Last year marked a significant change in the U.S. renewables landscape, as solar power purchase agreement (PPA) offer prices rose consistently in 2020. Q4 2020 prices were 11.5% higher than in Q4 2019, for an average price of $30.56 per MWh. In Q3 2021, solar prices rose 14.7% year-over-year to $33.25 per MWh.

These prices were tracked by LevelTen Energy in its quarterly PPA Price Index report, and the latest edition of the report lays out the expectation that, until new supply chains emerge for the U.S. solar market, these increases will continue.

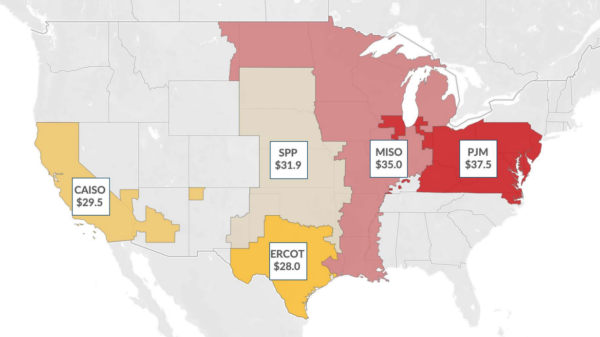

Broken down by Independent System Operator, PJM experienced the highest prices, averaging $37.5/MWh. That was followed by MISO at $35.0/MWh, SPP at $31.9/MWh, ERCOT at $28.0/MWh and CAISO at $29.5/MWh.

Since the trend first emerged, the consistent price increase has been driven by shifting supply of polysilicon from Chinese suppliers suspected of using forced labor; a shortage of PV component and module supply; and new potential tariffs on solar module imports from southeast Asia. However, solar PPA prices did not rise as high as many expected, which LevelTen says could be attributed to some developers taking a “wait-and-see” approach, before driving up their prices.

“There’s no denying that it’s currently a seller’s market. But, decisive buyers can use that to their advantage by understanding sellers’ motivations and constraints…” said Michael Casey, Director of Origination at LevelTen Energy. “For example, sellers are currently asking for emergency exits to be built into PPA contracts to protect themselves against regulatory uncertainty… These are provisions that may have seemed outlandish to buyers before, but they could become the new temporary norm until some of these development challenges are resolved.”

The majority of developers that LevelTen contacted in creating the report (53%) said they are altering their supply policies by incorporating anti-forced labor provisions into their module supply contracts, with roughly 20% going further in reporting that they are renegotiating module supply contracts, and nearly 30% said that they are finding new module suppliers.

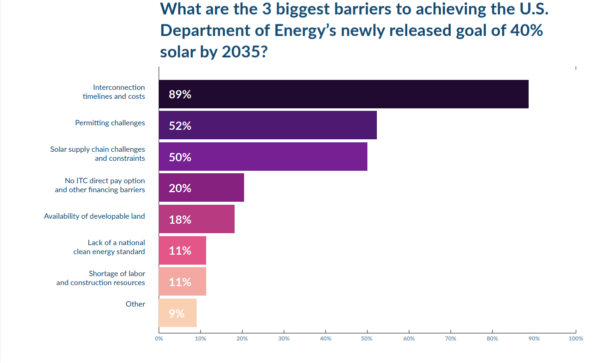

Despite these new constraints, only 8% of developers reported delaying, terminating, or planning fewer projects. This relative normalcy in the face of change may not hold forever, as respondents highlighted interconnection timelines and costs (89%), permitting challenges (52%), and solar supply chain challenges and constraints (50%) as barriers to achieving the level of solar development the Biden Administration is eyeing.

“Solar developers across the U.S. are navigating many challenges,” said Gia Clark, Senior Director of Developer Services at LevelTen Energy. “Long interconnection queues tend to put upward pressure on PPA prices, as they create uncertainty around commercial operation timelines and overall project costs. Though MISO solar prices this quarter experienced their first downward trend in a year, it would be unsurprising to see their rising trend resume in Q4.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.