While the headlines are nice, as PanelClaw CEO Costa Nicolaou told pv magazine:

The damage is done by the global tariffs. There is no incentive for the Canadian steel suppliers to drop their prices to 2017 levels.

When most people who aren’t in the solar industry think of solar manufacturing, they think of the factories that churn out cells and modules. But that’s far from all that goes into any solar installation, and a significant portion of the many other components needed to make a PV system work are produced in the United States.

This includes the systems on which the PV modules are mounted – whether on roofs or in large ground-mounted arrays that follow the sun. This segment of the solar manufacturing supply chain is particularly well-represented in the United States, and it has suffered under the tariffs imposed by the Trump Administration.

This was true not only for the Section 201 tariffs on cells and modules, which were widely opposed by this sector, but even more for the Section 232 tariffs on steel and aluminum. These tariffs which were announced a year ago had a minimal effect on the overall costs of PV installations, but hit the racking, tracking and mounting systems makers who depend on these raw materials.

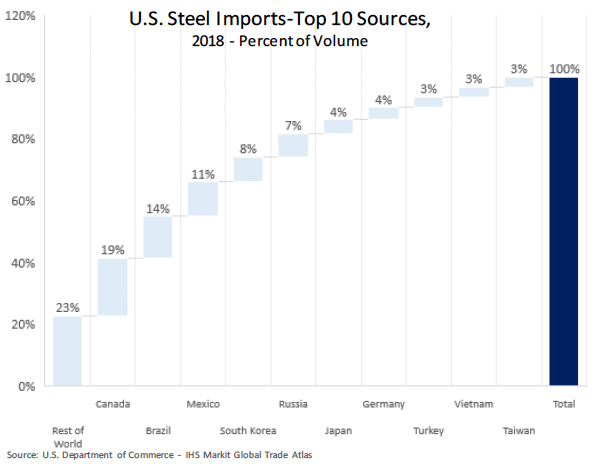

And due to the global nature of the tariffs, those countries whose exports were affected included Canada, one of our closest trading partners. In 2018 Canada was the largest source of imports of both materials, supplying 19% of the steel and a third of the aluminum imported by the United States.

On Friday the Trump Administration reached a deal with Canada to eliminate the Section 232 tariffs on steel and aluminum, along with Canada agreeing to remove retaliatory tariffs imposed in response, as part of the renegotiation of the North American Free Trade Agreement. However, as long as the global tariffs remain, manufacturers say prices for raw materials will stay high.

Trade flows

There is also the question of how these tariffs are affecting U.S. manufacturing. While PanelClaw’s Nicolaou notes that it is hard for many racking, tracking and mounting systems companies to move factories, tariffs affect the decisions regarding future locations for manufacturing. These companies have to consider that if they make products outside the United States they can get steel and aluminum without tariffs and then ship their products into the United States tariff-free – a contradictory result to the stated aim of Trump’s “America First” trade policy.

The deal announced on Friday says that the two nations will collaborate on a process to monitor the steel and aluminum trade between them, and if the imports exceed the historic volumes of trade the importing country can still impose 25% duties on steel and 10% on aluminum for individual products.

But for Nicolaou and other manufacturers, the important aim is the removal of the global Section 232 tariffs. “Lifting up tariffs is a good thing overall,” says Nicolaou. “If the global tariffs are removed, then we will see a return to the prices we saw in 2017 before the tariffs were imposed.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.