The fourth quarter of 2019 was another successful one for Sunrun, the largest residential solar company in the United States — building on an already strong 2019.

The company reported 117 MW of installations in Q4, representing a 9% increase over the 107 MW installed in Q3 2019. In total, Sunrun installed 413 MW in 2019, up from 373 MW 2018 and good for an 11% increase year-over-year.

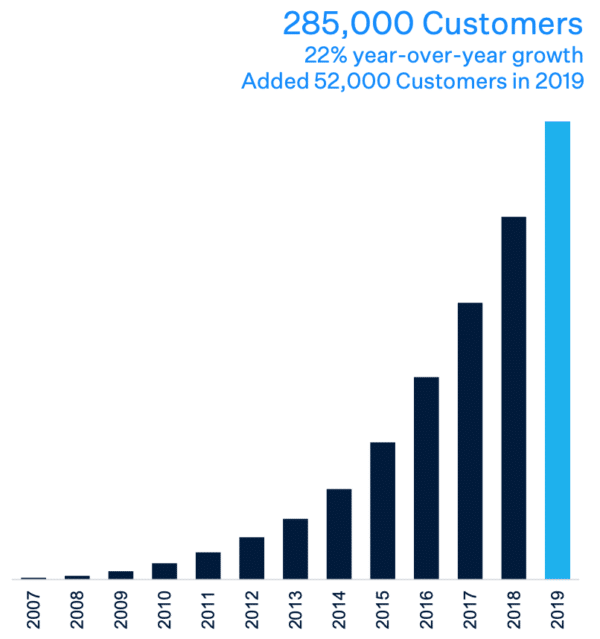

The company also increased its total customer base to 285,000 in Q4. This was driven by the addition of 52,000 customers in 2019, a growth rate of 22% year-over-year.

As for revenue, Sunrun ran into the same issue that has plagued residential solar companies: expenses outweigh income in the pursuit of long-term value. In Q4, Sunrun increased revenue to $243.9 million, up $3.8 million (2%) from Q4 2018. With this revenue came quarterly operating expenses of $292.4 million, an increase of 18% in comparison to 2018.

On the year, the company reported $858.6 million in total revenue, which represents a 13% increase from 2018’s $760 million. But, as was the case in Q4, Sunrun experienced $1,074.3 million in operating expenses on the year, which is up 22% from 2018.

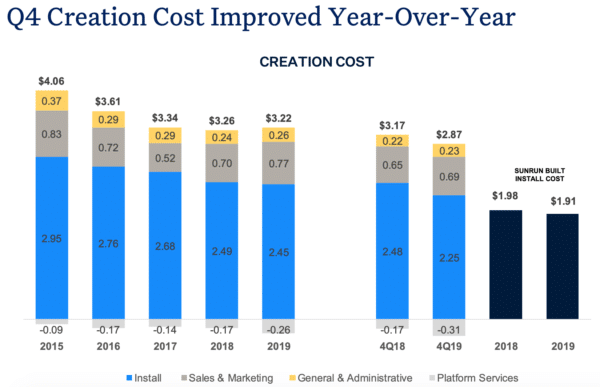

Note that operating expenses are rising alongside a decreasing “creation costs” for systems financed by Sunrun. This number represents the per-watt cost the company incurs for each new system installed, so long as Sunrun finances said system.

Sales and marketing expenses fell for the second consecutive quarter to $0.69/watt in Q4, representing a steady decrease from the $0.77/watt cost the company reported after Q2 2019. Installation costs experienced an impressive $0.234 decrease year-over-year, a figure equivalent to total installation cost decreases from 2017 to 2019.

Looking forward

Regardless of operating losses, the bane of residential solar companies nationwide, Sunrun expects to see even more growth in 2020. The company expects deployments to grow 15% year-over-year, with 20% growth in the overall customer base.

A portion of this confidence comes from the company’s drastically decreasing inspection time for new installations. Sunrun has begun to utilize onsite drone inspections for new installations, which has resulted in a 50% decrease in total inspection time. In tandem, Sunrun has also made strides in decreasing the time between contract closing and system installation, boasting 5-day and 2-day margins between signing and installation completion on projects in Q4.

As for Corona Virus-related hardware shortage concerns, Sunrun has none, with company representatives sharing that enough hardware was safe harbored leading up to the 2020 investment tax credit reduction to cover any potential shortages.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thanks for covering this Tim. I missed the earnings call this week.