Having recently announced two gigawatts of new solar power capacity across 22 projects, the New York State Energy Research and Development Authority’s (NYSERDA) is launching two Requests for Information (RFI) to gain feedback from stakeholders on proposed changes.

The comment period for both RFIs ends on July 28, 2022, at 3:00 p.m., with submissions online.

The Large Scale Renewables group released a Summary of Changes and Focus Areas that includes 19 subsections of potential changes. Within each subsection are questions on how the changes could be implemented by NYSERDA, along with requests for commentary on the broader global reality that developers are experiencing.

For instance, in section 2.2 on the topic of suspended import tariffs, NYSERDA asks developers whether or not they plan on buying modules before the end of the 24 month pause. NYSERDA also asks stakeholders whether or not they consider this purchasing strategy to be risky, and to explain the perceived risks and other factors that have been guiding their decisions.

These nuances are particularly important to understand because in this program, Tier 1 large capacity projects always take more than 24 months to deploy – after bids are secured. If there are large increases in solar panel pricing due to import tariffs years after a bid, then it will affect project finances and could imperil the viability of a project.

A second question related to increased costs is found in section 2.14. The New York “Buy-American” law requires certain iron and steel used in state-supported renewable energy facilities to be sourced domestically, unless specifically exempted by the head of the applicable state entity. After commissioning a series of studies, NYSERDA concluded that sourcing iron and steel domestically was not in the public interest due to increased costs and schedule delays as a result of manufacturer availability, steel availability, and other market dynamics.

With that in mind, NYSERDA is still aiming for increased US material in their installations, and is considering a “minimum dollar requirement” of $30,000 per MWdc (3¢/Wdc) related to iron and steel products.

A requirement of this nature could make the reopening of NexTracker’s new/old Pennsylvania steel facility a very intelligent decision.

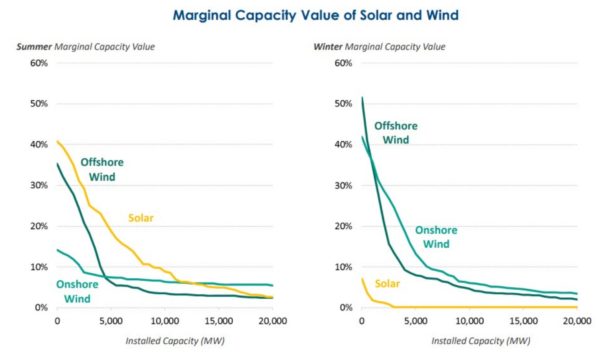

The second RFI seeks to refine how large scale wind and solar projects are paid for the energy capacity they offer. The current marginal capacity value of wind and solar are noted in the graph above.

The RFI puts forth the new calculation methods being considered for defining these project revenue streams. These methods are especially important to project developers, since increasing capacity deployments of solar will send the capacity value of these resources towards 0%.

NYSERDA asks a series of twelve questions regarding the newly suggested calculations. Among them are the questions of what other factors ought to be considered, and what other generation resources (tidal, geothermal, etc.) ought to be modeled within the framework.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.