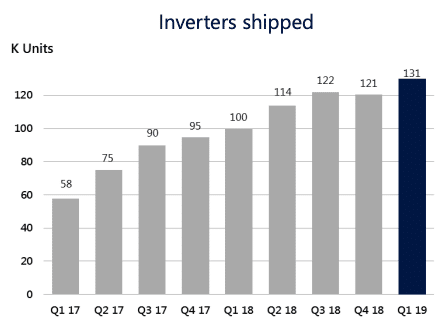

SolarEdge is on a roll, and has been for some time. The 131,000 inverters that the power electronics maker shipped during the first quarter of this year is a new high, and while power optimizer sales dipped slightly to 3.0 million (versus 3.1 million in the prior quarter), SolarEdge still hit record revenues of $272 million, a 30% increase over the year prior.

Nor is profitability any problem. While the company’s margins were not at the highs it saw a year ago, SolarEdge still earned a 10% operating margin with a net income of $18 million.

Nor is profitability any problem. While the company’s margins were not at the highs it saw a year ago, SolarEdge still earned a 10% operating margin with a net income of $18 million.

And it has achieved this profitability while spending heavily on R&D and swallowing up other companies. In January SolarEdge closed on Italian EV systems manufacturer SMRE, after buying South Korean battery maker Kokam and UPS supplier Gamatronic – all in less than one year.

Tariff woes

And while it seems that there is no stopping SolarEdge, the last few days have not brought good news. In addition to its manufacturing in Hungary, SolarEdge also makes its products in China, and these are expected to be subject to 25% tariffs per U.S. President Donald Trump’s tweets on Sunday.

SolarEdge says that it will be opening a new manufacturing site in Vietnam to make both power optimizers and inverters for the U.S. market. “We are in the process of building the lines now, and we are supposed to start producing end of June, beginning of July,” stated CEO and Chair Guy Sella on the company’s results call.

Sella also noted that the company has additional production lines in Hungary which can be ramped.

Market share?

Of course SolarEdge is not the only company that will be affected by the 25% tariffs. In the short run this increase will hit its competitor Enphase harder, as until a Flex factory comes online in Mexico the microinverter maker is entirely dependent on Chinese manufacturing.

Another big question brought up by SolarEdge’s results call is the relationship of these two companies in the market. A few years ago SolarEdge’s power optimizers and Enphase’s microinverters were duking it out in the U.S. residential market, and based on California market numbers and Enphase results, it appeared that SolarEdge was going to crush its rival.

However, in recent quarters Enphase has made a remarkable comeback, and is shipping more units than ever, as well as returning to the black. EnergySage market data even shows it regaining market share from SolarEdge.

Neither company has been willing to share figures for the larger market, with SolarEdge CEO Sella stating that it leaves those to Wood Mackenzie to determine. “We think that our market share is growing, but that’s not a very independent analysis,” quipped Sella on the call. And with the U.S. residential solar market showing slugging growth, then how are both expanding?

One answer is that both companies are diversifying geographically, and in fact SolarEdge revealed that during this quarter 53% of its shipments were destined to locations outside of the United States. Furthermore, SolarEdge has also expanded into the commercial and industrial market, and it appears that both companies are taking share from other inverter makers, with Sella stating that “we see some large central inverter companies going down in their market share”.

The future of prices

SolarEdge notes that its average selling prices are lower in its commercial division, but the company has plenty of margin to manage that, and C&I represents a big growth opportunity.

As for the future of prices, Sella says that he formerly expected a decline in the second quarter, but with Trump’s new tariffs, “we have no clue about what would be the ASP in future quarters”. He asked if instead the analysts on the call would like to make predictions instead.

Even the threat of higher tariffs is not slowing down SolarEdge. The company expects another record with $310-320 million in revenues during Q2, and similarly high profitability. Furthermore, it expects to raise money to expand battery making at Kokam.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.