Climate First Bank, an FDIC-insured climate change focused community bank, announced it launched its first digital solar loan platform for residents of Florida. The loan platform features a streamlined online application process with real-time approvals. The company said eligible clients can be approved for 100% financing with no money down in 48 business hours or less.

The loan product comes with no dealer fees, meaning no there are no unexpected upfront costs. Climate First Bank said dealer fees are often imposed on solar loans as a way to advertise low or even 0% interest rates, but often these fees can be as high as 25% of the system costs.

Under the loan program, clients can prepay fully at any time without penalty. Any payments made in addition to the contractual monthly payment will be applied to a reduction in the principal balance of the loan. Customers are also able to directly access their 26% federal investment tax credit if they wish, or they can apply it to the loan.

“Now with a few clicks, clients can increase their property values, drastically reduce or even eliminate costs and save the planet all by investing in renewable solar energy,” said Ken LaRoe, founder and CEO of Climate First Bank. “I wish something this simple existed when I was putting solar on my house.”

The company said it is interested in partnering with top-tier residential and commercial PV installers. Those looking to become a preferred partner can apply by following this link. It said benefits for preferred partners include a dedicated personal banker, expedited approvals and processing, and 50% payment at project commencement, 50% at payment at project completion.

“Our robust tool is the next step forward for sustainable lending, making it easy for anyone who wants to stick a solar panel on top of their roof,” said Lex Ford, president of Climate First Bank. “Thanks to our transparent solar financing, consumers can purchase a solar energy system with no undisclosed surcharges or fees. Clients, installers and the planet alike all win with this new platform.”

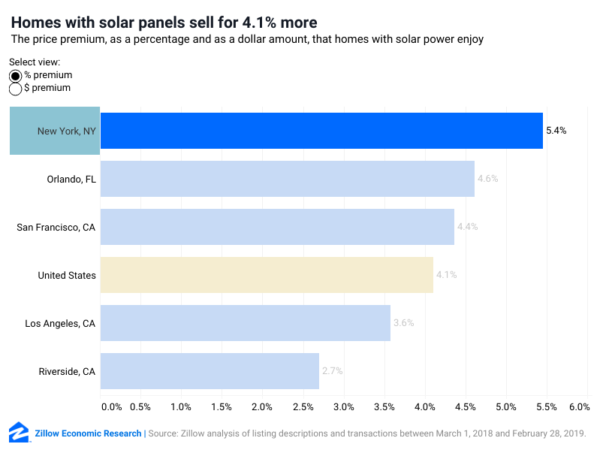

A 2019 study by real estate web giant Zillow found that solar raises a home’s property value by 4.1% on average. On a $500,000 home, that is an increase of $21,500 in value.

Solar financing is a common path to owning a PV system. SolarReviews said secured loans such as HELOC run between 3 to 8.5% APR, depending on credit score. The rate of PACE loans tends to be higher, with APRs between 6.5 to 8.5%. Unsecured loans have higher APRs, and generally vary widely in their APRs. In general, they range 6 to 30%, and having a good credit score helps keep rates low.

Many solar loans are zero-down, but where down payments are required, they typically range between $0 to $3000. You can find a solar loan as short as three years or as long as 30, but typically they range from 10 to 20 years, said SolarReviews.

Climate First Bank is currently offering the first 100 loans generated via the new platform a special promotion of 3.99% APR for 25 years with zero dealer fee.

With currently less than 1% of all roofs topped with PV in Florida, the Sunshine State, Climate First Bank and its competitors have a lot work ahead in providing financing for the energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.