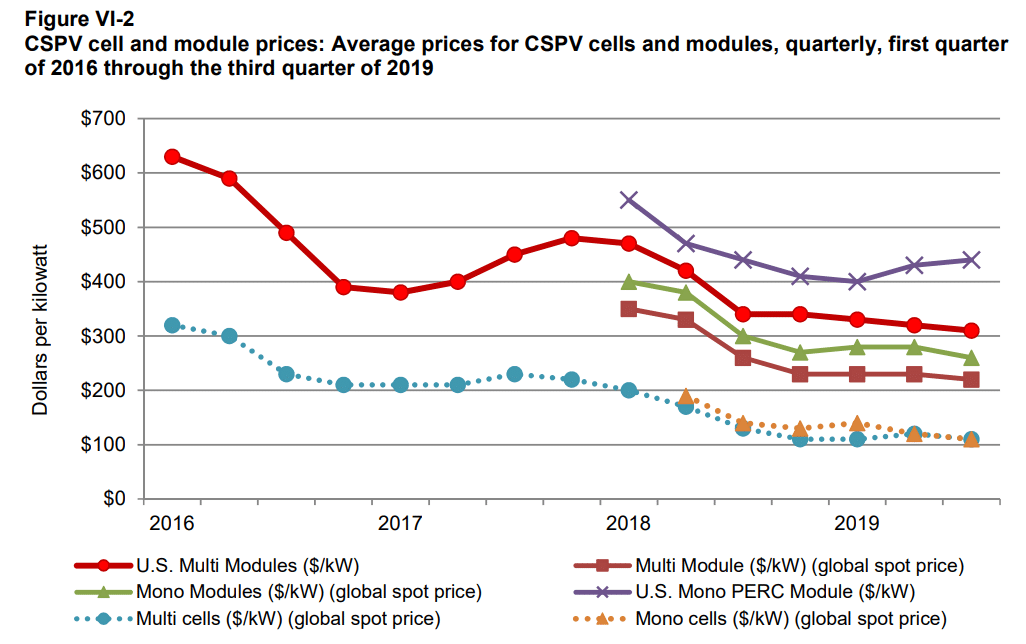

In an almost 500 page filing, with the majority of data redacted, the U.S. International Trade Commission has summarized developments in the U.S. crystalline silicon photovoltaic cell and module market since the implementation of a 30% import tariff on all solar modules. Broadly speaking, not much has changed – other than an increase in solar module prices while the rest of the world saw its pricing decrease, while greater than $741 million in tariffs have been collected.

On February 7, 2018, the solar module import tariff took effect at 30%. Since then, we’ve seen the tariff drop by its 5% two times, to its current value at 20%.

Suniva’s ghost, the company that originally brought the case to the courts, haunts the document with 142 unique references. That shell of a company stopped producing solar cells and modules prior to filing the lawsuit. The company testified that, if it recieved the proper funding, it could restart solar cell production within 100 days. The report quoted Suniva as stating, “there are rumors of domestic (solar cell) suppliers coming online in 2020.”

As of 2019, the report noted that only one company, Panasonic, was producing solar cells within the U.S. This value has fallen every year since 2016, and Panasonic has reported that the average wages earned as part of its cell manufacturer business fell in 2019 relative to 2018.

In recent news, Tongwei announced a $2.8 billion 30 GW solar cell manufacturing facility that will open in 2021. In China.

Sixteen module manufacturing companies responded to the government request of information for this report. The large majority of these responses were redacted. The report suggested that these groups represented 75% of U.S. manufacturing capacity. In addition to these companies though, the report stated there are seven additional manufacturing plants with known commercial module production totaling approximately 960 MW/year of capacity.

If these seven groups represented 25% of capacity, then the sixteen who responded represent an additional 2.88 GW/year of manufacturing capacity – meaning a total of 3.6 GW of module manufacturing capacity exists in the USA. First Solar, which makes thin film products for the utility scale market, is not accounted for in these values.

The report gives a bit more coverage of the six largest U.S. manufacturers: Hanwha Q-Cell at 1.7 GW/year; JinkoSolar with 400 MW/year; and LG with 500 MW/year — plus Mission Solar, SunPower, and, amusingly, Suniva.

These manufacturing companies did increase production and related worker hours in the first half of 2019, after seeing decreases from 2016 through 2019. However, while wages paid were higher during due to greater hours worked during, unit labor costs and hourly wages were lower. As well, worker productivity – even in these cutting edge facilities – have gained little since 2016.

An unnamed manufacturer in the U.S. has told pv magazine that the manufacturing lines deployed in the U.S. use lesser automation, and more human labor, as the capital costs for the machines outweigh the economic benefit relative to cheap Americans.

Sounds like the U.S. has become the world’s new China.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“”Suniva’s ghost, the company that originally brought the case to the courts, haunts the document with 142 unique references. That shell of a company stopped producing solar cells and modules prior to filing the lawsuit. The company testified that, if it recieved the proper funding, it could restart solar cell production within 100 days. The report quoted Suniva as stating, “there are rumors of domestic (solar cell) suppliers coming online in 2020.””

There were those early on that gave evidence this would be the case. Entities like the SEIA pontificated that tariffs would increase the cost of installing solar PV systems and the industry would lose 120,000 installation and ancillary jobs created in the solar PV installation and construction industry.

When one looks at the modern solar PV manufacturing plant, the obvious automation is the first thing one sees in the operation. Requiring less employees to manufacture giga-watts of panels per year only requires a few hundred employees. When a solar PV plant shuts down, you lay off 500 employees. When tariffs interfere with installations of the product and thousands to hundreds of thousands are laid off to price constraints, then one has to wonder how effective the tariff is.

This may have a decided effect on China’s 2025 plan of manufacturing 75% of the goods used around the World. The crybaby “would be” American manufacturers will have to ‘get over’ any entitled expectations of the past and get with a World view of manufacturing on the World scale. Using say solar PV and energy storage to power one’s manufacturing line seems like the ownership of one’s own micro-grid can control the bottom line and help during economic down turns.

This is really appreciable, how you managed all the necessary details in this article.