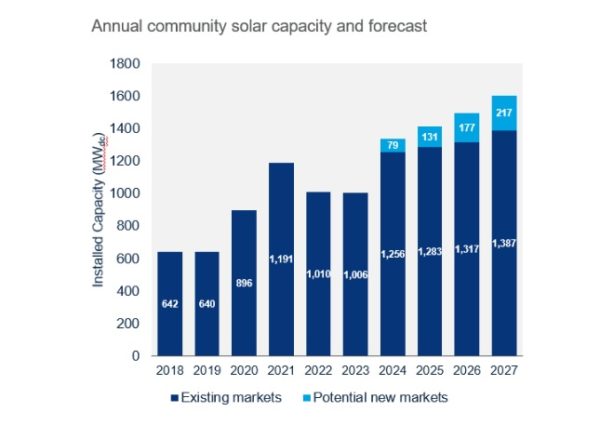

U.S. community solar installed capacity was down 16% in 2022 compared to the previous year, primarily driven by interconnection delays in key state markets such as Massachusetts, Maine, and Maryland. Industry-wide supply chain constraints also pushed project timelines into 2023, according to the latest report released by Wood Mackenzie in collaboration with the Coalition for Community Solar Access (CCSA).

Community solar is a way for homeowners, businesses and other organizations to invest in the benefits of clean energy when they have unsuitable conditions for rooftop or on-site ground-mounted installations. The way it works is that, either through buying or leasing a portion of an off-site solar project, customers typically receive a utility bill credit for the electricity generated by their share of the community solar system, similar to the way rooftop solar net billing works. Community solar is also a way to ensure a more equitable energy transition, as people can opt to use clean energy even when they don’t own their own rooftop or may not have the credit needed for a full solar installation.

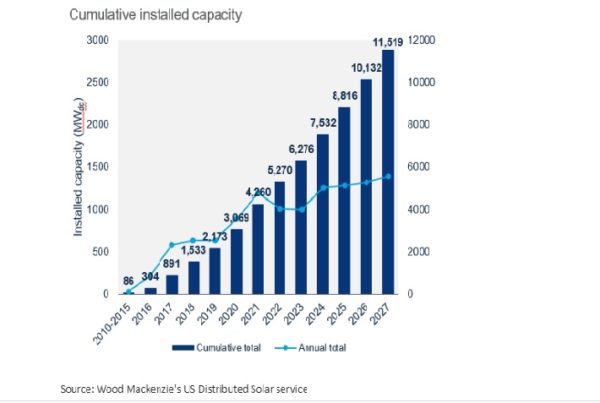

While installations of community solar contracted in 2022, Wood Mackenzie forecasts the U.S. community solar market to grow 118% over the next five years, with at least 6 GWdc expected to come online in existing markets between 2023 to 2027.

According to the CCSA, there are now 22 states with some form of competitive community solar policy, with new states like California and New Mexico coming online this year, and more poised to pass bills in the coming years. New York is a leader, currently holding nearly half of the U.S. market with around 500 MWdc installed in 2022, according to the report. Current total installed capacity for 2022 is estimated to be 5.27 GWdc.

CCSA’s new target of 30 GW of community solar by 2030, announced in January 2023, will require an acceleration of installed capacity in existing markets and continued establishment of new state markets.

“Any upside to our existing forecast will require strong policy and market reforms that release pipeline backlogs in existing markets, as well as additional capacity from new state markets. The newly passed state-wide program in California, for example, has the potential to yield a significant number of megawatts in the coming years,” said Caitlin Connelly, research analyst at Wood Mackenzie.

“The Inflation Reduction Act (IRA) is cause for optimism. Community solar developers are well-positioned to take advantage of the new and extended investment tax credits (ITC) once guidance is released in 2023, with many developers interested in qualifying projects for the low-to-moderate income (LMI) and domestic content adders,” Connelly said.

Connelly noted that the adders along with programs like the greenhouse gas reduction fund “will support growth in existing markets and create momentum for the creation of new state markets,” which Wood Mackenzie and the CCSA intend to monitor closely.

“To meet policymakers’ economic, social, and environmental goals, state legislatures and regulators must move community solar projects swiftly through interconnection queues and remove red tape to get as much capacity installed as possible,” said Jeff Cramer, CEO of the Coalition for Community Solar Access. “Doing so will move us closer to what we all want — jobs, economic development, and a decarbonized, cost-effective grid that works for all of us.”

If program proposals are enacted, new state markets will provide upside to the national forecast starting in 2024. Wood Mackenzie’s preliminary forecasts, which Wood Mac says are inherently conservative, project a 605 MWdc boost by 2027 from potential new state markets including Michigan, Ohio, Wisconsin, Pennsylvania, and Washington.

Source: Wood Mackenzie’s US Distributed Solar service

The report also found that as project portfolios grow, community solar developers are increasingly outsourcing subscriber acquisition and management services to third-party companies, with the top three subscriber companies now managing over 37% of the total market.

“The landscape for subscriber companies is becoming more competitive and complex. Developers seek partners that can successfully subscribe projects, form trusting relationships with subscribers, and manage these relationships throughout the lifetime of the project or program,” Connelly said.

The top three community solar developers secured 16.5% of the total market between 2017 to 2022, but competition remains stiff for newcomers.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.