Demand for residential solar is hot as energy prices climb and Americans are looking for ways to save on bills. Power outages and the desire for backup energy storage has been pushing solar adoption as well. Technavio projects the market for U.S. solar may grow by 10% compound annual growth rates through 2025, reaching $5.99 billion in incremental growth by the end of that year.

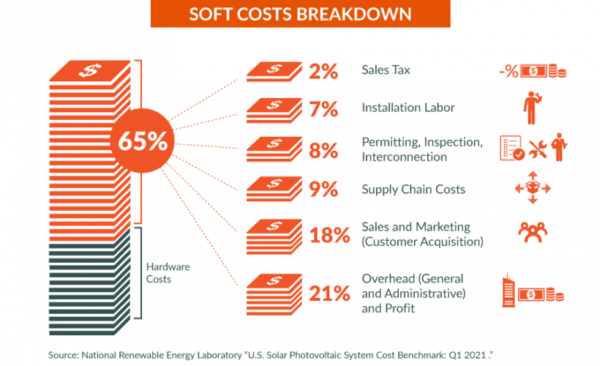

However, the U.S. market faces a problem with soft costs, a barrier that other major nations’ markets have largely overcome. Soft costs represent any cost not tied directly to the cost of hardware itself. In the U.S., soft costs represent 65% of the project, said the Department of Energy (DOE).

Shawn Rumery, senior director of research at SEIA, said since 2014, residential system costs have come down 25%, but soft costs have dropped only 15%. Customer acquisition and overhead costs have risen 31% in the same time period, Rumery said.

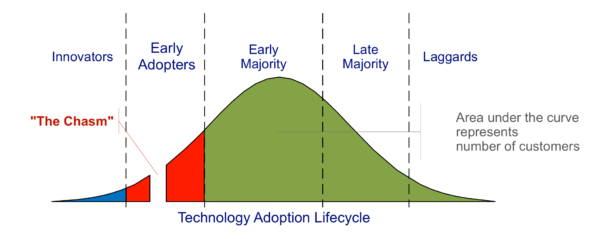

Customer acquisition is difficult in the U.S. as residential solar crosses “The Chasm” in the technology adoption curve, a popular model for analyzing the time it takes for a new technology to be widely accepted by the general public.

The concept is that as a technology is adopted, expectations and customer profiles shift. Early innovators and early adopters, the first 15% or so to adopt a new technology, are highly motivated to adopt solar, perhaps as tech enthusiasts, environmentalists, or by other less financially-focused motivations. As you cross from the early innovators to the middle 30% of adopters, you encounter the early majority. This is the customer base that is motivated by pragmatic reasons, like wanting to save money on electric bills and having backup power during outages.

Crossing the chasm is considered the most critical moment in the adoption process, when a technology is accepted by the general public, and the momentum of a technology becomes essentially unstoppable. For solar to cross the chasm, it must meet the expectations and needs of pragmatists.

A short, painless project cycle with faster installation times and lower costs are two important parts of meeting these needs. These two needs underpin why SEIA and DOE have targetting permitting as an area of improvement.

Permitting, inspection, and interconnection represent 8% of the U.S. residential solar cost stack. Based on data from its members, SEIA estimates that a one week delay in system installation due to permitting, inspection and interconnection processes increases the client cancelation rate by 10%.

SEIA wrote on the subject, “The total direct and indirect cost of permitting for a residential system is on the order of $1/watt (or $6,000 – $7,000 per system) for residential solar PV systems. Outside the U.S., soft costs and specifically permitting costs are much lower.”

SEIA is currently working in partnership with DOE to nationally roll out SolarAPP+, which offers instant permits and slashes costs. In a pilot of five jurisdictions across diverse residential solar market characteristics and needs, SolarAPP+ reduced overall project times by an average of 12 days.

DOE also partnered with the Interstate Renewable Energy Council (IREC) and the International City/County Management Association to develop the SolSmart program, offering targeted, no-cost technical assistance to communities across the U.S., aiding municipalities in becoming solar-ready and streamlining local processes.

Also within the SolSmart program and other DOE efforts are community engagement plans that aim to educate and reach pragmatists, cutting down on customer acquisition and marketing costs. The community engagement plans help cut predatory practices and set reasonable expectations for the solar installation process, making for a better customer experience.

A good customer experience is more likely to lead to a referral, generating more business and accelerating the adoption curve. Referrals are so valuable, in fact, that many residential installers and their affiliates are willing to shell out for them. Third-party lead generator SuperGreen Solutions recently announced it would pay $1,000 per customer referred that moves forward with an installation.

The Inflation Reduction Act (IRA) includes a provision to chip away at residential soft costs as well. For systems less than 5 MW, the IRA makes interconnection costs eligible for the 30% investment tax credit.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Utility-scale solar is a lot cheaper: about $0.80 per watt compared to an average of $2.84 per watt for residential solar according to the SEIA. Just wait for it.

As utility scale solar builds out, customers who don’t own a roof, suitable or not, and can or can’t afford solar…will still benefit from utility scale solar fuel savings.

Other returns on investments like U.S. Treasury Series-I Savings Bonds (paying 9.65%) can help reduce future bills of all kinds. Plus, they’ll be worth what you paid for them years later with nothing to recycle.

And you’ll have nothing to install, maintain or replace in the years ahead, especially if there are no expensive batteries involved.

Something to think about…

$10,000 in I-bonds will return you $15,000 in interest/dividends before taxes over a ten year period. Compare that to savings from a $10,000 rooftop solar system about half the size of my 10kW array…after its 30% tax credit in 2015.

And you can invest $10,000/person/year if you like…and up to $10,000 more if you are due an IRS Tax Refund.

Nothing to install, but a U.S. Treasury online account:

https://www.treasurydirect.gov/

Just sayin…rooftop solar is not the only AN$WER…think twice…