Editor’s note: Jenya Meydbray will be speaking on high-efficiency cell and module designs – including heterojunction technology – at pv magazine’s Future PV Roundtable at the Solar Power International Trade show from 10 AM – 12 PM on September 25. Space will be limited, so clink the link above to register.

pv magazine: In terms of the cell and module technology that is either being commercialized now or will be in the next three years, what are the most promising developments from your perspective?

Jenya Meydbray: It’s helpful to break the segments out when thinking about this. There is the more cost-sensitive, large ground-mount utility-scale, 20 MW+ projects, and there are rooftop, real estate constrained projects with a heavy focus on high efficiency. They’re two obviously different product classes, but both have plenty of innovation underway.

Jenya Meydbray: It’s helpful to break the segments out when thinking about this. There is the more cost-sensitive, large ground-mount utility-scale, 20 MW+ projects, and there are rooftop, real estate constrained projects with a heavy focus on high efficiency. They’re two obviously different product classes, but both have plenty of innovation underway.

On the high-efficiency side, the current price points that I’m hearing on premium modules are north of the 50 to 60 cents per watt range – not even talking about SunPower, which is the premium premium, but the high efficiency LG and Panasonic types that have a good business in the rooftop segment today. There is a lot of opportunity for high-efficiency technology to get commercialized in that price level.

And that is where heterojunction can play a central role over the next few years.

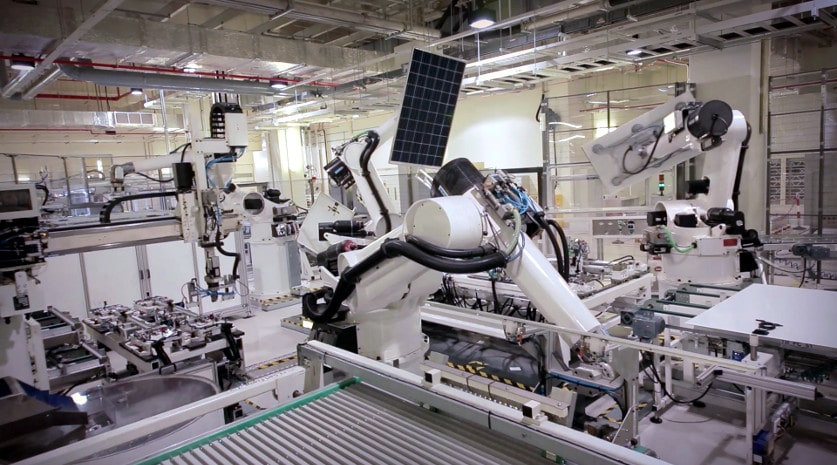

Heterojunction (HJT) cell factories are really different. The layout, the design, the equipment is pretty different from a PERC cell factory. There are no PERC factory upgrades that get you to heterojunction. Heterojunction is only going to be implemented to the extent that manufacturers have greenfield expansion.

Folks that have massive capacity of PERC installed are not likely to mothball existing cell lines and replace them with heterojunction lines. This will fundamentally limit the pace of adoption of heterojunction.

All PERC cell lines that have been installed have to naturally reach the end of life. I think the depreciation schedules on these are pretty short nowadays but the cell lines are still expected to run at least 3 – 5 years probably.

Heterojunction can play a big role in incremental expansion in that premium rooftop price point. I think today’s heterojunction technology can be attractive and it is very high efficiency. And as the volume increases, the cost will come down.

So what else is happening?

Shingling is another way to achieve high efficiency. The intellectual property suits between Solaria and GCL and others limited the adoption of shingling for a few years. However, this was settled in late 2017 and we’re seeing shingling make a comeback in technology roadmaps. This technique can achieve pretty high module efficiency by squeezing as much active area into the real estate of a module as possible. This can actually be done with different cell technologies by cutting them into strips and interconnecting the strips with electrically conductive adhesive or ECA.

Of course, new technologies may introduce new risks in degradation and failure mechanisms.

On the utility-scale side, I expect bifacial technology to eventually become totally dominant on both trackers and fixed tilt systems because it can achieve better economics. In the US market, bifacial was a technically attractive alternative to monofacial before the tariff exclusion, and now that the exclusion is in place I think the adoption of bifacial technology will accelerate.

However, the devil is in the details in how you optimize a bifacial system from the technical design and layout perspective. Also, separately, the devil is in the details in how you finance it, without taking an undue haircut.

In the event of no data or incomplete data, independent engineers and finance firms will make conservative assumptions about performance. Bifacial is wrought with lack of data, or incomplete data, so today I expect bifacial performance to mostly over-perform assumptions up front. There is a lot about modeling bifacial performance that we don’t yet know how to do as an industry.

This uncertainty will fundamentally slow down the adoption or adversely impact the economics of bifacial systems in the near term. A lot of developers are developing a project, building it and selling a project at COD, so they don’t realize the benefits of any actual production, they realize the benefits of what is financed, or forecasted production.

Technical performance assumptions to support what is financed are absolutely critical. That’s where we at PVEL help a lot.

pv magazine: How much more room is there for improvement with mono-PERC and other monocrystalline technologies, before we run out of practical, cost-effective means to improve efficiency and we have to move to something like heterojunction?

Meydbray: With each technology the efficiency curve shows fast growth then mostly levels off. With the aluminum back surface field (BSF), which was the last technology, the most efficiency you could squeeze was about 20 or 20.5%. The technology is very simple, stable and well-understood, but if you want to go higher, you have to move to PERC.

PERC Is the incremental next step in technical advancement. There is an incremental efficiency improvement on PERC until you hit about 23%, 23.5%. Typical efficiencies today are maybe 22%, 21.5%, so there is still some juice you can squeeze out of PERC. When the average efficiency coming off of production lines starts to hit the upper 22%, 23%, the next technology must be introduced to keep moving up that efficiency curve.

It may be heterojunction although a lot of manufacturers are working on passivated contacts that can add quite a bit of efficiency, maybe 25%. But at this point nobody has really demonstrated high volume, stable production of passivated contacts in my view. I think Trina has the largest production capacity today at a few hundred MWs. Overall, it’s very much still in R&D.

pv magazine: So heterojunction has been around for 25 years or more, but very few companies have managed to manufacture it at scale successfully over a sustained period of time. And even for those like Panasonic that do it’s still expensive. Do you expect a bunch of new growth in heterojunction and what do we do about the cost issue?

Meydbray: Heterojunction manufacturing historically has been done on pretty low volumes. The manufacturing tools are highly customized and heavily engineered for the specific factories and applications.

More recently, Meyer Berger has been pushing their turnkey heterojunction lines. They’ve cost reduced the manufacturing line itself quite a bit. The new wave of heterojunction manufacturing capacity that’s using Meyer Burger or similar technology should be fundamentally cheaper than what has been manufactured historically because the manufacturing tools have come down quite a bit in price. What I’ve seen recently is a heterojunction cell line is about three times as expensive as a PERC cell line.

Maybe 5 vs. 15 million dollars for a 100 MW cell line. While a pretty big gap remains, costs are coming down. And there is also the question on the OpEx side.

The process itself is simpler. There are fewer steps but that doesn’t mean those steps are easy. There’s a lot of sensitivity in those steps and the manufacturing yield and throughput today is likely to be lower than PERC but there is a lot of room to grow and improve.

Silver is the most expensive thing that goes into heterojunction cells and other cells from a raw material perspective. Historically, heterojunction has used a very high volume of silver and that actually drives up cell cost quite a bit.

The SmartWire Meyer Burger technology has lower silver consumption and has a pretty clear roadmap to substantially lower silver consumption. So the cost will be reduced over time. We’re obviously not specifically promoting Meyer Burger as a company, but the technique of changing the metallization on the cell can help reduce the amount of silver used. A goal of reaching 50 milligrams per cell – about half the volume used today – is probably realistic.

pv magazine: So if we look beyond the 3-year time frame what cell & module technologies are you particularly excited about?

Meydbray: From around 2009 until now, the efficiency of crystalline silicon cells has steadily ticked up at roughly 0.6% per year which is amazing. We’ve observed a steady step up the efficiency curve. Continuing to climb the curve at this rate requires squeezing as much efficiency as possible out of PERC over the next few years.

Next a broad transition to a combination of passivated contacts and heterojunction could step efficiency up the curve to about 25% by roughly the mid 2020s. Transitioning to an IBC or back contact, which means moving all the contacts to the back, can add another 1% or 1.5% of efficiency. So by the late 2020s we could expect to see a 500 watt 72-cell module based on today’s geometries. Which is a big change.

In the 2030s, you probably need to introduce novel materials like Perovskite tandem cells to achieve 35% efficient cells and 40% efficient cells. There is plenty of R&D for these technologies that’s already well underway. Every cell and module company I know is actively researching some kind of Perovskite or tandem cell.

Tandem cells are basically a regular solar cell with a tandem cell on top of it. While they are not ready for primetime today, in a decade I think they could be.

A very good bottom cell for a Perovskite tandem is heterojunction. Because of Perovskite’s performance characteristics, it’s better suited than other technologies. And so there’s another long term broad application for heterojunction.

pv magazine: Wow. That’s strange because heterojunction is already essentially three layers of cell. So you’re talking about really a four layer cell if you use…

Meydbray: Well heterojunction is multiple layers but it’s one cell, right? Using heterojunction as your substrate for your top cell which could be a Perovskite that is screen printed on or something. But it doesn’t have to be Perovskites. There are other materials that people are researching. But that’s how we get to the 35% efficient cell and the 600 watt module.

pv magazine: What haven’t we talked about that you think is important for readers to know about cell & module technology?

Meydbray: For the recent past during the steep growth of the solar industry, efficiency gains have all been on the back of BSF cells. Aluminum BSF is a very simple cell structure that is very stable.

Next came the shift to PERC. We’ve seen new degradation behaviors and not just degradation but meta-stability introduced meaning that they can actually improve. There is some degradation behavior and some regeneration that can happen in the field. So these new novel cell technologies can be fundamentally less stable.

The underlying cell technology needs to be more thoroughly vetted. Some of the stabilizing techniques used in the factory must evolve as cell efficiency ticks up – they’re not necessarily static either. I think there are more moving parts now. Of course there are always standard concerns around cost reduction. As we pull cents out of raw materials there are field performance and reliability implications.

A lot of people are moving to thinner glass. A lot of people are moving to slimmer wafers too. That means more sensitivity to cell cracks. People are moving to ECAs or electrically conductive adhesives from solder because they are required for some of these new technologies. There are a million different electrically conductive adhesives some of which just don’t have the same properties as solder. Modules will degrade in different ways in the future as these new technologies get introduced.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Here in lies the problem: “Heterojunction (HJT) cell factories are really different. The layout, the design, the equipment is pretty different from a PERC cell factory. There are no PERC factory upgrades that get you to heterojunction. Heterojunction is only going to be implemented to the extent that manufacturers have greenfield expansion.”

The “tooling” needed for one design or another, early on it was Sanyo with HIT, now we have PERC, TopCon, HJT, multi-wire, cell configurations, half cell, shingled cells, with specific designs of blocking diodes that are supposed to ‘limit’ any shading of the panels. The ‘claim’ is better efficiency in panels that are sometimes shaded, by landscape or nearby buildings, even bird droppings and dust. The constant “retooling” of the production line has been well known in the auto industry. What has recently been done are product lines that can make ‘different’ models of vehicles with the same robotic assets in place using batch programs to switch between products. IF one is going to spend millions to hundreds of millions of dollars on manufacturing facilities, might as well make it flexible enough to chase the next technology that comes along.

I like this thinking right here: “Using heterojunction as your substrate for your top cell which could be a Perovskite that is screen printed on or something. But it doesn’t have to be Perovskites. There are other materials that people are researching. But that’s how we get to the 35% efficient cell and the 600 watt module.”