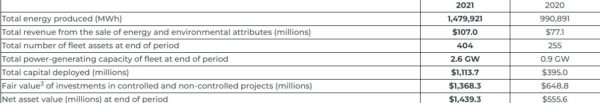

Greenbacker, a publicly reporting, non-traded investor and manager of sustainable infrastructure assets, announced its year-end 2021 financial results. Strong growth was posted, with Greenbacker’s revenue increasing 39% to $107 million.

The company dramatically expanded the capacity of its holdings from 900MW to 2.6GW, a near tripling. This includes operational and pre-operational assets. The company added 149 new projects to its fleet in 2021, bringing the project count over 400, representing a 58% increase in number of assets.

Greenbacker deployed $1.8 billion in capital, marking annual growth of 182% in spending. The fair value of its assets increased 111% over the year, reaching $1.4 billion. Net assets nearly tripled for the company, with $928.3 million in new equity capital raised in 2021.

“Despite supply chain challenges in 2021, our capital deployment and fleet expansion reached new highs. I’m happy to report that this growth brings even greater economies of scale throughout our operations, creating additional value for our investors and allowing us to deliver cheaper renewable power across the country.” Charles Wheeler, CEO

Greenbacker estimates its fleet abates 2.7 million metric tons of carbon, saves 2.5 billion gallons of water when compared with coal generation, and supports over 4,600 jobs.

The company invests in solar and wind projects in a variety of project sizes and sectors. Earlier this year, it invested in floating solar developer Noria Energy. It has investments in solar PV assets that power colleges, rooftop commercial solar portfolios, and utility-scale solar projects.

By the end of 2021, Greenbacker was conducting business in 32 states, Canada, Puerto Rico, and Washington, DC.

When it was gounded was founded in 2014, it set a goal to raise equity capital of about $1.5 billion. Now that it has neared that goal, the company has made the decision to close to new equity capital opportunities.

“We believe GREC’s expansion will continue to illustrate the long-term earnings power of our strategy. And, as always, we’re excited to focus on new opportunities to drive the future of clean energy” said Wheeler.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.