Enlight Renewable Energy Ltd., a global renewable energy developer, filed a Form F-1 registration statement with the U.S. Securities and Exchange Commission to pursue an initial public offering on the Nasdaq Capital markets exchange.

The Israeli company is currently listed on the Tel Aviv Stock Exchange and will seek to use the same ticker, ENLT, when it officially dual lists in Israel and the U.S. The exact number of shares or capital size of the U.S. offering of shares has not been determined.

J.P. Morgan, BofA Securities and Barclays are lead book-running managers for the U.S. listing, with Credit Suisse and Wolfe | Nomura Alliance serving as joint book-running managers. Roth Capital Partners is a co-manager for the offering.

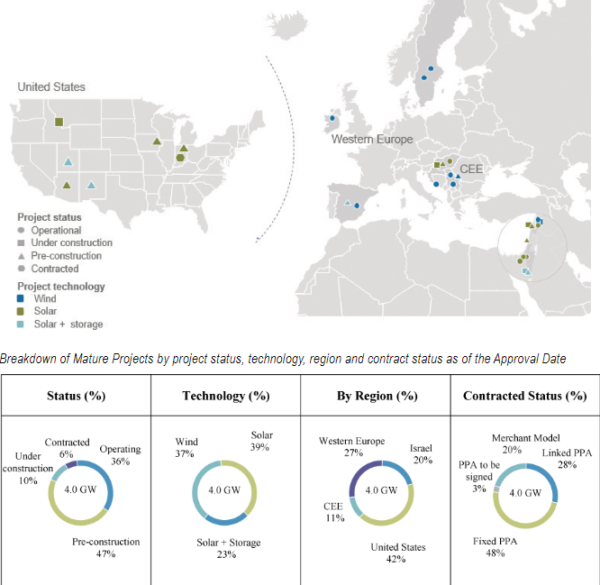

Rosh Ha’ayin, Israel-based Enlight, has an active operational portfolio and development pipeline of 17 GW solar and wind farms plus 15.3 GWh of storage in nine countries, including in 17 U.S. states.

Select U.S. projects:

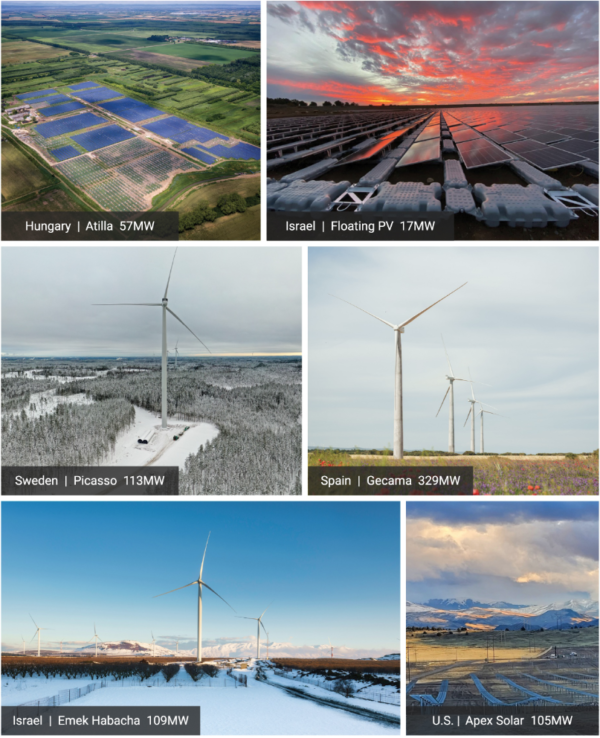

- Apex Solar (105 MW, Montana) is expected to be Enlight’s first U.S. solar project to reach commercial operation by Q2 2023; Solar modules procured from India-based supplier Waaree; Project has 20-year power purchase agreement (PPA) with NorthWestern Energy.

- Atrisco Solar (360 MW solar + 1.2 GWh storage, New Mexico) is a utility solar-plus-storage project with a 20-year PPA with PNM Resources. Located near Albuquerque, the main load pocket in New Mexico, the project is expected to reach commercial operation by the Q2 2024, with power capacity to fill in for retiring coal and nuclear resources in the PNM region.

- Co Bar solar cluster (1.2 GW, Arizona) consists of two projects, Co Bar SRP (480 MW) and Co Bar A (100 MW), contracted to Salt River Project and APS, respectively. In December 2022, as part of an acquisition, Co Bar C & D (620 MW) were added to the portfolio, completing full ownership of the cluster.

Formed in 2008, Enlight develops, finances, constructs, owns and operates utility-scale renewable energy projects, generating revenue from the sale of electricity produced by facilities secured under long-term PPAs.

Enlight first entered the U.S. renewables market in August 2021 through the acquisition of Clēnera, a Boise, Idaho-based developer of utility-scale solar and storage projects with 4.0 GW of assets, for $433 million. Michael Avidan heads Enlight’s U.S. business after holding various senior roles at Recurrent Energy, SunPower and PG&E.

Currently about 7.7 GW of Enlight projects are in advanced interconnect status to enter operations in the U.S., where 64% of its operations are in California, the Southwest and western region.

Enlight generated $102.5 million in 2021 revenue, a 45% increase from $70.3 million in 2020 revenue. The company currently trades for a 7.16 billion shekel ($2.1 billion) market capitalization value on the Tel Aviv Stock Exchange.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.