The U.S. solar market passed 100 GW of installed electric generating capacity in the first quarter, doubling the size of the industry over the last 3.5 years, according to the U.S. Solar Market Insight Q2 2021 report, released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

The report said that residential solar was down 8% from the fourth quarter of 2020, but up 11% from the first quarter of 2021 with 905 MW installed. The report credited “healthy sales pipelines” that spilled over into the first quarter.

Commercial solar and community solar volumes fell from Q4 2020, as is typical for these market segments. Commercial solar rose 19% over Q1 2020 and community solar fell 15% from Q1 2020.

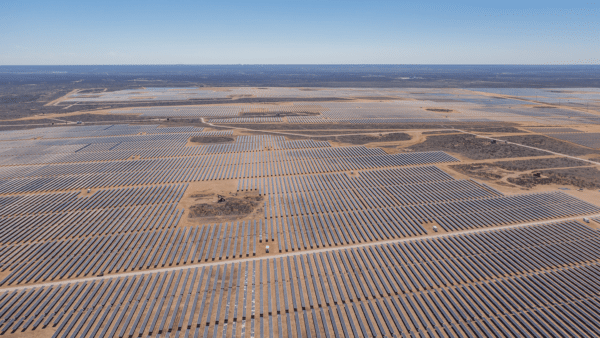

Utility-scale solar set a record for first-quarter installations at 3.6 GW. Texas made up the largest share of this capacity, with more than 1.4 GW of installations.

Image: Ørsted

A total of 6.2 GW of new utility-scale solar power purchase agreements were announced in Q1 2021, on par with Q1 2020. The total utility-scale contracted pipeline has grown to nearly 77 GW, the report said.

Wood Mackenzie forecasts that the solar industry will continue to break annual installation records every year for the next three years before the investment tax credit (ITC) fully phases down under current law. Another 160 GW of capacity will be installed between 2021 and 2026, bringing the total operating PV fleet to over 250 GWdc by the end of 2026.

Texas led all states with 1.52 GW of new solar capacity in Q1, more than it added in all of 2019 and three times more than any other state. Indiana, Virginia, Michigan, and Iowa were among the top 10 solar states this quarter. Indiana rose from 32nd in terms of new installed solar capacity in 2020 to 4th as of the first quarter. Meanwhile, Georgia fell from 7th place to 38th over the same time period.

The report also calls attention to rising costs in the solar industry and helps to explain the dynamics at play. It said that “compounding cost increases across all materials started at the end of Q1 and are beginning to affect installers now.” (Read “Supply chain constraints are starting to hit the solar industry, SEIA says.”)

Stem and CleanCapital extend business ties

Stem Inc. entered into a memorandum of understanding (MOU) for a new financing partnership with CleanCapital. Under the terms, the two will work to develop a framework in which Stem will provide support for smart energy storage services—including storage hardware and Athena smart energy software—to developers as CleanCapital’s preferred energy storage provider. Stem will have right of first refusal for all of CleanCapital’s storage projects that the parties originate together.

The proposed partnership will focus on mid-market commercial energy storage and small utility front-of-meter (FTM) projects up to 30 MW across the United States. The partners will target commercial & industrial end users and electric cooperatives.

In April, CleanCapital announced a $300 million corporate investment commitment from Manulife Investment Management to expand its portfolio of clean energy assets. With Stem as its new partner, CleanCapital expects to actively pursue investments in standalone energy storage, solar retrofits to add storage, and new-build solar plus storage projects.

Heliogen raises $108 million

Heliogen said it raised $108 million in two funding rounds to back the deployment of its Sunlight Refinery, a concentrated solar energy system that aims to make carbon-free energy for high-temperature heat, power, and green hydrogen.

The company recently closed $83 million in funding, a round that is in addition to $25 million raised in the previous round. Among the new investors are steel and mining company ArcelorMittal, utility holding company Edison International, Prime Movers Lab, Ocgrow Ventures, A.T. Gekko, private investment partnership of industry-leading families 8090 Partners, Gordon Crawford, and technology, consumer, and media-focused investor Rashaun Williams.

Heliogen said its baseline system will provide industrial-grade heat that will be capable of replacing fossil fuels in processes including the production of cement, steel, and petrochemicals. Its technology is also expected to enable power generation through the addition of a supercritical CO2 turbine and green hydrogen fuel production in combination with an electrolyzer.

Solar array for Cannon AFB

Ameresco Inc. said it will deploy a $19 million project for Cannon Air Force Base in New Mexico and the Defense Logistics Agency Energy that includes a 1.9 MW ground mount solar array, smart controls, and other energy conservation technologies.

The project is expected to convert 4% of Cannon’s electric energy usage to onsite renewable resources. Planned improvements include upgrades to existing transformers, direct digital controls, and heating, ventilation, and air conditioning equipment.

Cannon is expected to save around $1.1 million in the first year and $33 million over the course of the performance period. Construction is set to begin in the third quarter and reach completion by by the first quarter of 2023.SE

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

EIA has the April solar panel shipment report. April solar panel shipments were 2,256,057W compared to 1,242,915W in April last year. Cumulative Jan-April of 8,422,621W of solar panels. This is equivalent to about the same amount shipped Jan-June 15 2020.