Eight years ago, the solar industry was focused on manufacturing. Crystalline silicon was under threat from improving thin-film products, including Copper Indium Gallium diSelenide (CIGS) which was accelerating through efficiency records.

But after a rapid ramp-out of Chinese capacity, that story came to an end. Low-cost crystalline silicon crushed nearly all of its thin-film rivals, and the resulting evisceration of margins meant that low-cost PERC was the only cell-level technology innovation that most companies invested in for many years.

But as capital not supplied by the Chinese government dried up, innovation went downstream. New third-party solar models brought residential solar to a wider range of homeowners. New residential solar empires were built on this model, including SolarCity, Sunrun and Vivint.

This model has since been eclipsed by newer, more sophisticated and flexible loan products, and even more significantly behind-the-meter solar is joining with battery storage to evolve into part of both a home energy ecosystem and increasingly a contributor to grid reliability.

It is within this larger context that today’s announcement from SunPower can be understood, as SunPower has followed these trends by evolving from not only from a manufacturer into a downstream solar company, but through its dealer network the second-largest residential solar company in the United States by megawatts deployed.

Along with this size is increasing sophistication, and an increasingly wider array of products to differentiate its business. These include its Equinox and Helix integrated platforms for the residential and commercial and industrial businesses, which can include battery storage, and even a new tool for visualizing residential installations.

The split

Today SunPower announced that it will be spinning off the high-efficiency manufacturing business which the company was founded on into a new company, Maxeon solar, named after its interdigitated back contact (IBC) cell product.

Maxeon products have traditionally led the industry as the highest-efficiency products available for most applications other than satellites. This evolution continues with the company working a new Maxeon 6 after the U.S. launch of its A-Series modules based on its Maxeon 5 (NGT) cells earlier this year.

Tainjin Zhonghouan Semiconductor (TZS) pouring $298 million into the new company, which SunPower says will enable both a scaling of Maxeon 5 – including faster conversion of Maxeon 2 lines to Maxeon 5, as well as development of Maxeon 6.

TZS is already one of the world’s largest wafer makers with 40 GW of capacity, as one of the two big Chinese monocrystalline wafer makers (LONGi is the other) whose rapid growth is enabling monocrystalline silicon to eclipse multicrystalline as the main cell technology.

The relationship between TZS and SunPower is not new, and the two companies have been working together for some time including in a joint venture for a multi-gigawatt Chinese factory to make SunPower’s shingled P-series product. Maxeon will keep a 20% stake in this venture.

And while continuing to innovate on Maxeon cells, Maxeon also plans to expand its manufacturing capacity to make the lower-cost P-Series.

This does not mean that SunPower will be entirely free of manufacturing or R&D. The company will retain the P-Series module factory in Hillsboro, Oregon. It will also keep its SIlicon Valley-based R&D, while Maxeon gets the overseas R&D capabilities, and the two companies plan to partner on development of new products.

Under the current deal, which still must receive regulator approval, existing SunPower shareholders will keep SunPower shares and receive a 71% stake in the Maxeon, with TZS holding the balance. The company will also keep a multi-year, exclusive supply agreement with SunPower.

Jeff Waters, who currently serves as CEO of SunPower Technologies, will take over as CEO of Maxeon. The company will be headquartered in Singapore, and plans to launch as a publicly traded company the NASDAQ after closing of the split.

The new SunPower

With its manufacturing spun off, the new SunPower is free to focus on what has increasingly occupied its time, which is its downstream presence. SunPower has built a powerful presence through dealer network, which includes companies who only sell and install SunPower products.

The megawatts sold through this network make SunPower the 2nd-largest company in the U.S. residential solar space, second only to Sunrun. Unlike Sunrun, SunPower also has a large presence in the nation’s commercial and industrial market.

But this is just the beginning. SunPower estimates that it has a 50% market share in the new homes market, and contracts with 18 of the top 20 builders in California. “We are ideally positioned to lead the California new homes mandate in 2020,” notes Werner.

And SunPower’s innovation is not limited to its cell and module work. “We are increasingly living in a digital world,” notes SunPower CEO Tom Werner, emphasizing the company’s software innovations, such as its new Design Studio.

SunPower is one of only two companies known to pv magazine to have won contracts to supply capacity to U.S. grid operators from behind-the-meter solar, and this may be just the beginning.

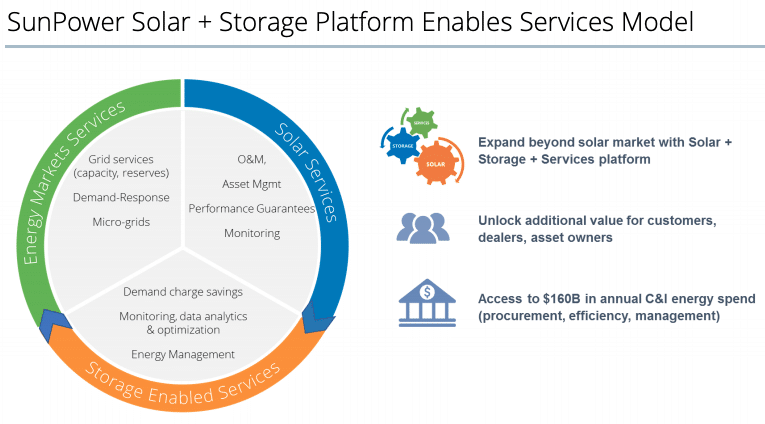

Werner says that SunPower has an “opportunity to capitalize in the growing energy services market”, and says that the company plans to offer ancillary services as well as capacity from behind-the-meter resources. This of course will be enabled by increasing deployment of solar plus storage.

The deal has received the blessing of French oil company Total, SunPower’s main shareholder. “We support this transaction which will bring clarity and focus for both entities on their respective activities,” stated Total CEO Patrick Pouyanné. Total will remain a shareholder of both companies.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.