An estimated 20% of transmission and distribution investments in Texas are designed to meet load growth, and could largely be deferred by adding distributed battery storage.

That’s a key finding of a report from the Texas Advanced Energy Business Alliance (TAEBA), which pegged the annual savings possible in Texas from this “non-wires solution” at $344 million per year.

“Customers would save substantially if non-wires solutions were explicitly considered as competitive options compared to traditional infrastructure build-out,” said Suzanne Bertin, TAEBA’s managing director, in testimony to the Texas Senate Committee on Business and Commerce in February. Bertin publicized the TAEBA study and her testimony in a recent post co-authored by Claire Alford, a policy associate with the national clean energy group Advanced Energy Economy.

The report, prepared by Demand Side Analytics, also showed that 1,000 MW of distributed storage could reduce electricity costs for Texas consumers by more than $300 million per year.

Storage works best

While the analysis of transmission and distribution (T&D) deferrals referred to distributed energy resources (DERs) generally, and did not specify what type of DERs could effectively defer T&D expenditures, another part of the report referred to DERs that could meet peak demands on late afternoons in the summer and on winter mornings — both of which storage could do. Bertin’s testimony also focused on storage, including storage that could be made available to the grid by electric vehicles.

Analytical insights

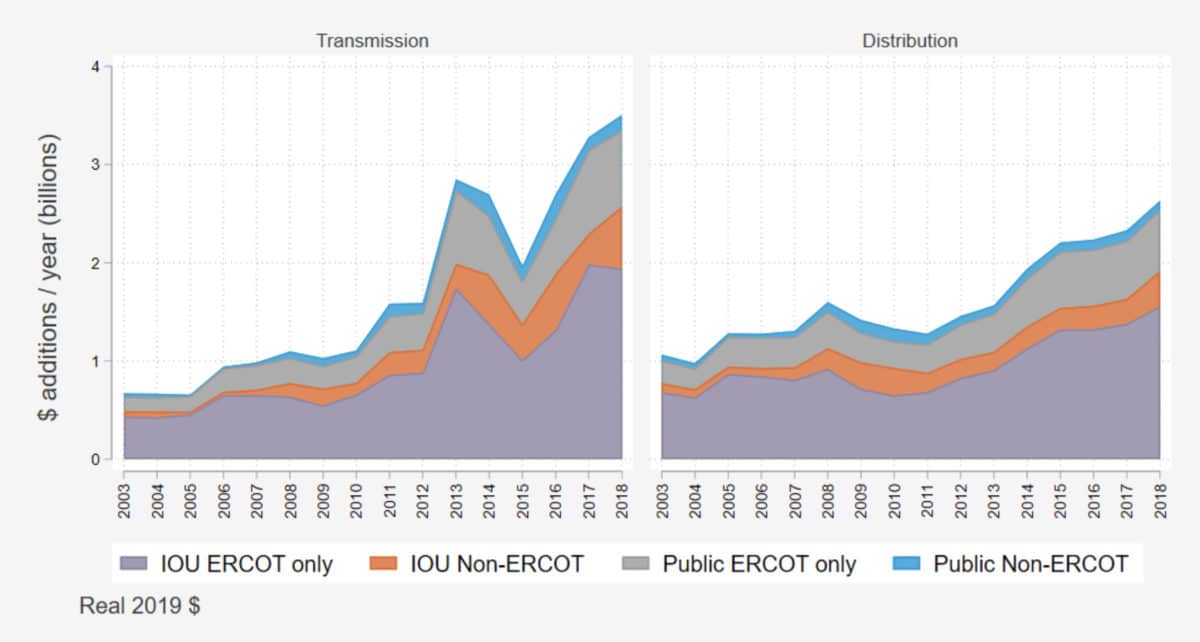

Demand Side Analytics derived its estimate that 20% of Texas transmission and distribution expenditures are due to load growth largely based on estimates made by utilities in five other states; those estimates ranged from 9% to 32%. Because Texas is growing faster than most other states, the report said, the share of growth-related investments in Texas is likely to be at the high end of that range.

A key insight of the study is the relationship between the growth rate in peak demand, and the T&D deferral period from reducing peak demand. “For example, if peak loads are growing at a 2% annual rate and enough DERs are introduced to shave peak demand by 20%, it is possible to defer infrastructure expansion for 9.2 years, after taking into account compound growth,” the report said.

Looking at recent annual growth in peak demand across ERCOT zones — zones established by Texas grid operator ERCOT — the study found most growth rates in the range of 1% to 3%.

The analysis assumed that added storage or other DERs would reduce peak demand by 20%. Based on that assumption, the annual savings from adding DERs would be $344 million per year. A sensitivity analysis considered peak demand reductions ranging from 5% to 25% from adding DERs, finding substantial savings across that range. The report noted, however, that “most T&D planning teams will not consider deferral unless resources are large enough to defer the project for two or more years. When the magnitude of DER resources is a small share of the feeder capacity, say 5%, the deferral period may be insufficient at most locations to defer T&D in practice.”

A bill to create opportunities for utilities to contract for battery-based “non-wires solutions” to defer T&D buildout passed the Texas State Senate unanimously last year, said TAEBA’s Bertin in her testimony. The bill also passed a State House committee, but “time ran out” before the full House could vote on the bill, she said.

The TAEBA report is titled “The value of integrating distributed energy resources in Texas.” The report shows 25 businesses as members of the association.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Yes very correct and even more so.

Most future storage will be in home, building, business and EV batteries and heat/cold storage in the same.

It is the most cost effective as does several jobs for them and on EVs the pack is already paid for and far more capacity than an EV can use unless a taxi like job and both save, get retail prices selling on demand power getting a check instead of a bill.

And grid batteries, grid paying list and getting wholesale prices can’t compete.