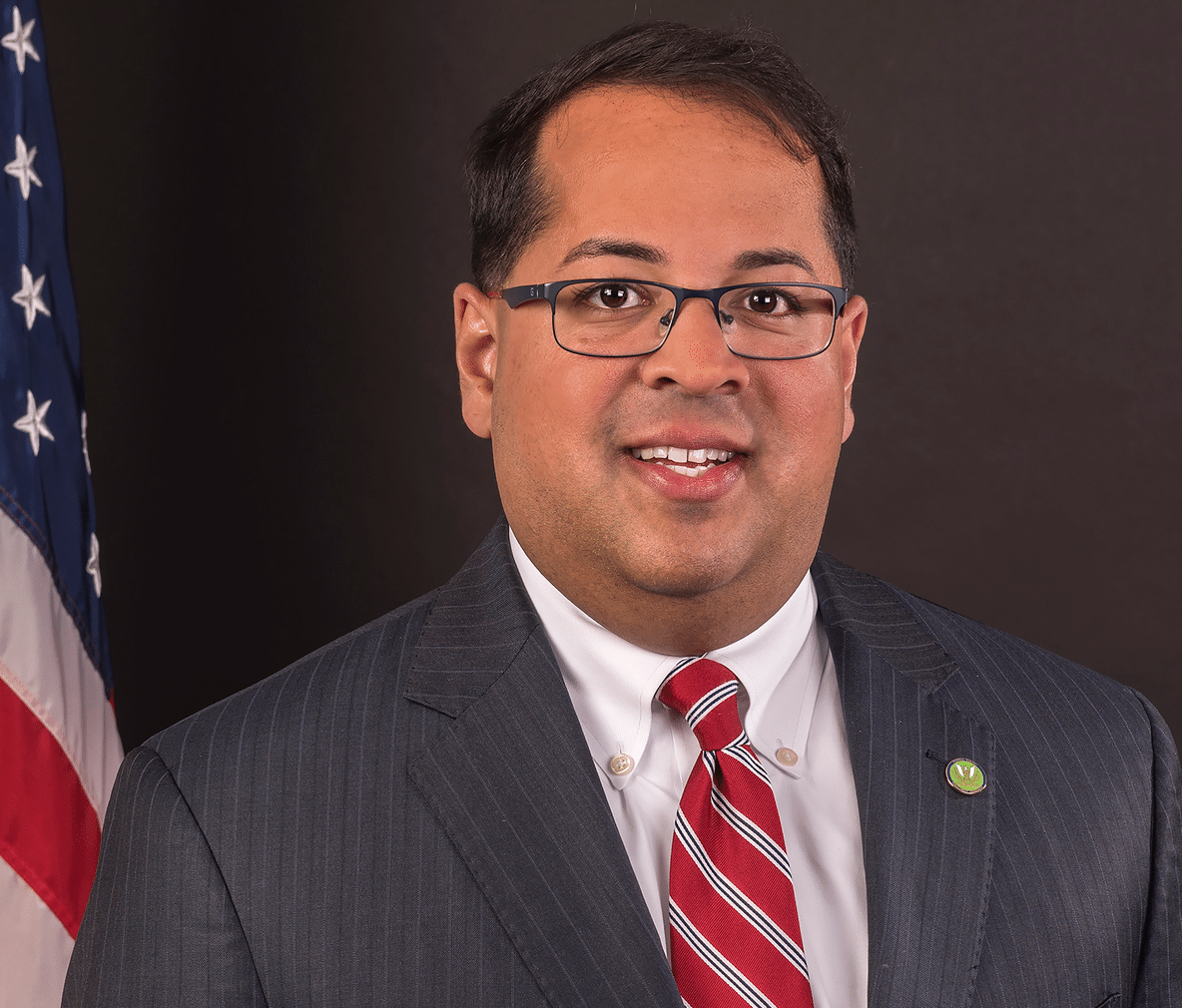

The Federal Energy Regulatory Commission has had a busy year. Chairman Neil Chatterjee gave a keynote at last week’s virtual REFF Wall Street to sum up 2020’s regulatory challenges and victories.

Chatterjee believes in competitive markets and is happy to see renewable sources win on price on an equal playing field. He didn’t mention solar by name — but he is really enthusiastic about storage, hybrid generation, and the changing regulatory landscape around these new resources.

“We’ve seen a rapid rise of renewables and regulated markets. Zero emission resources have become more and more cost competitive. And frankly, consumer preferences have shifted — companies and households are demanding cleaner sources of energy. This certainly isn’t new to anyone here,” said Chaterjee.

Here are three key takeaways from the Chairman’s talk.

Carbon pricing

In a first for the FERC, Chatterjee has accepted a petition for a technical conference on carbon pricing scheduled for later this month.

“When we received the petition asking us to look at the intersection of carbon pricing and the markets we oversee, I was truly struck by the diverse array of stakeholders that joined the petition and asked us with one voice to have this conversation. When such a broad set of interested parties ask a regulatory agency to use its convening power to host a dialogue, I think it’s important to not just set it up, but to sit up, to pay attention and do what you can to help create an exchange of ideas.”

“This is the first time the commission has ever explored these issues and I’m proud that it’s doing so under my leadership. We’ve set up an agenda that squarely tees up the tough issues, everything from legal questions, like how this conversation fits into our statutory authority to technical questions, like how market design choices in a multi-state market could help ensure that one state’s policies don’t affect consumers in another state. So I’ll just say it promises to be a really interesting forward-leaning conversation. And I think it is an important and timely topic.”

Energy storage and hybrid resources

FERC Order 841 allows energy storage to participate in wholesale regional marktets.

“When I look back at my time at FERC, I think I’ll be able to say that our work on Order 841 was one of the most important things we accomplished during my tenure as chairman, when it comes to the energy transition. Order 841 is our landmark rulemaking to break down market barriers to storage and require regional market operators to facilitate the participation of energy storage resources in their markets. Though our action was challenged in the courts, the DC Circuit Court of Appeals upheld the rulemaking on the merits — finding that first action was solidly within our statutory authority. That was a huge and welcome victory.”

“We have thousands of megawatts of hybrid resources entering interconnection queues across the country. And that has raised some unique rulemaking orders. There was some really interesting discussion of these matters at a technical conference the commission held last month and I look forward to seeing the post-conference comments and assessing what steps we might be able to take to carry the ball forward.”

“I’ve long said that the co-location of storage and renewable resources promises to be a game changer. My staff mocks me because I continually talk about this in what they view as cliche terms. But the reality is that our cliches and our nomenclature come from things that are very real. And I truly believe that the co-location of storage and renewable resources will fundamentally alter the way we generate, transmit and consume energy in this country and potentially around the world.”

Transmission infrastructure

“One of my top priorities has been ensuring that we have the right transmission infrastructure in place to bring new energy resources online and usher in the grid of the future– a grid that is able to keep up with the pace of change. FERC’s ROE [returns on equity] policies are critical when it comes to the grid, investments we’ll need to meet future needs. To that end we’ve updated the methodology we use to calculate transmission utilities ROEs, we are focused on making sure our ROE methodology better reflects investor expectations. And, and this is a really important piece, is also legally durable so that it will stand up if challenged in court. As I mentioned before, we recognize that investors seek certainty and stability.

Transmission incentives are another piece of the puzzle. In March. We issued a notice of a proposed role making to update the commissions transmission incentives policy. We proposed to depart from the commission’s existing approach, which was established nearly 15 years ago. And in awards incentives, based on the risks and challenges of the project. We proposed to instead grant incentives, ensuring reliability and reducing the cost of delivered power. This proposed approach more closely aligns the commission’s transmission incentives policy with our statutory authorities. But frankly, it also makes good sense. We should incentivize the most beneficial transmission projects, not the riskiest ones. We are working through rule making comments on this topic. And I’m optimistic that this reform will move forward. Swiftly.

Bullish on renewables

“I believe the cost of renewables has already come down to such a point that there’s a strong market based business driven case for the accelerated deployment of renewables. And I only believe that that is going to continue and that renewables will thrive in an efficient market environment,” assured the FERC Chairman.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Great to hear this from the FERC Chairman.

Agree with Dan – this is a great development, and particularly surprising / refreshing, given that he was appointed by Trump and is a former McConnell advisor.