First Solar will join the S&P 500 Index of public companies and becomes the third clean energy systems manufacturer to join the prestigious index of large-cap companies. Fellow solar technology suppliers Enphase Energy and SolarEdge Technologies are also on the S&P 500 Index.

Inclusion in the S&P 500 index is given to U.S. companies with a minimum market capitalization of $8.2 billion. In addition to having liquid common shares, at least 50% of the company’s outstanding shares should be available for public trading and the company must be reporting positive earnings over its most recent quarter.

First Solar’s debut on the S&P 500 is effective December 19 and marks a cap to a momentous year in which the module manufacturer received close to 22 GW of domestic and international orders for modules, driven in part by the passing of the Inflation Reduction Act.

In November, First Solar procured an additional 4.9 GW module order from power producer Intersect Power, bringing its sub-total with the customer to 7.3 GW. Earlier that month, it selected Lawrence County, Alabama as the location for its fourth U.S. PV module manufacturing facility.

The Alabama factory is part of a previously announced investment in scaling First Solar’s American manufacturing footprint to over 10 GWDC by 2025, and is expected to create over 700 new direct jobs in the state. The southern facility represents $1.1 billion in new investments and is expected to have 3.5 GW of annual production capacity.

First Solar, founded in 1999, has had a manufacturing presence in Ohio since 2002 when it produced 1.5 MW of modules and employed 150 people. In 2019, First Solar commissioned a second U.S. factory, and just recently it announced that a third Ohio factory is under construction.

In November, First Solar signed a 4.9 GW module order with Intersect Power, which was announced shortly after the company received 2 GW module orders apiece from Swift Current Energy and Arevon Energy. Over the summer, First Solar signed orders with Silicon Ranch (700 MW), bringing its sub-total with the Shell-owned developer to 4 GW, as well as National Grid (2 GW), Azure Power (600 MW), Akuo Energy (500 MW), and Scout Clean Energy (378 MW).

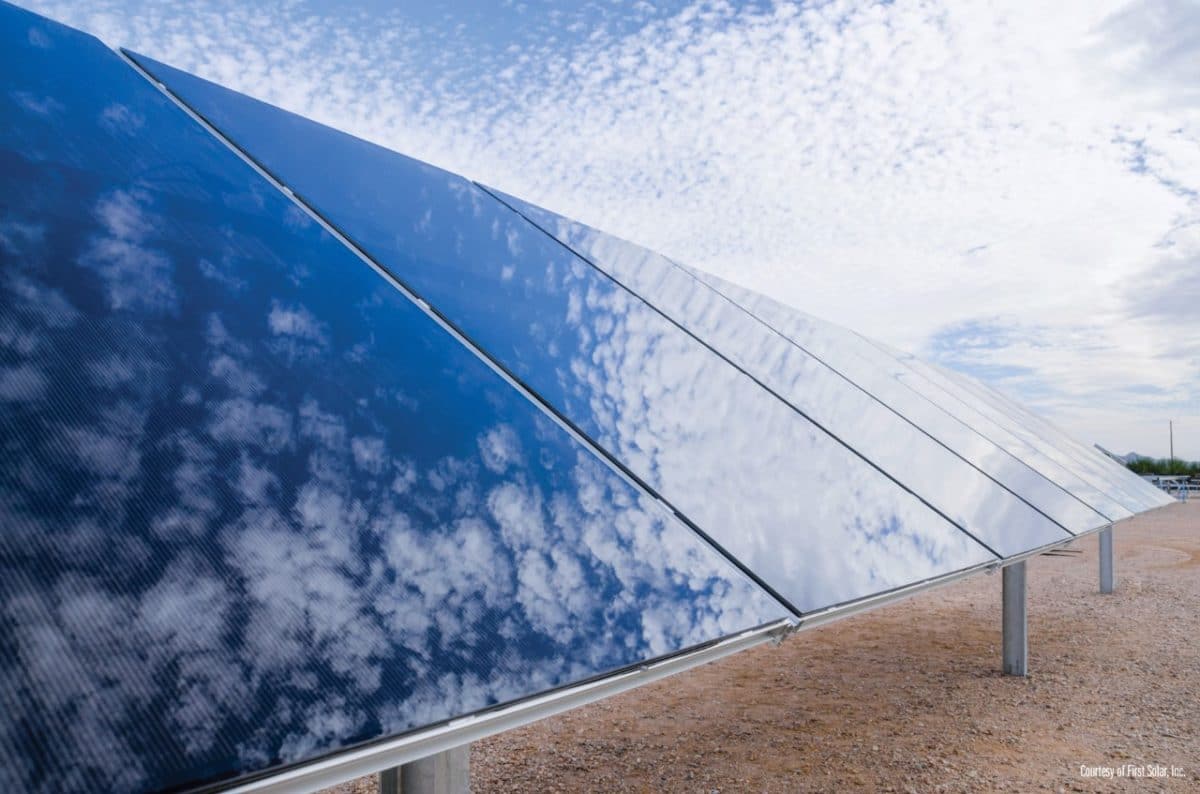

First Solar modules utilize cadmium tellurium (CdTe) thin-film, which is primarily used in utility-scale projects. With the signing of the IRA legislation to boost America’s clean energy economy, coupled with the goal of attaining 100% carbon pollution-free electricity by 2030, there is a push for increasing U.S. manufacturing across the solar supply chain. First Solar intends to scale its U.S. manufacturing base in support of the effort to decarbonize the American economy and achieve self-sufficiency in reliable and competitive renewable energy technologies.

The company estimates that new investments in Alabama and Ohio of $1.3 billion will bring its total investment in U.S. manufacturing to over $4 billion.

In addition to its U.S. facilities, First Solar also operates factories in Vietnam and Malaysia, and is building its first new manufacturing facility in India, which is scheduled to begin operations in the second half of 2023.

First Solar common shares increased 36% from $118 on August 15, a day before the IRA was signed into law, to $160.25 per share in afternoon trading today, with a market cap of $17.07 billion. Peers Enphase and SolarEdge traded at $333 and $339.80 per share today, with $45.3 billion and $19 billion market caps respectively.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.