New research from Wood Mackenzie said that annual global storage deployments will nearly triple year-on-year, reaching 12 GW/28 GWh this year.

Despite disruptions from the Covid-19 pandemic, the firm’s Global Energy Storage Outlook forecasts nearly 1 TWh of total demand from 2021-2030.

The U.S. and China are expected to dominate the global storage market, making up more than 70% of total global installed capacity through 2030. Deployments in the front-of-the-meter (FTM) segment could reach 700 GWh, or nearly three-quarters of total global deployment by 2030.

Image: Rev Renewables

The firm said that moves to accelerate the decarbonization of the U.S. and Chinese power sectors provide the foundation of its global market forecast. It said that China’s newly instituted 30 GW of energy storage by 2025 target has an “outsized impact on the regional FTM market.”

(Read “Battery energy storage pairs well with solar, EIA data show.”)

Wood Mackenzie said it sees the Asia Pacific market growing 20-fold, reaching 400 GWh of total storage capacity by 2030, with the FTM sector accounting for 82% of that demand.

Prolonged growth

Days earlier, IHS Markit released its global energy storage forecast, and said the market is expected to enter a “prolonged period of growth” starting this year. It pegged annual installations reaching more than 30 GW by 2030, up 250% from 2021 levels.

The IHS Markit forecast said that the energy storage industry will notch rapid growth this year, with installations topping 12 GW. That would be an increase of more than 7 GW from 2020. Annual global installations are forecast to exceed 20 GW in 2024 and 30 GW by 2030.

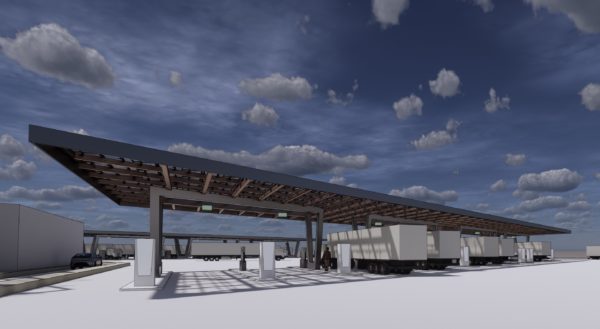

Image: WattEV

The firm warned, however, that growth in electric vehicle (EV) adoption is leading to increased constraints in the supply of Li-ion batteries. This could cause delays to project commissioning as cell manufacturers prioritize larger customers in the automotive industry over relatively small energy storage system integrators.

The lower share of battery demand from the energy storage industry will leave it at risk of supply shortages. Even so, IHS Markit said it expects that the disruption to ease within 12-18 months, as suppliers diversify their supply base and EV manufacturers firm their procurement plans.

Supercharged

The Wood Mackenzie report said that the current U.S. investment tax credit (ITC) for storage-plus-solar applications has “supercharged” demand. It noted a 4.5x increase in annual FTM deployments expected this year. Work currently under way in Congress on budget reconciliation and energy tax reform resulting in a new ITC for standalone storage applications would provide upside to the current 10-year market outlook, it said.

Image: Wikimedia Commons/David Maiolo

Europe’s storage market is also set to surge, with Wood Mackenzie expecting cumulative installs to exceed 100 GWh by 2030, led by Germany and Italy. High power prices will push the European non-residential segment from 11% in 2020 to 19% in 2030, while the residential market will exceed 27 GWh by 2030.

Behind-the-meter (BTM) markets are expanding worldwide, with 57 GWh of new deployments forecast through to 2030. The residential sector is being driven by cost reductions and consumer awareness, coupled with solar hybridization and electric vehicle adoption.

In support of global demand expansion, the report notes that global lithium-ion battery capacity will double in the next two years, with NMC and LFP demand forecast to reach 2.30 TWh in 2030, accounting for 89% of global battery cell capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.