The fundamental difference between the two regimes is that net energy metering subtracts energy produced from energy consumption and prices the resulting “net energy” at the retail rate while net energy billing charges imports of energy from the grid under the retail rate and compensates exports from the consumer to the grid at a much lower rate, which is sometimes interpreted to be the wholesale market rate.

What’s the difference in payback periods between the two regimes: the one that’s currently in place that relies on net energy metering, NEM 2.0, and the one that’s going to kick in sometime in the spring of 2023, based on the CPUC’s unanimous decision on December 15 to rescind net energy metering and replace it with net energy billing?

The answer depends on who you ask. The issue has become so politicized that I don’t know who to trust. To answer the question, I decided to carry out a thought experiment using stylized data from my solar-plus-storage system that is the kind that commission wants to promote.

I installed solar-plus-storage in December 2019 and was given permission to operate the system a month later. Earlier, in June 2019, I had bought a Tesla Model 3.

I installed an 8 kWdc system and paired it with a battery capable of storing 9.8 kWh of energy. The system was designed to net out my energy usage for the year, which in the prior twelve months was 10,000 kWh. After discussions with my local utility about my best rate, I decided to switch to the EV2-A rate.

The payback for the system was estimated at nine years, using (a) an estimate of $200 a month for the 12 months preceding my purchase of the EV and the installation of the pre-solar-plus-storage bill and (b) the estimated savings from the system after its installation. The big unknown was the magnitude of the bill savings, which depends on a number of factors, including the weather, the amount of shade from any big trees, the orientation of the roof, the efficiency of the panels, and so on. This analysis did not include a projected change in future rates, so it was a bit conservative given PG&E’s rates history.

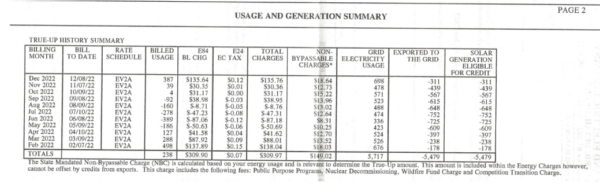

During this calendar year, from January to November, my True-Up bill under NEM 2.0 and PG&E’s EV2-A rate came in at $42 a month. That’s based on the numbers in the table below (adding $309.90 in the 5th column to $149.02 in the 8th yields $458.92, then dividing by 11 yields $41.72).

I am guessing by the time the data from December is added, the monthly average bill will come in at $50 a month.

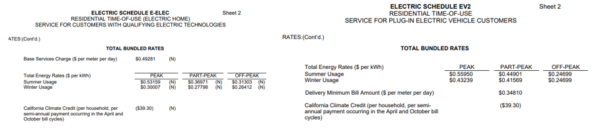

Now let’s engage in a thought experiment. Imagine if I had not made my investment back in 2019, but was planning to make it sometime in the coming year with the new net energy billing rules in place. I would be switched over to the E-ELEC rate and pay an additional fixed charge of $15 a month. See the comparison of rates below.

My energy rates during the peak and part-peak periods would be a tad lower on the E-ELEC schedule but the off-peak rate, which has the largest number of hours, would be higher. Let’s assume the effect of switching rates would cancel out, so there would be no incremental impact on my bill.

Under net energy billing, export compensation will drop down by 80% in five years and then hold steady. My pre-solar bill was $200 a month. Under NEM 2.0, the post-solar-plus-storage bill is $50 a month, representing a savings of $150 a month. Using a rule of thumb, I am estimating that 60% of the monthly bill savings (or $90) from my solar-plus-storage system comes from reducing usage and 40% from export (or $60). Some 80% of the export savings ($48) will disappear, leaving me with just $12 of savings from exports.

I would only be saving $102 a month as opposed to $150 a month, a drop of roughly a third. Clearly, that would extend the payback period from 9 years. I just don’t see how the payback period would be shortened, as asserted in the December 15 decision.

The ostensible purpose of the decision seems to be to promote self-consumption. Consumers will have to avail themselves of the following choices under the new rules:

- Install the same size system they would have installed under NEM 2.0 but pair them with two batteries. In my example, install an 8 kW system which will produce 10,000 kWh to net out my annual usage but install another 9.8 kWh battery to absorb the excess generation in the afternoon.

- Undersize their PV systems to prevent exports from taking place and end up with an annual deficit. In my case, that would mean I would just install a 4 kWh system and have an annual deficit of 5,000 kWh. I would pay PG&E directly for the difference at rates that are projected to rise at least another 30% by 2026.

- Cut their consumption in half. That’s never easy to do, regardless of how much one invests in energy efficiency. I made a major investment in energy efficiency in February 2016, via the Energy Upgrade Program. I also gave away an 8-person spa. My bills only went down by 20%. None of these three options will appeal to customers.

- “Cut the cord” and construct their own microgrid using a bi-directional EV charger and to install a small backup generator that might run for a total of 50 hours a year. Of course, this route carries its own risks and for the foreseeable future, will only interest the ultra-wealthy.

The decision to end net energy metering will have several consequences. Rooftop solar installations will plummet because most people don’t want to pair them with batteries. Battery installations are rare because they are expensive. I personally know two dozen people who have installed solar panels. Of this number, only three have installed batteries.

Only wealthy customers who really don’t care about payback periods, earning a million dollars a year and higher, would make that investment. I certainly would not be making that investment if I had not already made it. Neither will the low-income customers whose well-being is the stated intent of the decision.

The only thing I can think of that will validate that assertion is that rooftop solar installations, either with or without batteries, will plummet and thus the so-called cost shift from the poor to the rich will diminish. Maybe that’s the real intent of the unanimous decision. But what will also diminish is California’s pursuit of net zero carbon emissions.

Telling consumers that large-scale solar costs only 4 cents/kWh rings hollow when they are paying 30 cents/kWh. In the coming decade, electricity rates will continue to rise in the billions of dollars, as stated by the utilities. They won’t be able to blame NEM for the rate increases. However, the one option consumers have today for lowering bills while staying connected will be taken away by this unanimous decision.

This will also represent a setback for the state’s electrification goals. What’s the primary reason that heat pump installations are rare in California? The high cost of electricity mentioned above. Heat pumps become cost-effective when customers have installed rooftop solar panels. The same can be said for EVs.

Consumers will be asking why they can’t get power for 4 cents/kWh if the utilities keep insisting that bulk renewables are the cost-effective solution. The utilities undermine their own viability when they insist on ignoring the customers’ viewpoint on the economics of power purchasing.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

On grid rooftop solar with batteries costs 19 cents to 24 cents per kilo watt hour to produce when the solar panels and batteries are pro-rated. Just under the tier 1 rates charged by PG&E, it makes very little sense to install solar when the utility only pays one 4 to 6 cents for any extra power produced. Going off-grid however locks in the 19 cents to 24 cents rate for 25 years and with utilities raising prices every year, in ten years the 24-cent rate will look good compared to the 60 cent rates they will be charging by then. Of-grid will not pay a monthly “tax on the Sun” fee when it gets imposed in a couple of years and everything the solar panel system makes, the homeowner gets to keep. What was a great deal for rooftop solar under NEM 2.0 will now be a bad deal under NEM 3.0 if one decided to connect to the grid rather than building a stand-alone micro grid. Depending on how much sun the roof gets and how close to the marine layer along the California coast the property is in California, the summer bonanza, rooftop solar was getting in credits, is over and using up the power to charge batteries, EVs or run air conditioning will be the determining factor going forward for rich people. The poor get nothing from NEM 3.0 so all those advocates that said the rich were pushing infrastructure costs onto the poor, did not win but the utilities won a cash bonus. Going off grid pays no infrastructure fees anyway. Now who will pay for CARE and the other programs, for the poor, the rich Houshold’s have been paying for 22 years, if they all go off grid? The taxpayers will.

If you own your own home, In California, you are wealthy. That makes getting away from 35 cents per kilo watt hour utility power to 19 cents per kilo watt hour solar plus battery costs a no brainer for all the homeowners in California. Going off grid with a Micro grid with a solar system is not as profitable as the old NEM 2.0 but will still give one energy independence 99% of the time. One will still need the electrical meter and meter charge for wintertime back up power to charge the batteries from the grid during long rainy weather, but the winter utility rates drop to just 26 cents in tier 1 for the first 10 kilo watt hours per day.

The utilities in California also sell natural gas and both charges are on the one monthly bill. The 4-cent electricity is wholesale before transmission and is a myth when you look at your electrical bill and find the wholesale cost is upwards of 12 cents after transmission. East Bay Community Energy that supplies my electricity and is a non-profit that sets its wholesale prices around 11 cents per kilo watt hour and that gets jacked up to 35 cents per kilo watt hour by PG&E.

NEM 3.0 is nothing more than a “Power Grab” by the 3 largest California utilities two of which have GAS in their names. The CPUC says it will help the poor install solar, but the poor don’t own their own homes in California. They live in rentals, apartments and even Cardboard Boxes as housing becomes more expensive. The CARE program, that gives a 20% discount to the poor, is financed by charging the populace at large, utility customers, more money for their electricity to pay for the program. The tiered tariffs of up to 48 cents per kilo watt hour for those who used more than 300 kilo watt hours per month made California’s larger homes pay more for their electricity. This is why 1.5 million California homes installed solar panels in the first place. Those 1.5 million homes are Grandfathered into NEM 2.0 for now but that could change at future CPUC meetings.

There is one other avenue, which to an extent has been pursued in one sense. The four solutions you listed are are personal, building-to-building, owner-to-owner ones. The CCAs have already been making inroads into IOUs’ customer bases, and the MicroGridKnowledge.com people have been writing for a while about what one might in this case classify as “medium-scale” community-based solutions. One or several towns and cities may want to take a fresh look at going in on their own renewable and storage plants, both for economics and for the raw safety of having backup power and reduced fire hazard from long transmission. The word of the day is Climate Action Plan, and all power to the people!

Limiting export (same as local consumption) seems to be the strategy.

Charging a battery instead of exporting accomplishes this, but at a high cost.

Think about large controllable loads: a few examples: HVAC, resistance heating (cooking, water), battery charging (EV?), pumps/motors.

this is a newsom /power company grab as it will cost me more money either way and get less for my dollar.

Great article. Without true net metering (close to kwh for kwh credit) roof top solar makes little economic sense in most of the country. Your California example is best case. I’m in Illinois in the gray and snowy winter. I couldn’t build a battery system to get me thru winter. I’m running a 625kwh deficit mtd in December. But, I have a ytd surplus that’ll get me through the winter.

Fortunately I installed my system while Comed is still offering 100% net billing for energy (I pay about $14.50 for distribution charges).

What I don’t understand is utilities opposition to rooftop solar. Why not encourage consumers to fund the panels and use utility funds to invest in utility grade battery to capture the excess power they generate?

It seems the utilities bottom line is to raise rates and blame roof top solar. This defies logic of the most efficient way of producing electricity. If utilities are promoting battery storage for consumers, why aren’t they installing megabattery systems to store all surplus net metering from rooftop solar production. Again, it seems the utilities want charge everyone higher rates. Low income users end up paying more and rooftop solar producers are penalized for producing electricity.

A home battery is usually a poor investment. Better is to have an EV (or low-cost used EV) as the home battery. This gives you dual-purpose out of your battery (V2G) and makes your power source easily portable…if necessary.