Designing a 100% renewable grid for the island of Oahu, Hawaii with real-time pricing of retail electricity would yield combined consumer and producer benefits of 9% or more than the same grid with flat rates, says a white paper by researchers at the University of Hawaii at Manoa and Geneva’s Graduate Institute of International and Development Studies.

California is now pursuing demand flexibility through real-time pricing, also known as dynamic pricing, in a regulatory proceeding.

The Oahu study modeled scenarios in which the optimized system is built at one point in time, while allowing pre-existing assets to be retained. The results showed how much renewable capacity would be selected in an optimized system designed with flat prices versus one with real-time pricing.

The study jointly solved for investment and real-time operations with reserves, either with or without real-time pricing, using the open-source Switch optimization model. “To our knowledge,” the authors say, “such dynamic equilibrium models have not been solved in the economics or engineering literature.”

The study assumed that electricity consumption would change by 0.1% with each 1% change in the real-time retail price. As electricity prices fell, consumption would increase, and as prices rose, consumption would decrease. They modeled the overall 0.1% “elasticity” value by assuming higher elasticities for commercial air conditioning using ice storage, commercial smart water heating, and municipal water pumping, and elasticities of zero for other uses.

The authors compared scenario outputs to calculate the increase in social benefits from using real-time pricing, defining social benefits as the sum of “consumer surplus” and “producer surplus”—two concepts from economics.

For two scenarios based on a Hawaiian Electric Company forecast of 2045 costs for renewables and storage, the increase in social benefits from real-time pricing in a 100% renewable system was higher (14%) when assuming commercial customers widely participated in real-time pricing, deploying thermal storage and automated demand-response systems, with zero participation by residential customers. When assuming less participation by commercial customers, the social benefit increase from real-time pricing was lower (9%). Commercial customers comprise over 70% of Oahu’s demand, the authors said.

“By some estimates,” the authors said, current renewable energy and battery technology costs already rival the Hawaiian Electric Company cost projections for 2045 that they used in the analysis.

“Conservative” estimates

“We believe the assumptions underlying these estimates are fairly conservative,” the authors said. The benefits of real-time pricing would be “much higher,” they found in a sensitivity analysis, “if we optimistically assume” a high overall demand elasticity of 2, “which is not observed in history but might arise in a future that is more automated, has more price variability, and prevalent free or near-free electricity.”

The authors did not explicitly account for the capital cost of equipment, such as ice or hot water storage and smart controllers, that could enable demand response. They stated that some measure of these costs is implicit in the elasticities, and the estimated gains to customers from real-time pricing provide an upper bound for customer capital costs that would be economic.

While the paper did not disclose the generator investments selected by the model for various scenarios, the authors said that real-time pricing provides efficiency gains by curbing peak demand and thereby reducing investment in rarely used peaking power plants, “and also reducing market power.”

Real-time retail pricing that reflects the “incremental cost and marginal willingness to pay” for electricity represents a “well-known but rarely implemented solution” to efficiently mobilize demand-side resources, said the co-authors, citing research dating back to 2005. Automated smart devices acting on customers’ behalf are already available, “but remain rare, because incentives are limited,” perhaps because “few utilities and regulators are aware of the potential.”

While real-time pricing benefits flexible demand types more than inflexible demand types, the authors said, they concluded after running multiple scenarios that “even inflexible demand types normally benefit from real-time pricing, and in some cases, nearly as much as flexible demand types.” They added that “many if not most customers” probably have both flexible and inflexible demands, and that flexibility will also depend on adoption of smart devices that enable automated response.

Continent-scale implications

Regarding the applicability of their findings beyond island grids like Oahu’s, the authors point to recent research suggesting that shifting of heating and cooling loads with thermal storage “might do more than transmission” as a mechanism for “flattening existing demand variability” across the continental United States.

To facilitate similar studies of additional locations, the authors said they are making their input data and model code publicly available.

The white paper is titled “Real-time pricing and the cost of clean power.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

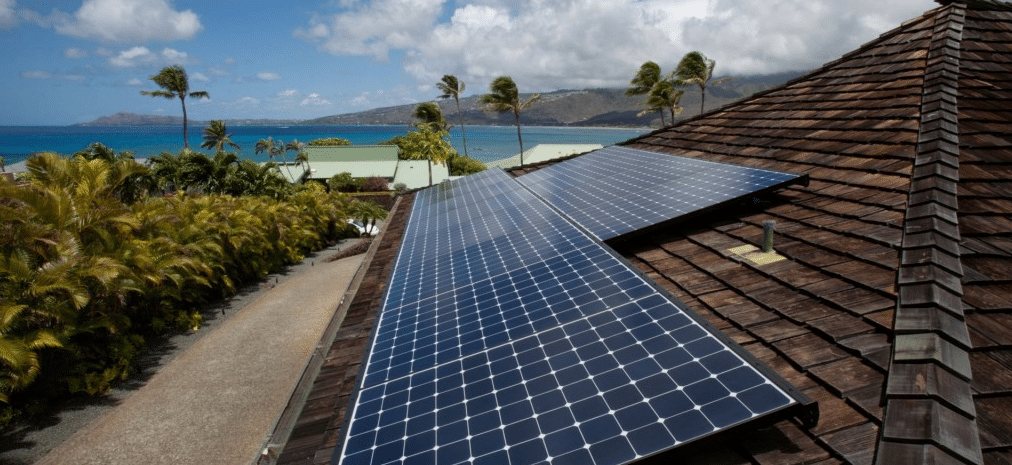

Hawaii is the perfect spot for a home to just go off-grid with their own solar, batteries and backup generator. If the planners do not get this done now, the homeowners will just go off grid and their Hawaii grid will fall apart without their solar participation. Electricity is so expensive in Hawaii that the payback for an off-grid system is less than 5 years which is shorter than for any state outside of California that has electrical rates even higher at times.