By Tony Clifford, Chief Development Officer, Standard Solar

On October 5, the Office of the U.S. Trade Representative (USTR) decided to revoke the exemption on bifacial solar modules from the tariffs that were imposed on module imports from China. What does this mean? Starting October 28, bifacial module imports will now be subjected to the same 25% tariffs that other modules currently face (which will step down to 20% in February).

On October 5, the Office of the U.S. Trade Representative (USTR) decided to revoke the exemption on bifacial solar modules from the tariffs that were imposed on module imports from China. What does this mean? Starting October 28, bifacial module imports will now be subjected to the same 25% tariffs that other modules currently face (which will step down to 20% in February).

In June, the Office of the U.S. Trade Representative (USTR) had decided to exempt bifacial solar modules from the tariffs that were imposed on module imports from China. The reason given for the exemption was that the market in the United States for the products was so small that bifacial module imports posed no threat to U.S. solar manufacturers the tariffs were designed to protect.

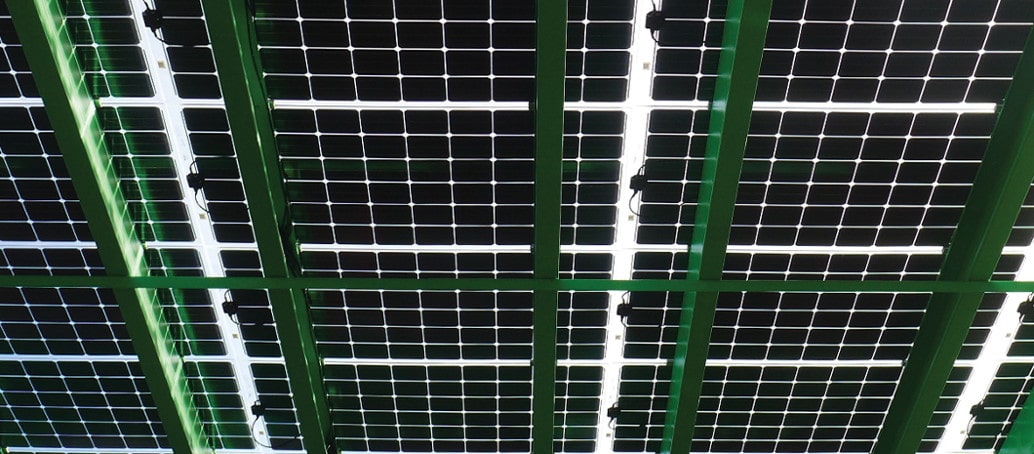

As bifacial modules increased in popularity—particularly for utility-scale projects, where their versatility and energy-harvesting potential was tailor-made—the USTR has become increasingly concerned with them as potential competitors for U.S.-based bifacial module manufacturers. As a result, they took away the exemption.

So what does this sudden change of policy mean for the U.S. solar market? The answer to that is, as of now, unclear.

While U.S. module manufacturers with potential bifacial manufacturing capacity could benefit in the short-term from this new rule because it will limit less-expensive Chinese imports, the long-term future is a bit cloudier. After all, significant questions remain about how much capacity can be shifted to bifacial modules to meet the ever-increasing utility-scale demand, at the potential cost to their monofacial-module production.

Will companies shift significant resources to a rapidly growing market that stands to grow at a pace far surpassing an original Wood Mackenzie prediction of 21 GW installed capacity in the next five years? Or will that shift in production priorities be too jarring for the internal finances of companies, resulting in the status quo being maintained? The truth is that it’s far too early to make any such predictions, but worries about the latter are likely to slow the use of bifacial modules in projects where they earlier would have been the logical choice. It won’t destroy the bifacial market, but Bloomberg New Energy Finance’s Jenny Chase is predicting significant slowdowns in the next 16 months following the imposition of tariffs on October 28.

On the other hand, two factors are occurring simultaneously that provide some hope that the newly imposed tariffs won’t damage the long-term bifacial markets. The first factor is similar to one that happened when the USTR imposed tariffs on monofacial modules: Prices on bifacial modules continue to fall precipitously. As a result, any increase in bifacial-module price may be offset by price reductions for the technology as a whole. We saw the same principle occur when the original tariffs were put in place, so

the overall disruption to the industry was minimal (I’m not saying it had no effect—just that it could have been much worse).

The second factor coming into play is that the tariffs themselves are time-limited and step down again in February 2020, when the tariffs will be reduced from 25% to 20%. In 2021 the tariffs will be reduced to 15%. As the tariffs are being reduced the price inflation they cause will diminish as well. So that’s why I tend to agree with Jenny Chase on the 16-month time horizon for the solar industry to see significant effects on the bifacial market—a freeze is what she called it—and then reduced effects thereafter thanks to these two complementary factors.

At Standard Solar, we have used bifacial modules in an increasing number of our projects because we believe they are, for many applications, the right solution. So, we will watch what happens next with great interest and concern and will continue to report on developments as they happen.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.