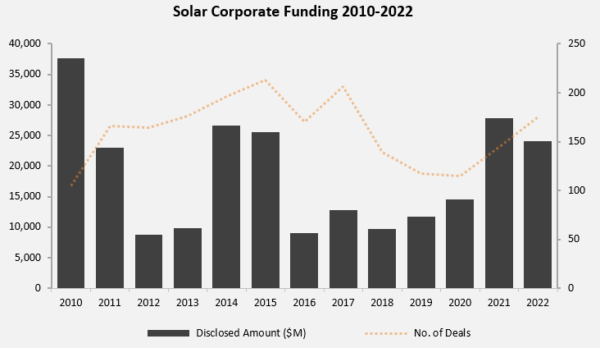

In a report that tracks solar funding for the full year 2022, Mercom Capital Group reported that total equity, debt and public market financing totaled $24.1 billion in 2022, representing a 13% decline over $27.8 billion raised in 2021. Dealflow, however, remained strong with a 20% increase in the number of transactions that took place.

Global venture capital (VC) and private equity funding came out to $7 billion in 2022, a 56% increase from $4.5 billion worth of equity deals in 2021, with 2022 representing the highest amount of solar VC funding in a single year since 2010. The average equity transaction was $100 million or more.

Image: Mercom Capital Group

“The war in Ukraine has accelerated demand for solar around the world and the Inflation Reduction Act has boosted the sector in the U.S,” said Raj Prabhu, chief executive officer of Mercom Capital Group. “But we are beginning to see higher interest rates bite into financing activity which resulted in lower public and debt financing in the second half of the year.”

In the solar market, $5.9 billion or 84% of equity deals in 2022 went to project development companies, while photovoltaic suppliers raised $864 million and balance of system companies raised $83 million.

Intersect Power ($750M), Longroad Energy ($500M), Yellow Door Energy ($400M), Palmetto Solar ($375M) and Aspen Power Partners ($350M) represent the five largest corporate funding transactions in 2022 among the largest funded segment for project development or downstream category.

In public markets, total funding activity of $5.1 billion represented a 32% decline from $7.5 billion raised by public companies in in 2021. The largest public raise in 2022 was JinkoSolar, the operating subsidiary of Chinese solar module producer JinkoSolar Holding Co. which raised $1.57 billion in a January 26 initial public offering on the Shanghai Stock Exchange.

Total debt transactions came to $12 billion in 2022, representing a 24% decline over $15.8 billion raised in 2021 due to the Ukraine War and interest rate pressure.

Image: Mercom Capital Group

Mergers and acquisitions (M&A) saw the busiest year since 2010, with 128 M&A transactions in 2022, with Essen, Germany-based RWE AG’s acquisition of Consolidated Edison’s clean energy group for $6.8 billion representing the largest deal of the year. The Con Edison Clean Energy Businesses consist of 3 GW of operating assets with a 7 GW development pipeline.

In 2022, 66 GW of solar projects changed hands, with developers acquiring a 35.7 GW majority of the assets put on the auction block, representing the second highest project-level acquisitions since 2010.

To access Mercom’s 2022 full-year funding and M&A report click here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.