To achieve a lower-cost grid by 2040, seven Southeastern states from Tennessee to Florida could increase planned capacity additions by 33 GW of solar, 39 GW of onshore wind, and 39 GW of battery storage, beyond what utilities have already specified in their resource plans. The region would also institute competitive wholesale power trading.

The improvements would reduce the region’s retail electricity costs in 2040 by 29%, or 2.5 cents per kWh, versus business-as-usual levels, boosting the region’s industrial competitiveness and yielding a cumulative $384 billion in savings.

The findings are from a study published by Energy Innovation and Vibrant Clean Energy, based on an analysis using VCE’s utility planning model, WIS:dom-P. The study shows “what full competition and restructuring might look like,” said co-author Mike O’Boyle of Energy Innovation, compared to a more limited power trading proposal from Southeastern utilities, called the Southeast Energy Exchange Market.

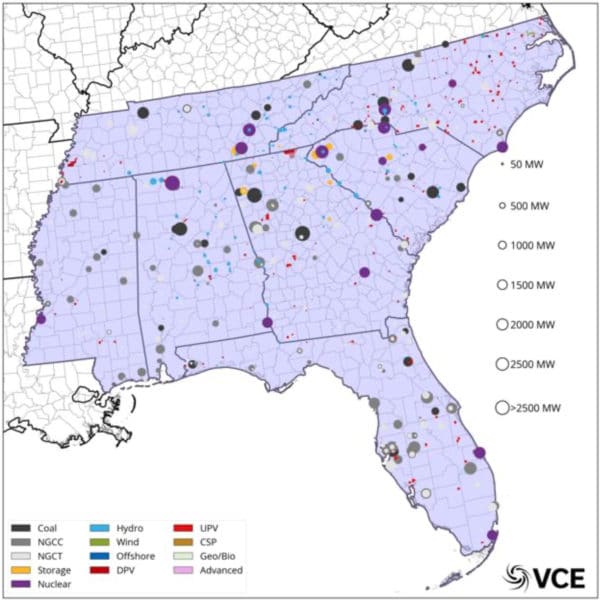

The image at right shows the seven states considered, and their current generation resources.

The lower-cost grid would reach 22% renewable generation by 2040. The modeling constrained solar and wind installations at 1.8 GW each in the first year, increasing 5% per year thereafter, to track historical capacity expansion of renewable generation. The modeled solar and wind additions “essentially” reached the limits each year. In comparison, 12 GW of solar projects gained interconnection approval from the Texas wholesale market operator in a recent 7-month period.

Savings

About three-quarters of the $384 billion in savings could be achieved solely through a cost-optimal mix of generation resources for each utility—substituting low-cost renewables plus storage for higher-cost fossil generation.

Adding a regional power market with more transmission capacity, and co-optimizing distribution system planning with generation planning, would yield the remaining one-quarter of the $348 billion savings.

Co-optimizing distribution and generation planning would yield about 10% of the total savings ($38 billion), as added behind-the-meter generation and storage would help reduce peak load nearly 12% below the business-as-usual scenario, “creating savings from generation all the way down to distribution.”

Perfect market

The modeling assumes wholesale power trading with perfect market competition, and no bias against renewables.

To achieve transparency, fairness and competition, a Southeast wholesale power market would need to be independent—not operated by the incumbent utilities, but “an independent system operator,” said Mike O’Boyle. The governance structure would need to involve “meaningful participation” from environmental groups, large power customers, and state public utility commissioners, he added.

“There are lots of advocates and experts in the region” who can bring their insight regarding what type of governance structure is appropriate, said study co-author Taylor McNair with GridLab. “Part of the impetus for this study is really teeing up this question.” McNair also highlighted the team’s separate policy recommendations.

The proposed Southeast Energy Exchange Market (SEEM) being discussed by the region’s utilities “doesn’t appear to be an agreement to use transmission without wheeling charges,” O’Boyle said. “Unless there’s an open transmission agreement, there will still be unnecessary costs and a lack of optimization across the region. The SEEM proposal pales in comparison to the savings that we find are possible through full market optimization.”

Coal and peakers

In the lower-cost system with added renewables and wholesale trading, coal generation would be eliminated as uneconomic. Nearly half of the power would be generated with gas units, as “storage and gas combine to provide sufficient flexibility to integrate significant shares of variable renewable energy by 2040.” The modeled total of 46 GW of 4-hour battery storage would represent 25% of the region’s 2040 peak load, and as a result most gas peaking units would be retired. Nuclear units, including Plant Vogtle, which is assumed to come online, would provide 20% of generation.

The regional utilities’ current plans show solar providing just 4 percent of annual generation in 2040, and wind less than 1%, says the study.

Modeling choices

For future costs of solar, the modeling used the “low” scenario from the National Renewable Energy Laboratory’s 2019 Annual Technology Baseline. For future costs of storage, the modeling used cost projections from Able Grid. The modeling assumed there would be no carbon price throughout the modeling period.

The modeling reduced the region’s reserve margin from 48% beyond projected peak demand in 2040, which utilities currently plan, to 16%, which remains above the 15% standard set by the North American Electric Reliability Corporation.

The modeling is fully described in Vibrant Clean Energy’s technical report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.