers may be forced to sell projects, portfolios, or their entire platform as they seek liquidity or an outright exit.

“Investors and established incumbents with stronger balance sheets may take this opportunity to invest, acquire and structure creative solutions, further driving consolidation in the sector,” said the report.

FTI also expects and uptick in corporate renewables adoption as decarbonization and electrification continues to come to the forefront. It expects oil and gas players to actively invest in the sector.

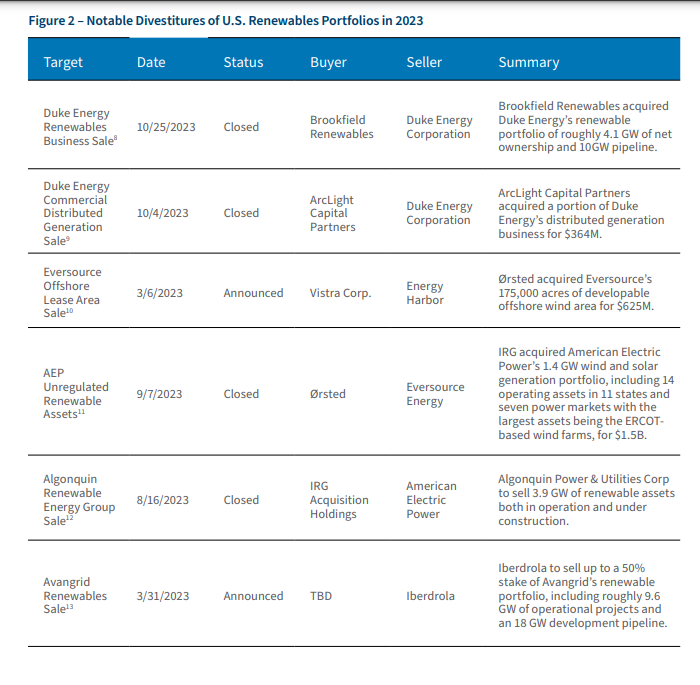

“Conversely, the sale of unregulated renewable businesses noted in 2022, including Con Edison’s $6.8 billion divestment of its unregulated clean energy segment, continued at an accelerated pace in 2023, with utilities such as AEP, Algonquin, Avangrid, Eversource and Duke Energy announcing their intentions to sell their renewable portfolios,” said the report.

FTI said supply chain constraints, increasing development costs, permitting issues, interconnection delays and shorter tenor offtake agreements have all contributed to an increase in the risk profile of unregulated renewable energy investment.

FTI recognized that a higher interest rate market may persist for some years. This may lead to smaller developers selling off assets, while on the demand side, larger players with greater operational diversity or public equity may be more creative, taking on risks and offering different value proposition to capital-stared developers that cannot achieve scale.

The report shared that government support from the IRA and other programs has begun to roll out, including $110 billion in available grant money made available through the 2022 law. FTI said the incentives could cause a “seismic shift on the U.S. energy sector and the economy as a whole over the next 12 to 24 months.”

Further pushed along by investment from corporate America, and “big oil” will continue to diversify its energy mix with strategic investments and acquisitions.

“Early developments in the new year indicate that these predicted market trends are taking hold, and 2024 will make up lost ground from the relatively low level of M&A activity seen in 2023,” said FTI Consulting.

FTI Consulting provides tailored services for strategic and financial investors, creditors and corporates, and has deep experience with renewable energy platforms, projects and portfolios.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.